Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

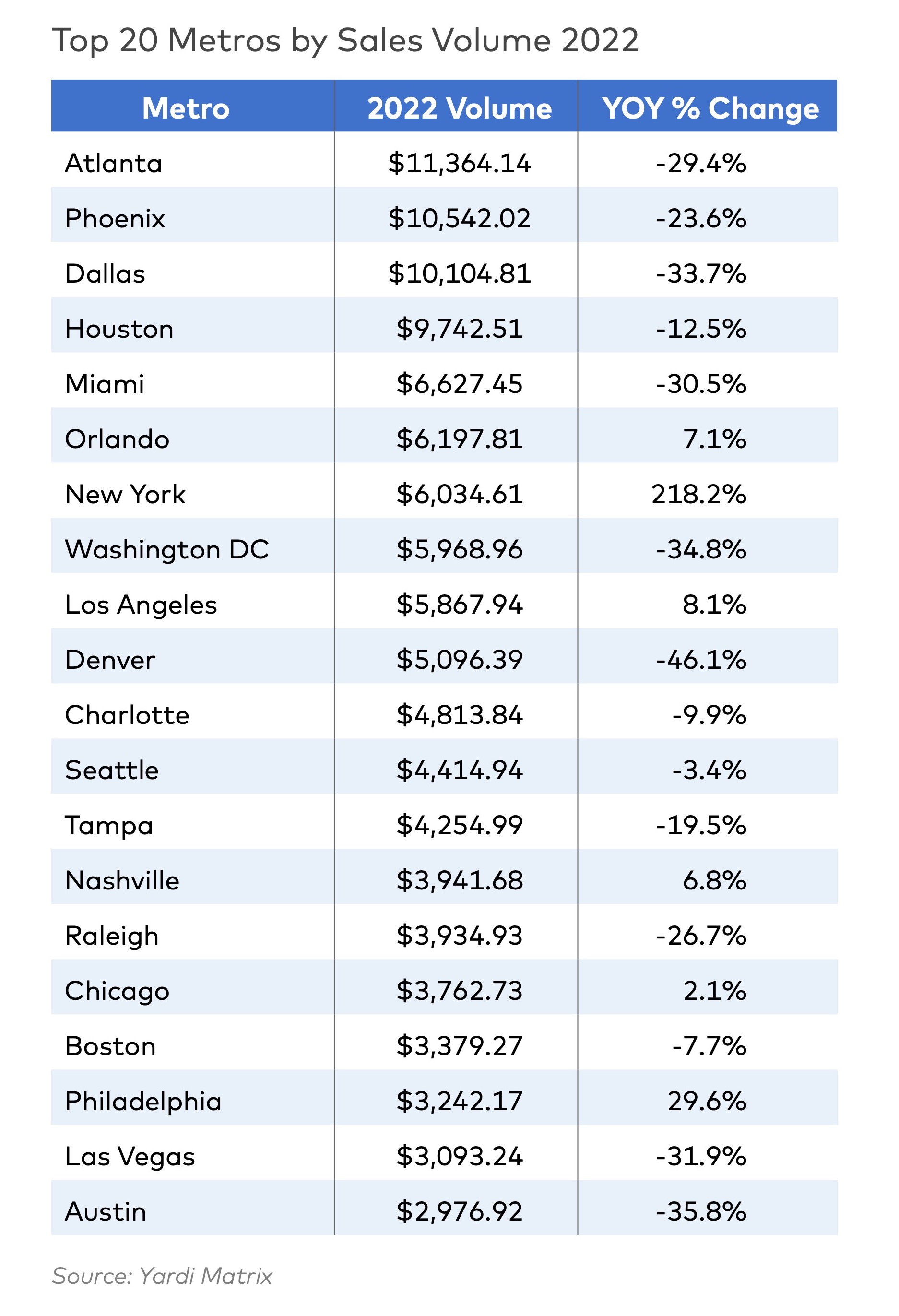

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

ProConnect Events | Apr 23, 2024

5 more ProConnect events scheduled for 2024, including all-new 'AEC Giants'

SGC Horizon present 7 ProConnect events in 2024.

Mixed-Use | Apr 23, 2024

A sports entertainment district is approved for downtown Orlando

This $500 million mixed-use development will take up nearly nine blocks.

Resiliency | Apr 22, 2024

Controversy erupts in Florida over how homes are being rebuilt after Hurricane Ian

The Federal Emergency Management Agency recently sent a letter to officials in Lee County, Florida alleging that hundreds of homes were rebuilt in violation of the agency’s rules following Hurricane Ian. The letter provoked a sharp backlash as homeowners struggle to rebuild following the devastating 2022 storm that destroyed a large swath of the county.

Student Housing | Apr 19, 2024

$115 million Cal State Long Beach student housing project will add 424 beds

A new $115 million project recently broke ground at California State University, Long Beach (CSULB) that will add housing for 424 students at below-market rates. The 108,000 sf La Playa Residence Hall, funded by the State of California’s Higher Education Student Housing Grant Program, will consist of three five-story structures connected by bridges.

Sponsored | Multifamily Housing | Apr 19, 2024

5 Reasons to Opt for Wood I-Joists in Multifamily Construction

From versatility to reliability and adaptability, engineered wood I-joists offer builders, designers and developers numerous advantages in multifamily construction. Discover the top five benefits and handy installation tips.

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

MFPRO+ News | Apr 15, 2024

Two multifamily management firms merge together

MEB Management Services, a Phoenix-based multifamily management company, and Weller Management, a third-party property management and consulting company, officially merged to become Bryten Real Estate Partners—creating a nationally recognized management company.

Mixed-Use | Apr 13, 2024

Former industrial marina gets adaptive reuse treatment

At its core, adaptive reuse is an active reimagining of the built environment in ways that serve the communities who use it. Successful adaptive reuse uncovers the latent potential in a place and uses it to meet people’s present needs.

MFPRO+ News | Apr 12, 2024

Legal cannabis has cities grappling with odor complaints

Relaxed pot laws have led to a backlash of complaints linked to the odor emitted from smoking and vaping. To date, 24 states have legalized or decriminalized marijuana and several others have made it available for medicinal use.