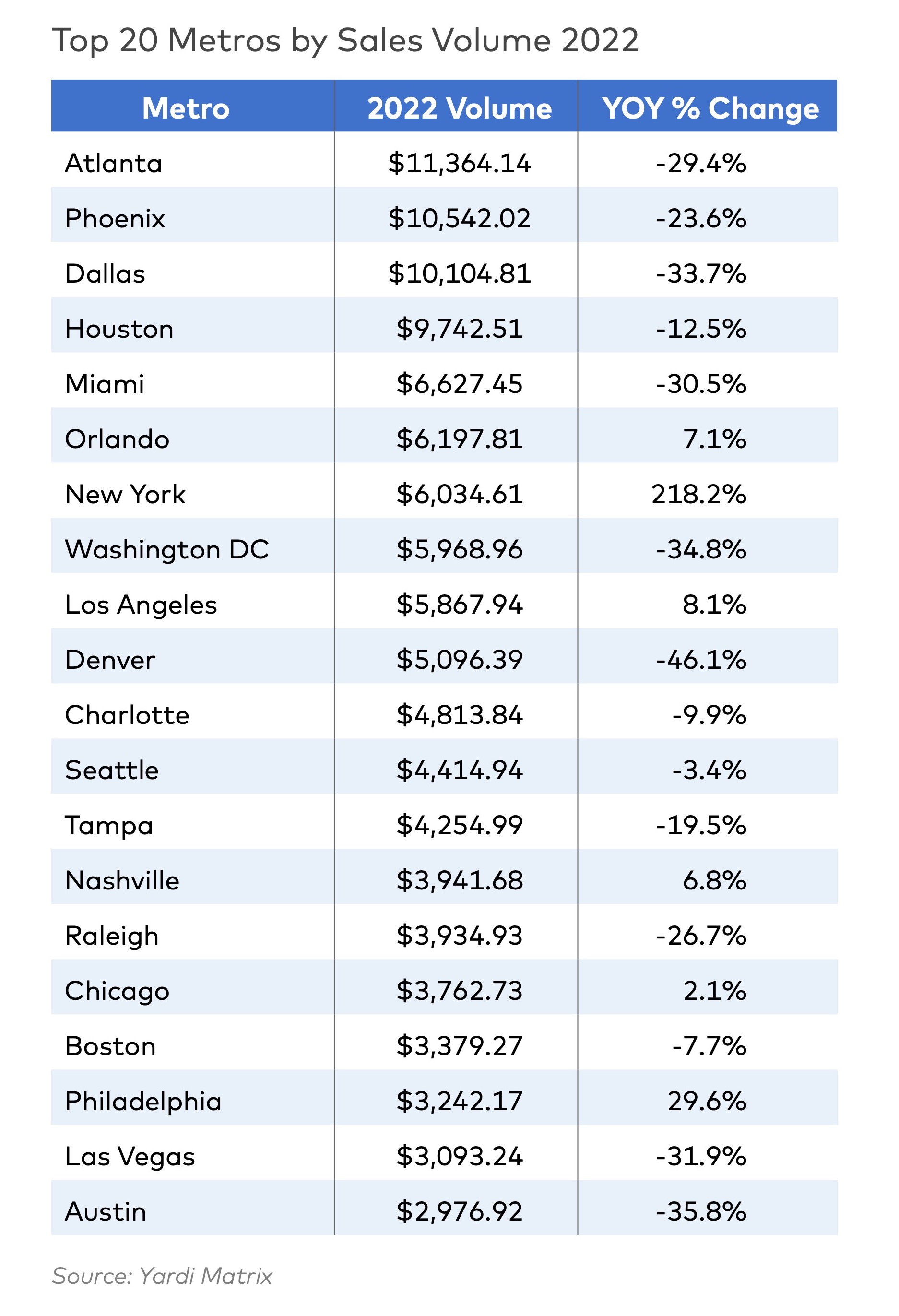

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Multifamily Housing | Jul 25, 2017

Co-living arrives in Queens: Common adds two new co-living homes

Common adds a new coliving home in Brooklyn and its first offering in Queens with Common Lincoln and Common Cornelia.

Multifamily Housing | Jul 19, 2017

Student housing trends: The transformation of co-living in college

The Student Hotel is representative of a new model for delivering housing solutions for students globally.

Multifamily Housing | Jul 19, 2017

KTGY-designed Elan Menlo Park nears completion

The 146-unit apartment community was designed as a series of six interactively connected garden-style apartments.

Multifamily Housing | Jul 12, 2017

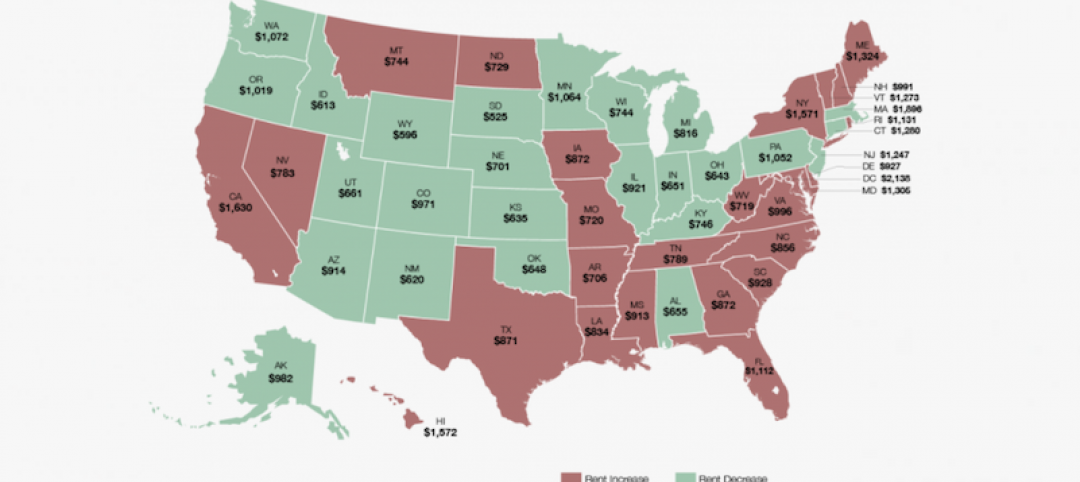

Midyear Rent Report: 26 states saw rental price increases in first half of 2017

The most notable rental increases are in growing markets in the South and Southwest: New Orleans, Glendale, Ariz., Houston, Reno, N.V., and Atlanta.

Multifamily Housing | Jul 12, 2017

7 noteworthy multifamily projects: posh amenities, healthy living, plugged-in lifestyle

Zen meditation gardens, bocce courts, saltwater pools, and free drinks highlight the niceties at these new multifamily developments.

Mixed-Use | Jul 7, 2017

ZHA’s Mandarin Oriental hotel and residences employs ‘stacked vases’ design approach

The mixed-use tower will rise 185 meters and be located in Melbourne's Central Business District.

Multifamily Housing | Jun 28, 2017

Renters don’t just want nice apartments; they want communities packed with amenities

Based on a survey from the National Apartment Association, the most popular amenities are the ones that bring the community together.