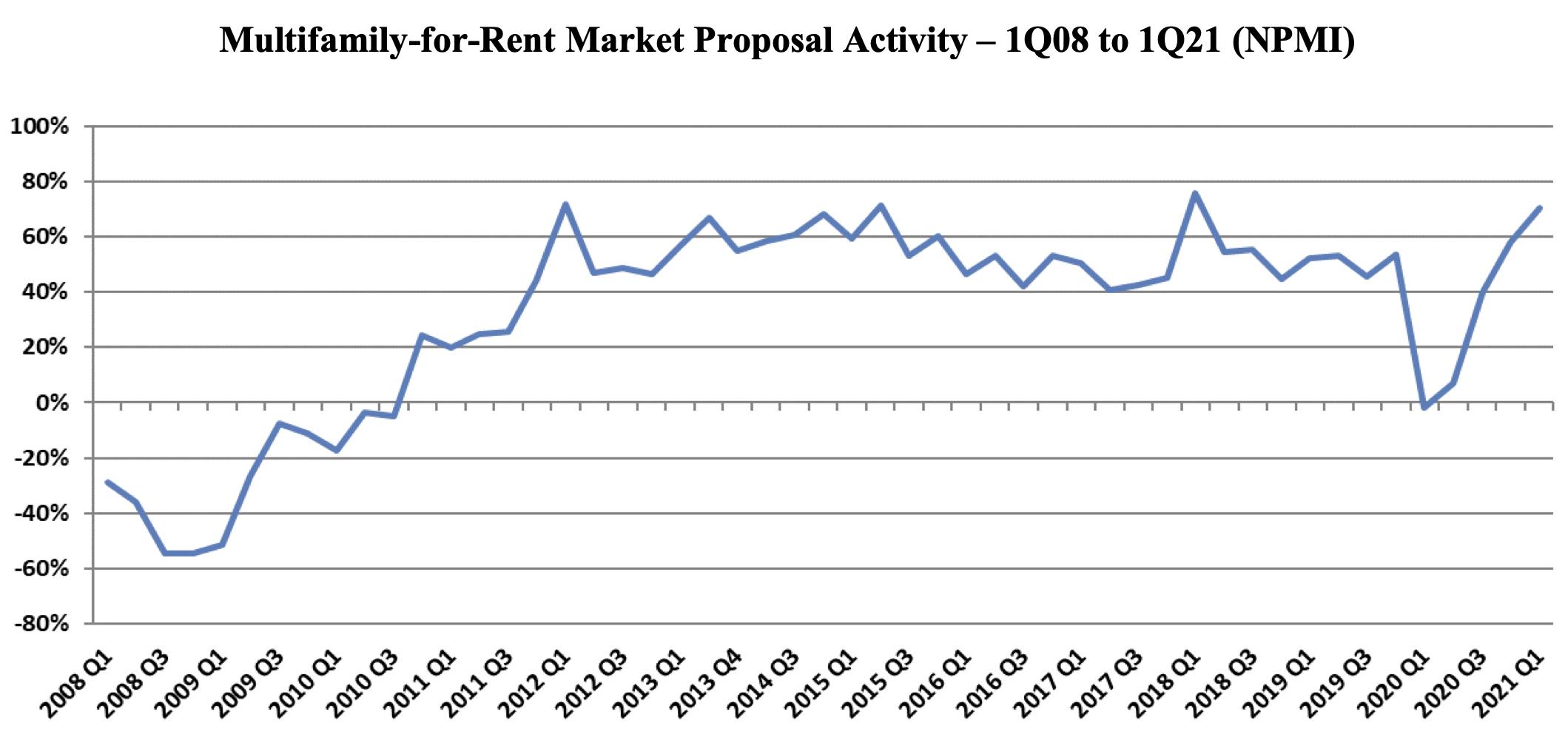

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.

| Dec 17, 2010

Condominium and retail building offers luxury and elegance

The 58-story Austonian in Austin, Texas, is the tallest residential building in the western U.S. Benchmark Development, along with Ziegler Cooper Architects and Balfour Beatty (GC), created the 850,000-sf tower with 178 residences, retail space, a 6,000-sf fitness center, and a 10th-floor outdoor area with a 75-foot saltwater lap pool and spa, private cabanas, outdoor kitchens, and pet exercise and grooming areas.

| Dec 17, 2010

Luxury condos built for privacy

A new luxury condominium tower in Los Angeles, The Carlyle has 24 floors with 78 units. Each of the four units on each floor has a private elevator foyer. The top three floors house six 5,000-sf penthouses that offer residents both indoor and outdoor living space. KMD Architects designed the 310,000-sf structure, and Elad Properties was project developer.

| Dec 17, 2010

Vietnam business center will combine office and residential space

The 300,000-sm VietinBank Business Center in Hanoi, Vietnam, designed by Foster + Partners, will have two commercial towers: the first, a 68-story, 362-meter office tower for the international headquarters of VietinBank; the second, a five-star hotel, spa, and serviced apartments. A seven-story podium with conference facilities, retail space, restaurants, and rooftop garden will connect the two towers. Eco-friendly features include using recycled heat from the center’s power plant to provide hot water, and installing water features and plants to improve indoor air quality. Turner Construction Co. is the general contractor.

| Dec 17, 2010

Toronto church converted for condos and shopping

Reserve Properties is transforming a 20th-century church into Bellefair Kew Beach Residences, a residential/retail complex in The Beach neighborhood of Toronto. Local architecture firm RAWdesign adapted the late Gothic-style church into a five-story condominium with 23 one- and two-bedroom units, including two-story penthouse suites. Six three-story townhouses also will be incorporated. The project will afford residents views of nearby Kew Gardens and Lake Ontario. One façade of the church was updated for retail shops.

| Dec 7, 2010

Prospects for multifamily sector improve greatly

The multifamily sector is showing signs of a real recovery, with nearly 22,000 new apartment units delivered to the market. Net absorption in the third quarter surged by 94,000 units, dropping the national vacancy rate from 7.8% to 7.1%, one of the largest quarterly drops on record, and rents increased for the second quarter in a row.

| Nov 3, 2010

Senior housing will be affordable, sustainable

Horizons at Morgan Hill, a 49-unit affordable senior housing community in Morgan Hill, Calif., was designed by KTGY Group and developed by Urban Housing Communities. The $21.2 million, three-story building will offer 36 one-bed/bath units (773 sf) and 13 two-bed/bath units (1,025 sf) on a 2.6-acre site.

| Nov 3, 2010

Rotating atriums give Riyadh’s first Hilton an unusual twist

Goettsch Partners, in collaboration with Omrania & Associates (architect of record) and David Wrenn Interiors (interior designer), is serving as design architect for the five-star, 900-key Hilton Riyadh.

| Nov 1, 2010

Sustainable, mixed-income housing to revitalize community

The $41 million Arlington Grove mixed-use development in St. Louis is viewed as a major step in revitalizing the community. Developed by McCormack Baron Salazar with KAI Design & Build (architect, MEP, GC), the project will add 112 new and renovated mixed-income rental units (market rate, low-income, and public housing) totaling 162,000 sf, plus 5,000 sf of commercial/retail space.

| Nov 1, 2010

Vancouver’s former Olympic Village shoots for Gold

The first tenants of the Millennium Water development in Vancouver, B.C., were Olympic athletes competing in the 2010 Winter Games. Now the former Olympic Village, located on a 17-acre brownfield site, is being transformed into a residential neighborhood targeting LEED ND Gold. The buildings are expected to consume 30-70% less energy than comparable structures.