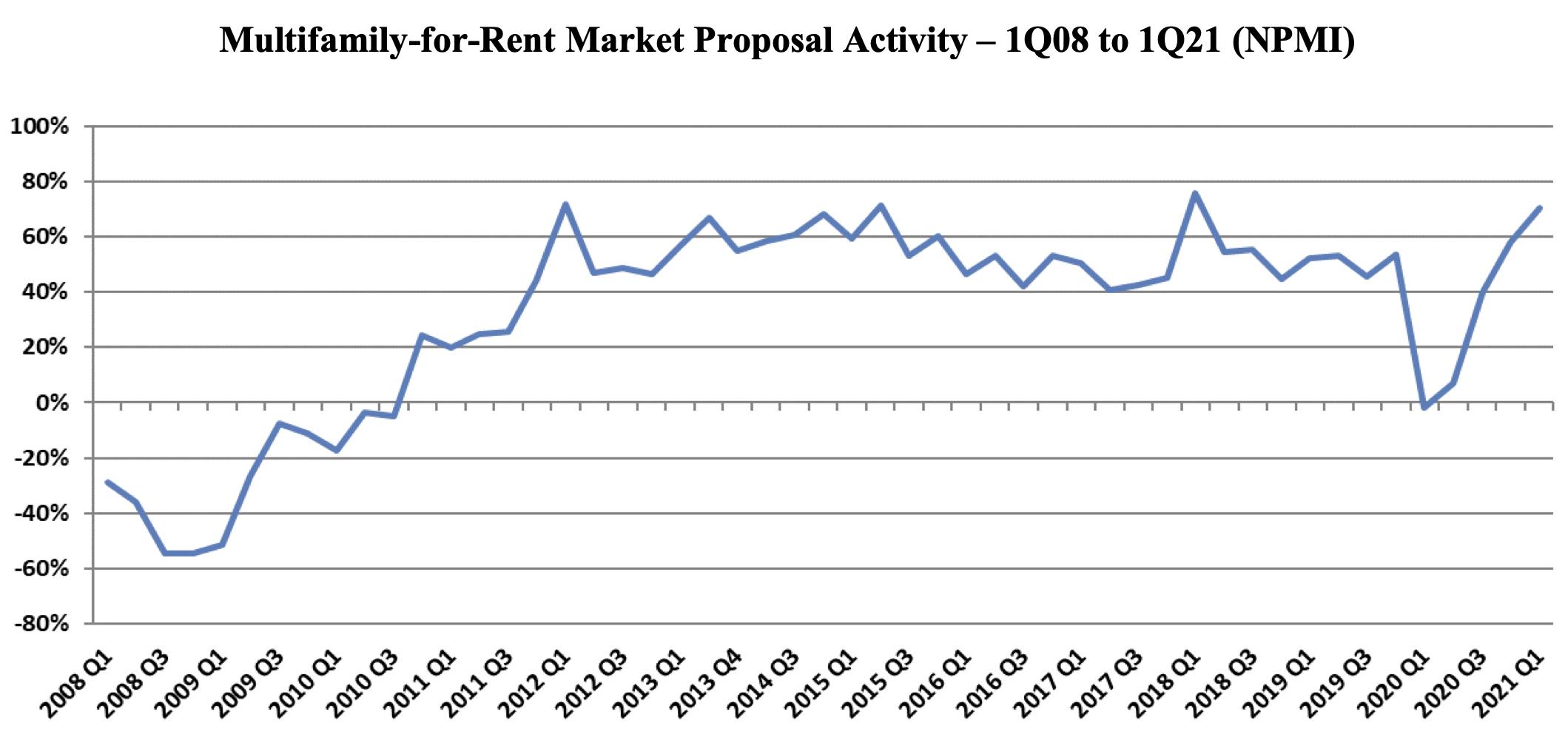

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

Multifamily Housing | Dec 4, 2019

9 tips on creating places of respite and reflection

We talked to six veteran landscape architects about how to incorporate gardens and quiet spaces into multifamily communities.

| Nov 20, 2019

ClosetMaid to celebrate 55 years in business at the 2020 NAHB International Builders Show

Company to celebrate 55 years in storage and organization with a visit by celebrity guest Anthony Carrino.

Multifamily Housing | Nov 20, 2019

Over 400 micro units spread across two communities under development in Austin

Transwestern is developing the projects.

Multifamily Housing | Nov 14, 2019

U.S. multifamily market stays strong into 4th quarter 2019

October performance sets a record amid rising political pressure to cap rent growth, reports Yardi Matrix.

Multifamily Housing | Nov 8, 2019

The Peloton Wars, Part III - More alternatives for apartment building owners

ProForm Studio Bike Pro review.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

| Nov 6, 2019

Solomon Cordwell Buenz opens Seattle office, headed by Nolan Sit

National design firm brings residential high-rise expertise to the Pacific Northwest

| Nov 6, 2019

Passive House senior high-rise uses structural thermal breaks to insulate steel penetrations

Built to International Passive House standards, the Corona Senior Residence in Queens, N.Y., prevents thermal bridging between interior and exterior steel structures by insulating canopies and rooftop supports where they penetrate the building envelope.