Recently, millennials have supplanted Baby Boomers as the largest generation on the planet. With such a huge number of people, many of who are 20-somethings beginning to get a little spending power, you better believe companies are doing everything they can to try and crack the enigma that is the millennial buyer and figure out what they value most (beyond ironic t-shirts, protesting, and coffee shops).

Perhaps unsurprisingly, when it comes to a place to live, what millennials value most is technology. A recent survey from Wakefield Research and Schlage of 1,000 U.S. renters in multifamily dwellings revealed that 86% of millennial renters who live in multifamily dwellings would pay higher rent for a “smart” apartment. For comparison, only 65% of Baby Boomers would pay more for an apartment packed with automated or remote-controlled devices.

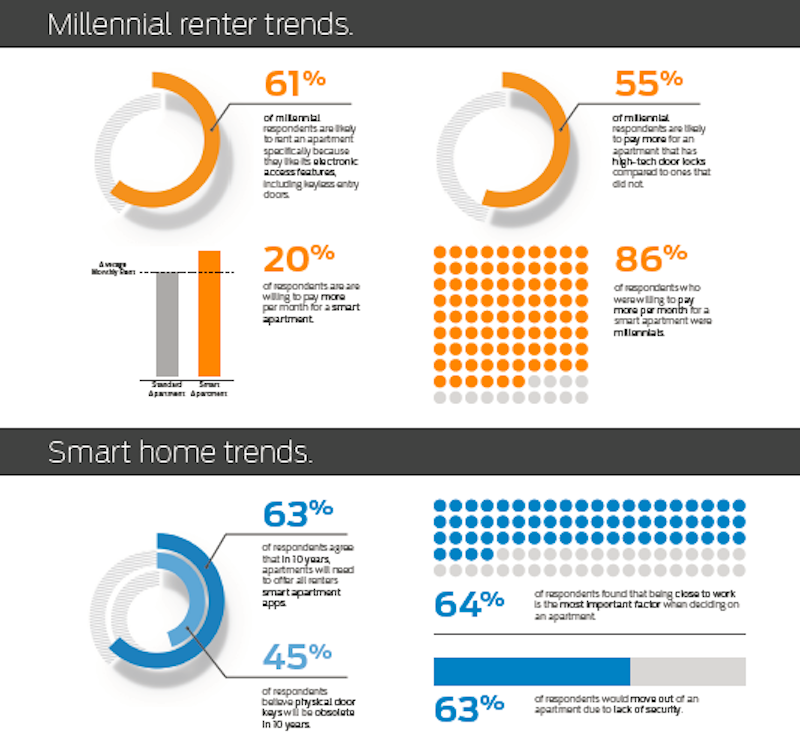

The survey also found that over 61% of millennial renters would rent an apartment specifically for electronic access features, such as keyless entry doors, and 55% would pay more for an apartment with high-tech door locks compared to traditional door locks. Another 44% of Millennials said they would sacrifice having a parking spot if it meant they could live in a high-tech apartment. Overall, millennials would pay about one-fifth more for smart home features than other generations.

It isn’t just technology millennial renters are after, however. Convenience and security are also important. 63% of millennial respondents said they would move out of an apartment because of poor security. Additionally, 64% of millennials feel it is more important for an apartment to be closer to work than friends and family.

At least according to this survey, the average millennial renter is more concerned with technology and convenience than anything else in an apartment, and are willing to pay for the things they desire.

The Schlage survey was conducted in October 2016 via email and an online survey.

Related Stories

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.