Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction. According to the report, Yardi finds that construction starts have remained "relatively robust" in the first half of 2023, with the under-construction pipeline increasing by 7.6% in Q3.

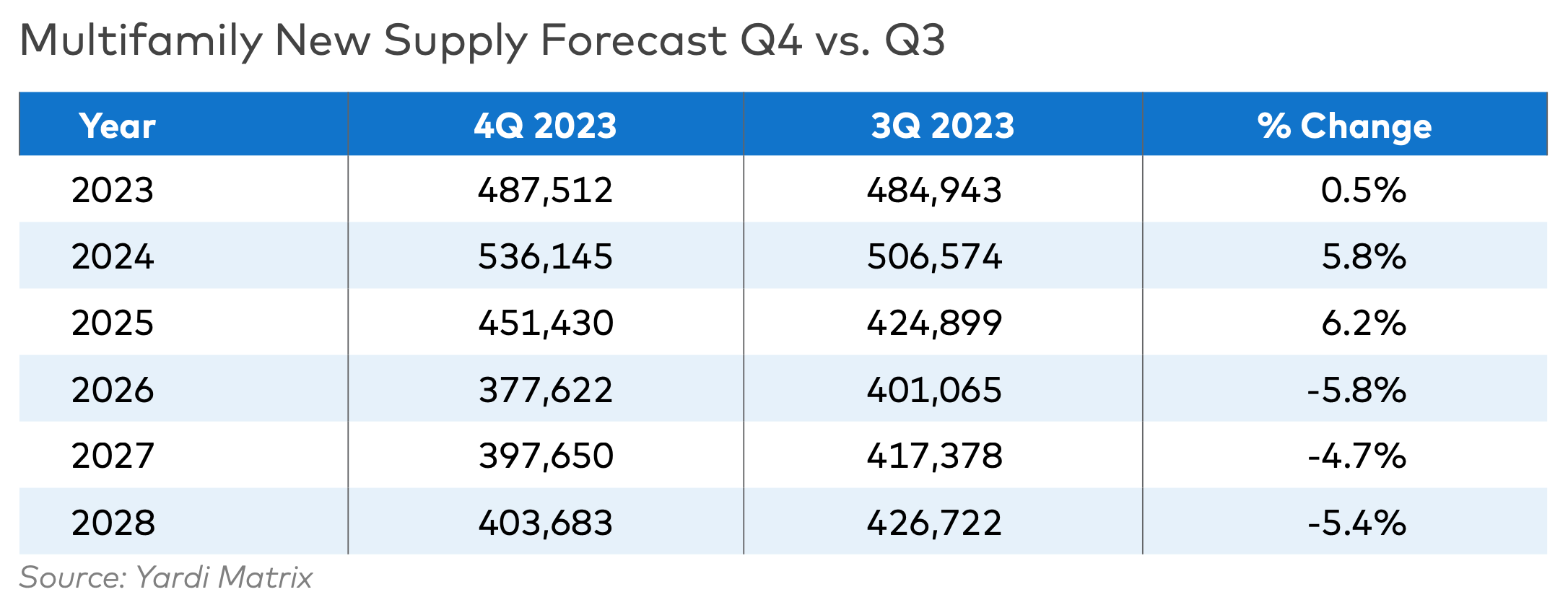

Because of this, new activity is starting to slow. The forecast for project completions has increased by 5.8% for 2024 and 6.2% for 2025. Completions for later years are forecasted to decrease by roughly 5 percent, according to Yardi.

Long-Term Multifamily Supply Forecast

"We continue to expect a mild recession will start in late 2023 or early 2024," the report states. Yardi's forecast for 2026 has therefore been reduced by 5.8% to 377,622 units, while the baseline forecast for 2027 and 2028 completions has been similarly reduced by 4.7% and 5.4% respectively.

For the multifamily markets monitored by Yardi Matrix, there are currently 1.2 million units within the under-construction pipeline. Of these units, just under 480,000 are in the lease-up phase, which is in line with the trailing six-month average of 483,000 units but represents a substantial 15.9% increase from the figures of the previous year. Most of these units are expected to be finalized either by the end of 2023 or during the first half of 2024.

What does this mean for 2024?

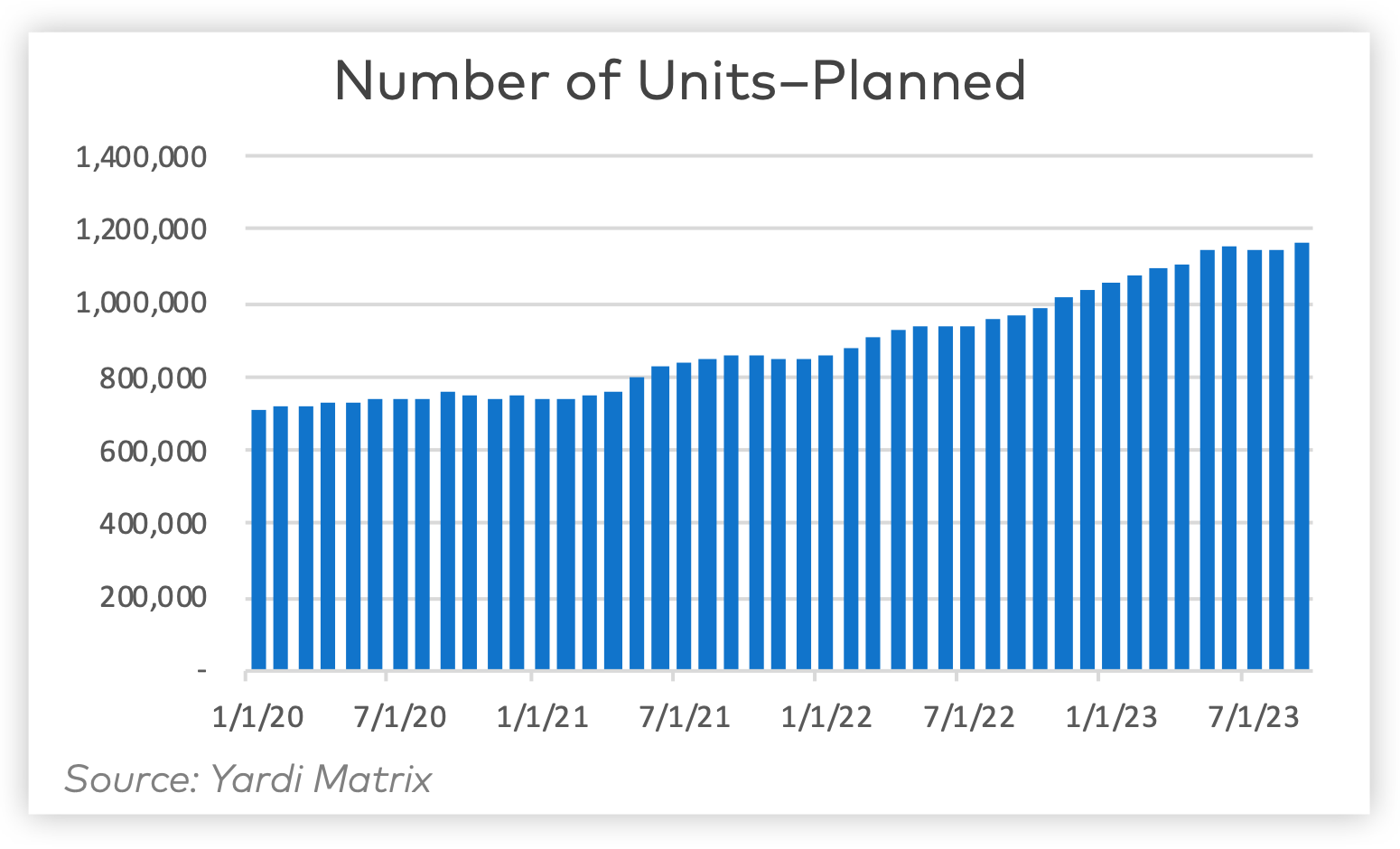

Though short-term construction starts remained elevated through the first half of 2023, several findings from the third quarter suggest that new development activity is slowing. The near flat growth recorded in Q3 is a sharp departure from the growth the planned pipeline recorded post pandemic—another sign that development interest is slowing, according to Yardi.

Overall, Yardi Matrix anticipates an uptick in construction completions in the next two years. Yardi's construction start data reached its year-over-year peak in May 2023. Both planned and prospective pipelines plateaued in Q3.

"Our baseline forecast envisions new supply bottoming in 2026 at around 377,000 units, while the alternative downside forecast models new supply bottoming in 2026 at 335,000 units," writes Ben Bruckner, Senior Research Analyst, Yardi Matrix.

Review the latest Multifamily Supply Forecast here.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

Giants 400 | Aug 29, 2022

Top 110 Multifamily Sector Contractors + CM Firms for 2022

Suffolk Construction, Clark Group, AECOM, and Whiting-Turner top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.

Giants 400 | Aug 29, 2022

Top 75 Multifamily Sector Engineering + EA Firms for 2022

Kimley-Horn, WSP, Langan, and Olsson head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.

Giants 400 | Aug 29, 2022

Top 175 Multifamily Sector Architecture + AE Firms for 2022

Perkins Eastman, Solomon Cordwell Buenz, KTGY, and Gensler top the ranking of the nation's largest multifamily sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.

Multifamily Housing | Aug 25, 2022

7 things to know about designing for Chinese multifamily developers

Seven tips for designing successful apartment and condominium projects for Chinese clients.

Giants 400 | Aug 25, 2022

Top 155 Apartment and Condominium Architecture Firms for 2022

Solomon Cordwell Buenz, KTGY, Gensler, and AO top the ranking of the nation's largest apartment and condominium architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 25, 2022

Top 65 Apartment and Condominium Engineering Firms for 2022

Kimley-Horn, Langan, Thornton Tomasetti, and WSP head the ranking of the nation's largest apartment and condominium engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 25, 2022

Top 100 Apartment and Condominium Contractors for 2022

Clark Group, Suffolk Construction, AECOM, and Lendlease top the ranking of the nation's largest apartment and condominium contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 90 Construction Management Firms for 2022

CBRE, Alfa Tech, Jacobs, and Hill International head the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 200 Contractors for 2022

Turner Construction, STO Building Group, Whiting-Turner, and DPR Construction top the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 45 Engineering Architecture Firms for 2022

Jacobs, AECOM, WSP, and Burns & McDonnell top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.