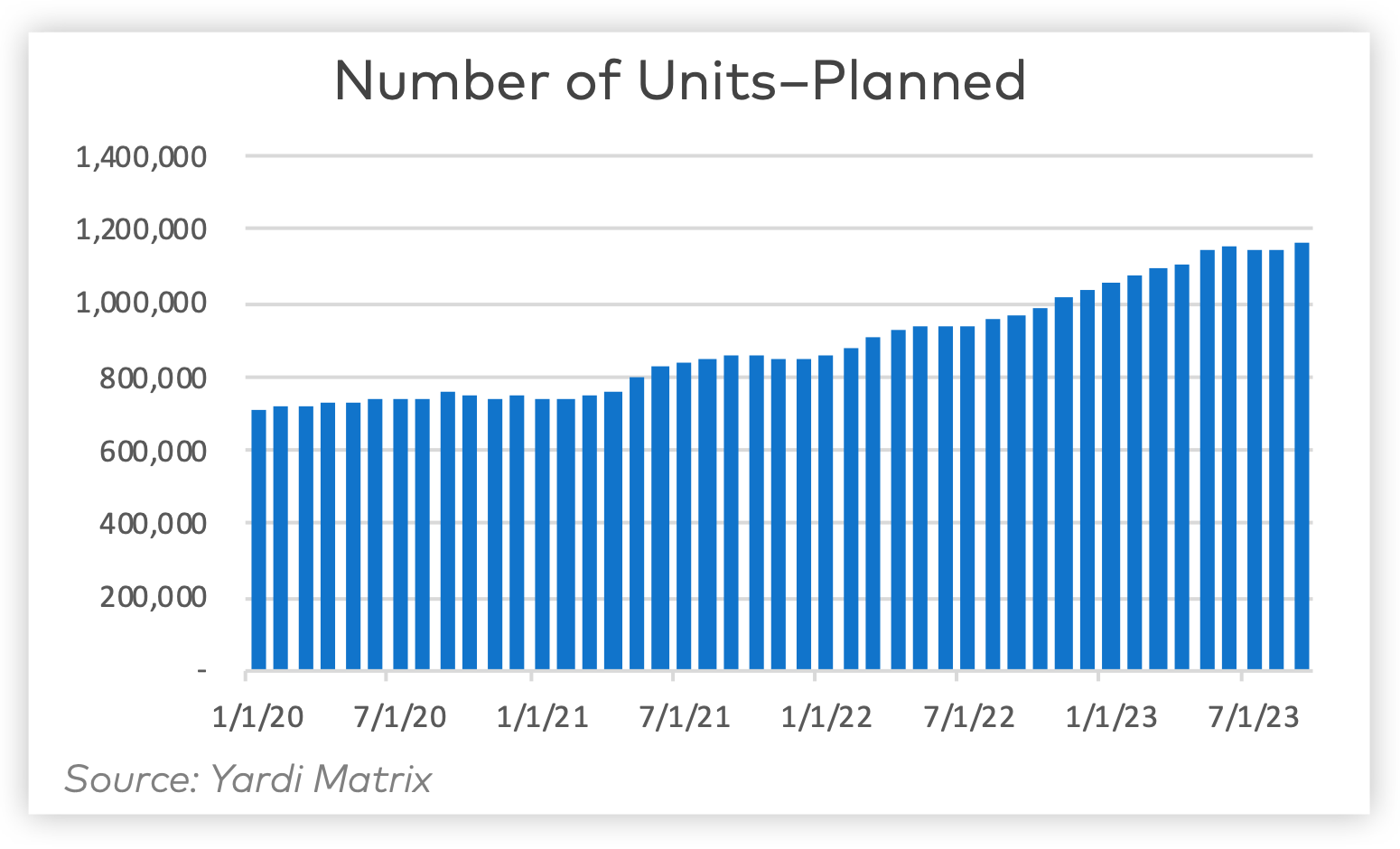

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction. According to the report, Yardi finds that construction starts have remained "relatively robust" in the first half of 2023, with the under-construction pipeline increasing by 7.6% in Q3.

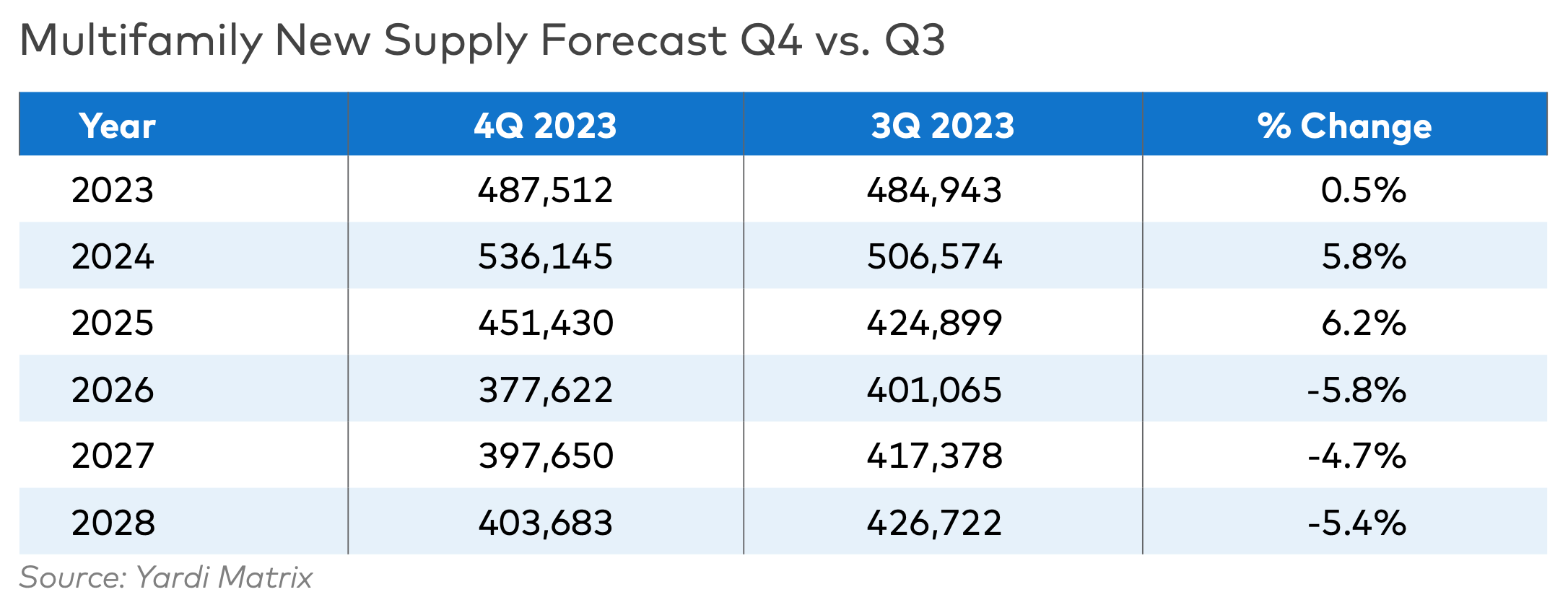

Because of this, new activity is starting to slow. The forecast for project completions has increased by 5.8% for 2024 and 6.2% for 2025. Completions for later years are forecasted to decrease by roughly 5 percent, according to Yardi.

Long-Term Multifamily Supply Forecast

"We continue to expect a mild recession will start in late 2023 or early 2024," the report states. Yardi's forecast for 2026 has therefore been reduced by 5.8% to 377,622 units, while the baseline forecast for 2027 and 2028 completions has been similarly reduced by 4.7% and 5.4% respectively.

For the multifamily markets monitored by Yardi Matrix, there are currently 1.2 million units within the under-construction pipeline. Of these units, just under 480,000 are in the lease-up phase, which is in line with the trailing six-month average of 483,000 units but represents a substantial 15.9% increase from the figures of the previous year. Most of these units are expected to be finalized either by the end of 2023 or during the first half of 2024.

What does this mean for 2024?

Though short-term construction starts remained elevated through the first half of 2023, several findings from the third quarter suggest that new development activity is slowing. The near flat growth recorded in Q3 is a sharp departure from the growth the planned pipeline recorded post pandemic—another sign that development interest is slowing, according to Yardi.

Overall, Yardi Matrix anticipates an uptick in construction completions in the next two years. Yardi's construction start data reached its year-over-year peak in May 2023. Both planned and prospective pipelines plateaued in Q3.

"Our baseline forecast envisions new supply bottoming in 2026 at around 377,000 units, while the alternative downside forecast models new supply bottoming in 2026 at 335,000 units," writes Ben Bruckner, Senior Research Analyst, Yardi Matrix.

Review the latest Multifamily Supply Forecast here.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

Mixed-Use | Sep 21, 2017

Entire living rooms become balconies in a new Lower East Side mixed-used development

NanaWall panels add a unique dimension to condos at 60 Orchard Street in New York City.

Giants 400 | Sep 20, 2017

Bubble? What bubble?: Apartment and condo construction simply can't keep up with demand

Since the current multifamily boom took off in 2010, most activity has focused on large urban areas.

Multifamily Housing | Sep 20, 2017

New housing development rises from a historic textile mill’s ashes

Loft Five50 will add 137 housing units to Lawrence, Mass.

Multifamily Housing | Sep 19, 2017

Top 90 multifamily construction firms

Lendlease, Suffolk Construction, and Clark Group top BD+C’s ranking of the nation’s largest multifamily sector contractor and construction management firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 18, 2017

Top 40 multifamily engineering firms

WSP, AECOM, and Thronton Tomasetti top BD+C’s ranking of the nation’s largest multifamily sector engineering and EA firms, as reported in the 2017 Giants 300 Report.

Multifamily Housing | Sep 15, 2017

Hurricane Harvey damaged fewer apartments in greater Houston than estimated

As of Sept. 14, 166 properties reported damage to 8,956 units, about 1.4% of the total supply of apartments, according to ApartmentData.com.

Giants 400 | Sep 14, 2017

Top 95 multifamily architecture firms

Humphreys & Partners Architects, KTGY, and Perkins Eastman top BD+C’s ranking of the nation’s largest multifamily sector architecture and AE firms, as reported in the 2017 Giants 300 Report.

Multifamily Housing | Sep 5, 2017

Free WiFi, meeting rooms most popular business services amenities in multifamily developments

Complimentary, building-wide WiFi is more or less a given for marketing purposes in the multifamily arena.

University Buildings | Sep 1, 2017

The University of Texas receives boutique-style student housing complex

The Ruckus Lofts provide 46 furnished units and 165 beds for UT students.

Mixed-Use | Aug 30, 2017

Former industrial building becomes 'lifestyle community' in ever-evolving Baltimore

The new community offers 292 apartments with 20,000 sf of retail space.