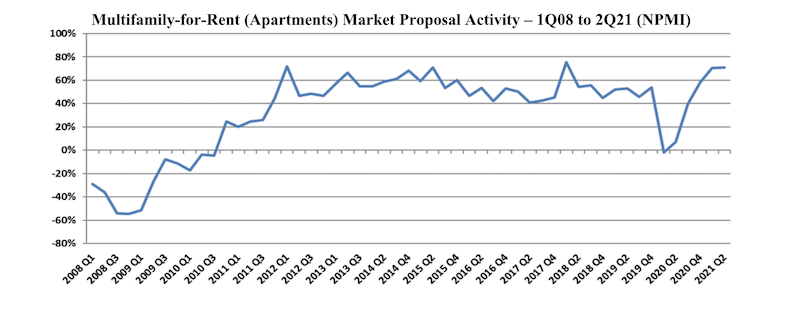

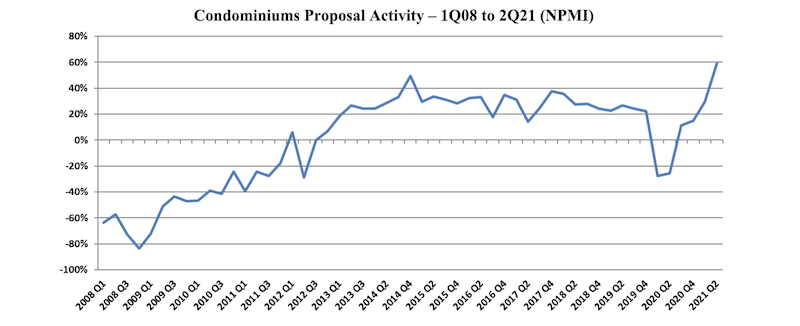

Proposal activity for Multifamily-for-Rent (Apartments) and Condominium properties continued to exceed historic norms, with Condos achieving its highest level since PSMJ Resources began tracking submarkets in its Quarterly Market Forecast (QMF) of A/E/C firm leaders. Apartments, which recorded its third-highest NPMI of 71% in the 1st Quarter, repeated that score in the 2nd Quarter.

While 61% of respondents working in the Condo market reported an increase in proposal activity from the 1st Quarter to the 2nd Quarter, only 2% saw a decline. This net plus/minus index (NPMI) of 59% exceeded the previous high for Condos of 49% achieved in the 4th Quarter of 2014.

Second-quarter proposal activity for Apartments continued to outpace all other submarkets in the Housing sector and all but one (Product Manufacturing) of the 58 submarkets measured across all construction sectors. A full three-quarters of the A/E/C firm leaders responding to PSMJ’s quarterly survey said that Multifamily proposal opportunities grew in the 2nd Quarter compared with only 4% who reported a decline.

The NPMI expresses the difference between the percentage of PSMJ member firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for 12 major markets served by the A/E/C industry since its inception in 2003, and for 58 submarkets since 2006.

The record-high NPMI for Apartments was 76% in the 1st Quarter of 2018, followed by 72% in the 1st Quarter of 2012 and 71% in the 1st Quarters of 2015 and 2021.

PSMJ Senior Principal David Burstein, PE, AECPM, says the future strength of the housing market relies heavily on the ability of state and federal government agencies to invest adequately in infrastructure. “The condo and apartment markets have been on fire for several years, resulting in a lot of new multifamily housing,” says Burstein. “This is now creating traffic and other congestion problems which, if not dealt with by the cognizant government agencies, may cause the multifamily market to slow down in the coming quarters. So it is important to continue tracking the PSMJ NPMI over the next few quarters to spot any emerging slowdowns.”

The Assisted/Independent Senior Living submarket leveled off to an NPMI of 49%, down 10 NPMI percentage points from the 1st Quarter. While 51% of respondents reported an increase in proposal activity, only 2% saw a drop and the remaining 47% said opportunities were flat.

The two other Housing submarkets measured in the PSMJ survey remained strong. The Housing Subdivision market recorded an NPMI of 68% for a second straight month, as not a single respondent in the 2nd Quarter survey reported a decline in proposal opportunities. Single-Family Homes also repeated its 1st Quarter NPMI; the 51% index score once again tied for its second-highest level since the inception of submarket data tracking in the QMF.

PSMJ Resources, a consulting and publishing company dedicated to the A/E/C industry, has conducted its Quarterly Market Forecast for more than 18 years. It includes data on 12 major markets and 58 submarkets served by A/E/C firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Market Data | Dec 19, 2018

Brokers look forward to a commercial real estate market that mirrors 2018’s solid results

Respondents to a recent Transwestern poll expect flat to modest growth for rents and investment in offices, MOBs, and industrial buildings.

Market Data | Dec 19, 2018

When it comes to economic clout, New York will far outpace other U.S. metros for decades to come

But San Jose, Calif., is expected to have the best annual growth rate through 2035, according to Oxford Economics’ latest Global Cities report.

Market Data | Dec 19, 2018

Run of positive billings continues at architecture firms

November marked the fourteenth consecutive month of increasing demand for architectural firm services.

Market Data | Dec 5, 2018

ABC predicts construction sector will remain strong in 2019

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry.

Market Data | Dec 4, 2018

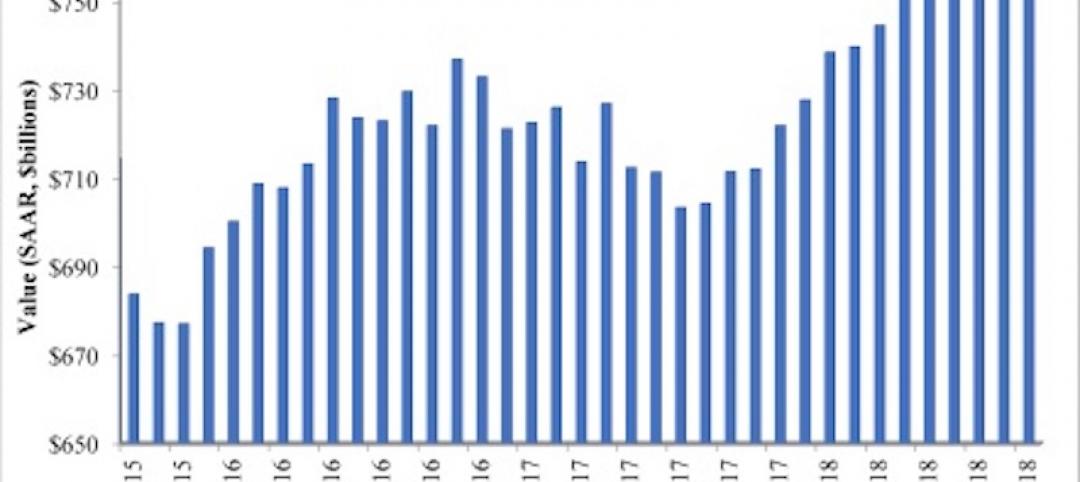

Nonresidential spending rises modestly in October

Thirteen out of 16 subsectors are associated with year-over-year increases.

Market Data | Nov 20, 2018

Construction employment rises from October 2017 to October 2018 in 44 states and D.C.

Texas has biggest annual job increase while New Jersey continues losses; Iowa, Florida and California have largest one-month gains as Mississippi and Louisiana trail.

Market Data | Nov 15, 2018

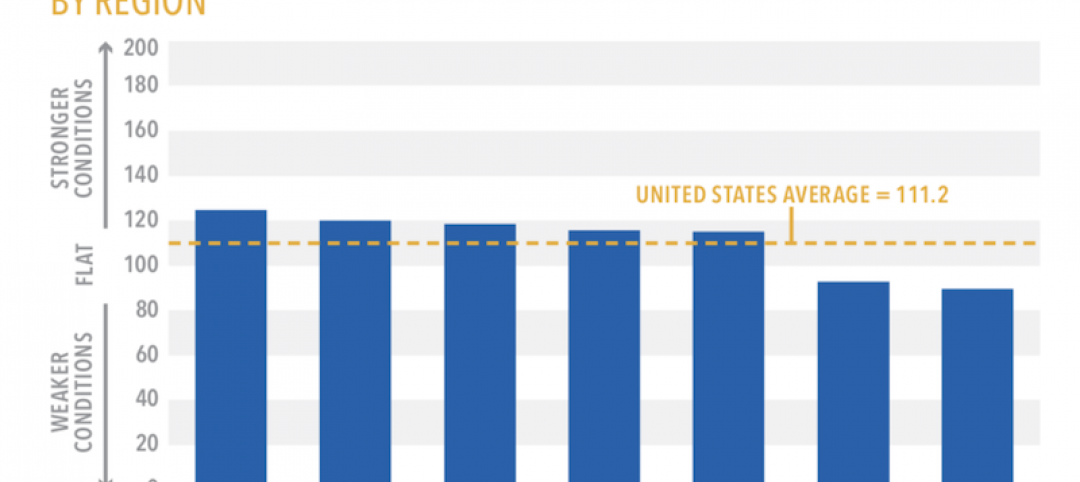

Architecture firm billings continue to slow, but remain positive in October

Southern region reports decline in billings for the first time since June 2012.

Market Data | Nov 14, 2018

A new Joint Center report finds aging Americans less prepared to afford housing

The study foresees a significant segment of seniors struggling to buy or rent on their own or with other people.

Market Data | Nov 12, 2018

Leading hotel markets in the U.S. construction pipeline

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs.

Market Data | Nov 6, 2018

Unflagging national office market enjoys economic tailwinds

Stable vacancy helped push asking rents 4% higher in third quarter.