After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

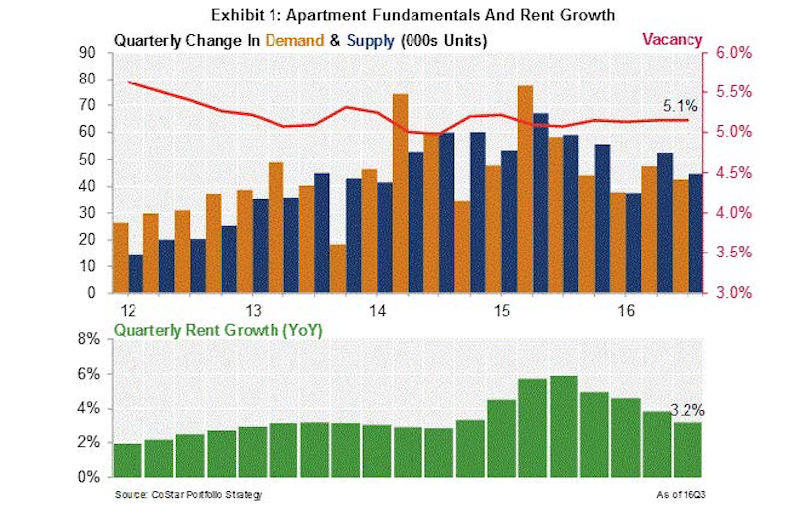

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Multifamily Housing | Feb 18, 2015

Make It Right unveils six designs for affordable housing complex

BNIM is among the six firms involved in the project.

Office Buildings | Feb 18, 2015

Commercial real estate developers optimistic, but concerned about taxes, jobs outlook

The outlook for the commercial real estate industry remains strong despite growing concerns over sluggish job creation and higher taxes, according to a new survey of commercial real estate professionals by NAIOP.

Multifamily Housing | Feb 17, 2015

NYC multifamily sales increased by 39% in 2014

For New York City as a whole, $20 million-plus deals accounted for more than half of all transactions.

Multifamily Housing | Feb 17, 2015

California launches pilot program to finance multifamily retrofits for energy efficiency

The Obama Administration and the state of California are teaming with the Chicago-based MacArthur Foundation on a pilot program whose goal is to unlock Property-Assessed Clean Energy financing for multifamily housing.

Multifamily Housing | Feb 17, 2015

Young Millennials likely to return home

Ninety percent of individuals born between 1980 and 1984 and who hold a Bachelor’s degree left home before they were 27 years hold. However, half of this group later returned to their parents’ home, according to a study by the National Longitudinal Study of Youth.

High-rise Construction | Feb 17, 2015

Work begins on Bjarke Ingels' pixelated tower in Calgary

Construction on Calgary’s newest skyscraper, the 66-story Telus Sky Tower, recently broke ground.

Mixed-Use | Feb 13, 2015

First Look: Sacramento Planning Commission approves mixed-use tower by the new Kings arena

The project, named Downtown Plaza Tower, will have 16 stories and will include a public lobby, retail and office space, 250 hotel rooms, and residences at the top of the tower.

Codes and Standards | Feb 12, 2015

New Appraisal Institute form aids in analysis of green commercial building features

The Institute’s Commercial Green and Energy Efficient Addendum offers a communication tool that lenders can use as part of the scope of work.

Multifamily Housing | Feb 9, 2015

GSEs and their lenders were active on the multifamily front in 2014

Fannie Mae and Freddie Mac securitized more than $57 billion for 850,000-plus units.

Multifamily Housing | Feb 6, 2015

Fannie Mae to offer lower interest rates to LEED-certified multifamily properties

For certified properties, Fannie Mae is now granting a 10 basis point reduction in the interest rate of a multifamily refinance, acquisition, or supplemental mortgage loan.