After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

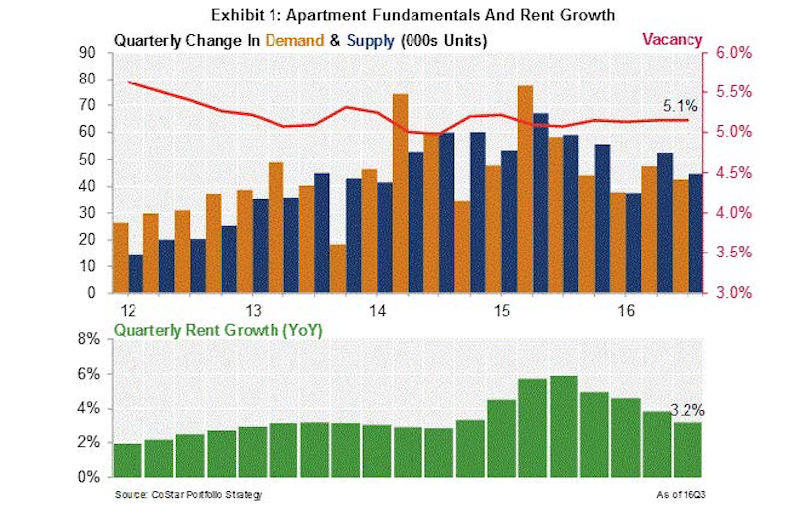

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

| Oct 18, 2013

Researchers discover tension-fusing properties of metal

When a group of MIT researchers recently discovered that stress can cause metal alloy to fuse rather than break apart, they assumed it must be a mistake. It wasn't. The surprising finding could lead to self-healing materials that repair early damage before it has a chance to spread.

| Oct 7, 2013

10 award-winning metal building projects

The FDNY Fireboat Firehouse in New York and the Cirrus Logic Building in Austin, Texas, are among nine projects named winners of the 2013 Chairman’s Award by the Metal Construction Association for outstanding design and construction.

| Oct 7, 2013

Reimagining the metal shipping container

With origins tracing back to the mid-1950s, the modern metal shipping container continues to serve as a secure, practical vessel for transporting valuable materials. However, these reusable steel boxes have recently garnered considerable attention from architects and constructors as attractive building materials.

| Oct 4, 2013

Sydney to get world's tallest 'living' façade

The One Central Park Tower development consists of two, 380-foot-tall towers covered in a series of living walls and vertical gardens that will extend the full height of the buildings.

| Oct 4, 2013

Mack Urban, AECOM acquire six acres for development in LA's South Park district

Mack Urban and AECOM Capital, the investment fund of AECOM Technology Corporation (NYSE: ACM), have acquired six acres of land in downtown Los Angeles’ South Park district located in the central business district (CBD).

| Sep 24, 2013

8 grand green roofs (and walls)

A dramatic interior green wall at Drexel University and a massive, 4.4-acre vegetated roof at the Kauffman Performing Arts Center in Kansas City are among the projects honored in the 2013 Green Roof and Wall Awards of Excellence.

| Sep 23, 2013

Six-acre Essex Crossing development set to transform vacant New York property

A six-acre parcel on the Lower East Side of New York City, vacant since tenements were torn down in 1967, will be the site of the new Essex Crossing mixed-use development. The product of a compromise between Mayor Michael Bloomberg and various interested community groups, the complex will include ~1,000 apartments.

| Sep 20, 2013

August housing starts reveal multifamily still healthy but single-family stagnating

Peter Muoio, Ph.D., senior principal and economist with Auction.com Research, says the Census Bureau's August Housing Starts data released yesterday hints at improvements in the single-family sector with multifamily slowing down.

| Sep 19, 2013

What we can learn from the world’s greenest buildings

Renowned green building author, Jerry Yudelson, offers five valuable lessons for designers, contractors, and building owners, based on a study of 55 high-performance projects from around the world.

| Sep 19, 2013

6 emerging energy-management glazing technologies

Phase-change materials, electrochromic glass, and building-integrated PVs are among the breakthrough glazing technologies that are taking energy performance to a new level.