A recent survey conducted by student housing developer, Core Spaces, of nearly 2,500 college students throughout the United States, reveals how Covid-19 has impacted them – including their mental state, sentiment about remote learning, personal and parents' finances and more. Core Spaces emailed the survey to student residents at 19 Core Spaces properties across 12 cities in 11 states. Responses were collected from June 2 to June 9.

“These important survey results speak to a wide range of ways the pandemic has impacted our young people,” explained Marc Lifshin, founder and chief executive officer of Core Spaces. “Their responses provide valuable insight into how college students are hurting and what they want. More than ever, it's crucial we do our best to make sure their housing is a welcoming and safe place.”

KEY FINDINGS:

Living preferences

Nearly 90% of respondents said they want to come back to campus when classes begin this fall.

72.5% of respondents would like to get back to their universities even if the schools continue online instruction in the fall.

Economic impact / confidence

More than three out of five (63.3%) respondents said the pandemic resulted in economic difficulties for themselves and their families in the following ways:

- Their summer job was canceled (57%)

- Their summer job hours or pay were reduced (32%)

- One of their parents lost his or her job (21%)

- One of their parents had hours or pay reduced (55%)

When it came to how students felt about their future job prospects due to the pandemic, nearly 20% were much less confident, and more than 40% were somewhat less confident. And 40% felt their job prospects were the same as before the pandemic.

Remote learning & studying

Nearly 60% of respondents said online classes had been a negative experience for them.

Nearly eight out of 10 said they feel they'd be more successful studying remotely in their apartments vs. their family’s homes.

Confidence with being safe back at school

90% of respondents were either "very confident" (46.6%) or "somewhat confident" (43.4%) that their universities would take appropriate and available measures to help protect them and other students from spreading the virus.

More than 85% of respondents were either "very confident" (41.6%) or "somewhat confident" (43.7%) that their student housing provider (Core Spaces) would take appropriate and available measures to help protect them and other student residents from spreading the virus.

Psychological impact

Since Covid-19’s onset, students said they had experienced the following:

- Sleep pattern has changed (76%)

- Feel more anxious or stressed (75%)

- Feel more depressed or worried (55.5%)

- Seen a professional for physical or mental health (12%)

Desire for vaccine

When asked how likely they are to want a vaccine if/when it is made available, 63% said very likely, 25.6% said somewhat likely, and 11.3% said not likely.

In total, there were 2,490 respondents from 19 Core Spaces properties in 12 cities and 11 states. The universities/cities, in order of the highest number of respondents, include University of South Carolina, Columbia (324); Penn State, University City, Penn. (304); *University of Florida, Gainesville (273); Michigan State University, East Lansing (231); University of Central Florida, Orlando (225); Purdue University, West Lafayette, Ind. (205); University of Alabama, Tuscaloosa (199 – three Core properties); *University of Arizona, Tucson (192); West Virginia University, Morgantown (144); University of Oklahoma, Norman (143); *University of Kentucky, Lexington (133); University of Mississippi, Oxford (116).

[*Represents two Core properties in the same city/campus.]

“There are so many unknowns around Covid-19," added Lifshin. “We, along with other student housing providers, need to do all we can to reduce the stress that students are feeling and increase their sense of comfort. We plan on offering a mindfulness and meditation program to our 15,000 residents starting late August – this same program had a positive impact on our own staff. We're also rolling out a wide variety of measures to consistently sanitize our buildings and continue to protect our residents.”

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

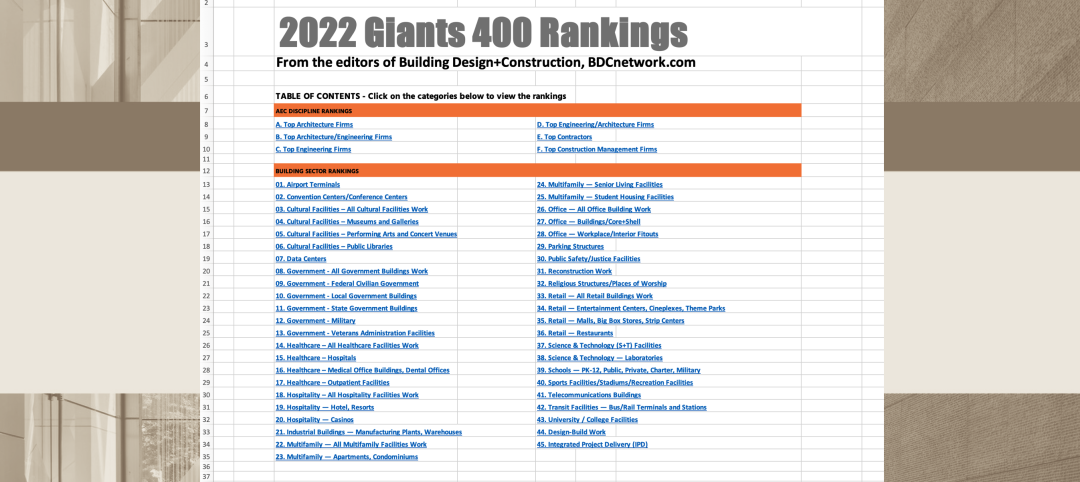

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.