NELSON, the Philadelphia-based interior design firm celebrating its 40th anniversary this year, has merged with two other firms, Cope Linder Architects and KA Architecture, to position itself as a full-service architectural and design outfit across multiple nonresidential building types.

The combinations became effective on June 1.

Founded in 1977, NELSON has steadily expanded for more than 15 years, primarily through acquisitions. In the past two years alone, it bought EHS Design and Marvin Stein Associates in Seattle, AAI in San Jose, and VeenendaalCave in Atlanta.

John “Ozzie” Nelson, Jr., NELSON’s Chairman and CEO, tells BD+C that his company’s marriages with Cope Linder and KA are the first of a series of mergers that NELSON plans to announce this year. Nelson says his company in 2017 would double its revenue to around $200 million and its workforce to “north of 1,200” from 625 at the start of the year.

Nelson and Ian Cope, AIA, LEED AP, Principal with Cope Linder Architects, had been talking, on and off, for 27 months about bringing their respective companies together. Cope says his firm had also been approached by two other suitors—including a Canada-based engineering firm—which it ultimately rebuked, he says, because it feared it might lose its identity with clients “who are concerned about all of this massive absorption of AEC firms” going on in the industry.

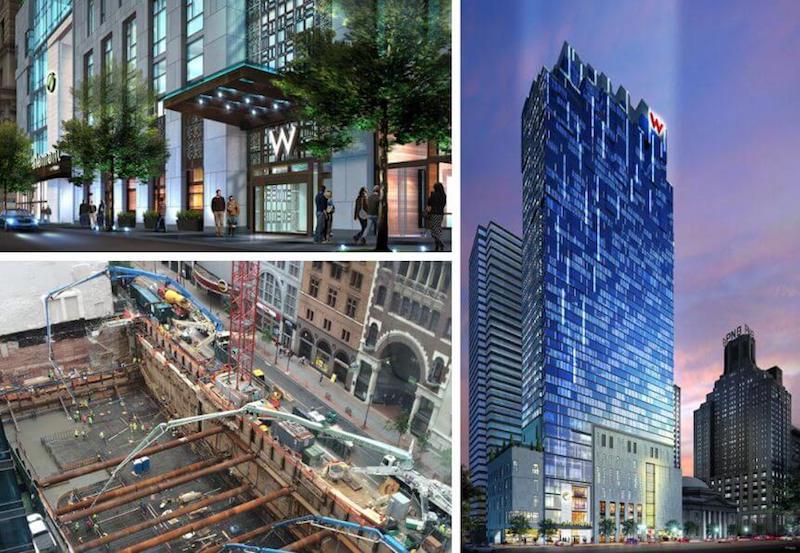

The addition of 50-year-old Cope Linder, also based in Philadelphia, makes NELSON that city’s third-largest studio, with more than 125 employees there. Cope Linder is best known for its work in the commercial, hospitality, gaming, and entertainment sectors. One of the first projects to be completed under the combined company will be the 51-story, 773,000-sf W and Element Hotel in Philadelphia, which opens next year.

Craig Wasserman, RA, Executive Vice President at KA Architecture, says his firm has been predominantly a core and shell builder and planner. It has tried to diversity on its own, “but it never worked out,” he explains. The merger with NELSON, on the other hand, “is the perfect compliment,” and allows KA to go to market as a full-service firm. “We’ve been telling our clients about this merger, and their reaction has been fantastic,” says Wasserman.

Cleveland-based KA Architecture—which was founded in 1960 and, prior to the merger, was into its third generation of ownership—has lent its design services to, among other projects, retail centers, mixed-used developments, and hospitality. Its merger with KA represents Nelson’s third location in the Midwest. The 1.3-million-sf Liberty Center in San Francisco will be the first major project completed under the new brand KA Architecture, A Nelson brand. (KA is the Executive Architect on this project.)

KA and Cope Linder are also forming a core-and-shell practice within NELSON, says Wasserman. Nelson states the combinations place NELSON more competitively into the high-rise architecture market.

The mergers also allow NELSON to launch a newly formed Hospitality Practice, and to beef up its Retail Practice.

Merging for the right reasons

Diversification is certainly one of the drivers behind NELSON’s acquisitive streak. For example, it is close to announcing another acquisition of a firm in New York that surveys and inspects buildings. Under Title 11, buildings over six stories high are required to be surveyed every five years. The firm NELSON would acquire already handles 800 of the 14,500 buildings in New York that fall under that regulation.

NELSON also runs a $13 million MEP engineering firm under a separate brand. But Nelson has never been a believer in combining architecture with other disciplines, such as engineering or building surveying, under one roof. He thinks the better solution to integrate vertically is to create holding companies to run those businesses separately, as it will the core-and-shell entity.

“Culture trumps everything else” when it comes to merging companies, says Nelson, speaking from experience. “It’s important for companies to look at the complete nature of coming together, and to be realistic.” He observes that, too often, smaller firms want to merge with larger firms just to take advantage of their marketing and sales clout without giving enough thought to how such a move might impact their employees and customers.

Nelson confirms that the managements of Cope Linder and KA are remaining with the company. He says NELSON looks for acquisition partners whose managements want to stay on with the combined firm.

When asked why so much AEC consolidation seems to be happening all of a sudden, Nelson says that relationships between firms and their clients don’t matter as much as they used to. “Everything has become a beauty competition,” and size, he says, has become a more important criterion to be considered for certain projects.

In the future, he says that NELSON will be looking to strengthen its position in Texas and the Washington, D.C. market.

Related Stories

| Jan 25, 2011

Bloomberg launches NYC Urban Tech Innovation Center

To promote the development and commercialization of green building technologies in New York City, Mayor Michael R. Bloomberg has launched the NYC Urban Technology Innovation Center. This initiative will connect academic institutions conducting underlying research, companies creating the associated products, and building owners who will use those technologies.

| Jan 25, 2011

Top 10 rules of green project finance

Since the bottom fell out of the economy, finding investors and financial institutions willing to fund building projects—sustainable or otherwise—has been close to impossible. Real estate finance prognosticators, however, indicate that 2011 will be a year to buy back into the real estate market.

| Jan 25, 2011

Chicago invented the skyscraper; can it pioneer sustainable-energy strategies as well?

Chicago’s skyline has always been a source of pride. And while few new buildings are currently going up, building owners have developed a plan to capitalize on the latest advances: Smart-grid technologies that will convert the city’s iconic skyline into what backers call a “virtual green generator” by retrofitting high-rise buildings and the existing electrical grid to a new hyper-connected intelligent-communications backbone.

| Jan 25, 2011

AIA reports: Hotels, retail to lead U.S. construction recovery

U.S. nonresidential construction activity will decline this year but recover in 2012, led by hotel and retail sectors, according to a twice-yearly forecast by the American Institute of Architects. Overall nonresidential construction spending is expected to fall by 2% this year before rising by 5% in 2012, adjusted for inflation. The projected decline marks a deteriorating outlook compared to the prior survey in July 2010, when a 2011 recovery was expected.

| Jan 25, 2011

Jester Jones Schifer Architects, Ltd. Joins GPD Group

GPD Group is excited to announce that Jester Jones Schifer Architects, a Marion-based architectural firm, has joined our firm, now enabling GPD Group to provide architectural services to the Central-Ohio market.

| Jan 21, 2011

Combination credit union and USO center earns LEED Silver

After the Army announced plans to expand Fort Bliss, in Texas, by up to 30,000 troops, FirstLight Federal Credit Union contracted NewGround (as CM) to build a new 16,000-sf facility, allocating 6,000 sf for a USO center with an Internet café, gaming stations, and theater.

| Jan 21, 2011

Manufacturing plant transformed into LEED Platinum Clif Bar headquarters

Clif Bar & Co.’s new 115,000-sf headquarters in Emeryville, Calif., is one of the first buildings in the state to meet the 2008 California Building Energy Efficiency Standards. The structure has the largest smart solar array in North America, which will provide nearly all of its electrical energy needs.

| Jan 21, 2011

Primate research facility at Duke improves life for lemurs

Dozens of lemurs have new homes in two new facilities at the Duke Lemur Center in Raleigh, N.C. The Releasable Building connects to a 69-acre fenced forest for free-ranging lemurs, while the Semi-Releasable Building is for lemurs with limited-range privileges.

| Jan 21, 2011

Harlem facility combines social services with retail, office space

Harlem is one of the first neighborhoods in New York City to combine retail with assisted living. The six-story, 50,000-sf building provides assisted living for residents with disabilities and a nonprofit group offering services to minority groups, plus retail and office space.