Dodge Data & Analytics today released its 2017 Dodge Construction Outlook. The report predicts that total U.S. construction starts for 2017 will advance 5% to $713 billion, following gains of 11% in 2015 and an estimated 1% in 2016.

“The U.S. construction industry has witnessed signs of deceleration in 2016, following several years of steady growth,” says Robert Murray, chief economist for Dodge Data & Analytics. “Total construction starts during the first half of this year lagged behind what was reported in 2015, raising some concern that the current construction expansion may have run its course. However, the early 2016 shortfall reflected the comparison to unusually elevated activity during the first half of 2015, lifted by 13 very large projects valued each at $1 billion or more, such as a $9 billion liquefied natural gas export terminal in Texas and a $2.5 billion office tower in New York City. As 2016 has proceeded, the year-to-date shortfall has grown smaller, easing concern that the construction industry may be in the early stage of cyclical decline. Instead, the construction industry has now entered a more mature phase of its expansion, one that is characterized by slower rates of growth than what took place during the 2012-2015 period, but still growth. Since the construction start statistics will lead the pattern of construction spending, this means that construction spending can be expected to see moderate gains through 2017 and beyond.

“On balance, there are a number of positive factors which suggest the construction expansion has room to proceed. The U.S. economy in 2017 is anticipated to see moderate job growth, market fundamentals for commercial real estate should remain generally healthy, and more funding support is coming from state and local bond measures. Although the global economy in 2017 will remain sluggish, energy prices appear to have stabilized, interest rate hikes will be gradual and few, and a new U.S. President will have been elected. For 2017, total construction starts are forecast to rise 5% to $713 billion. Gains of 8% are expected for both residential building and nonresidential building, while nonbuilding construction slides a further 3%.”

The pattern of construction starts by more specific sectors is the following:

- Single family housing will rise 12% in dollars, corresponding to a 9% increase in units to 795,000 (Dodge basis). Access to home mortgage loans is improving, and some of the caution exercised by potential homebuyers will ease with continued employment growth and low mortgage rates. Older members of the Millennial generation are now moving into the 30 to 35 year-old age bracket, which should begin to lift demand for single family housing.

- Multifamily housing will be flat in dollars and down 2% in units to 435,000 (Dodge basis). This project type now appears to have peaked in 2015, lifted in particular by an exceptional amount of activity in the New York NY metropolitan area, which is now settling back. Continued growth for multifamily housing in other metropolitan areas, along with still generally healthy market fundamentals, will enable the retreat at the national level to stay gradual.

- Commercial building will increase 6% on top of the 12% gain estimated for 2016. Office construction is showing improvement from very low levels, lifted by the start of several signature office towers and broad development efforts in downtown markets. Store construction should show some improvement from a very subdued 2016, and warehouses will register further growth. Hotel construction, while still healthy, will begin to retreat after a strong 2016.

- Institutional building will advance 10%, resuming its expansion after pausing in 2015 and 2016. The educational facilities category is seeing an increasing amount of K-12 school construction, supported by the passage of recent school construction bond measures. More growth is expected for the amusement category (convention centers, sports arenas, casinos) and transportation terminals.

- Manufacturing plant construction will increase 6%, beginning to recover after steep declines in 2015 and 2016 that reflected the pullback for large petrochemical plant starts.

- Public works construction will improve 6%, regaining upward momentum after slipping 3% in 2016. Highways and bridges will derive support from the new federal transportation bill, while environmental works should benefit from the expected passage of the Water Resources Development Act. Natural gas and oil pipeline projects are expected to stay close to the volume that’s been present in 2016.

- Electric utilities and gas plants will fall another 29% after the 26% decline in 2016. The lift that had been present in 2015 from new liquefied natural gas export terminals continues to dissipate. Power plant construction, which was supported in 2016 by the extension of investment tax credits, will ease back as new generating capacity comes on line.

The 2017 Dodge Construction Outlook was presented at the 78th annual Outlook Executive Conference held by Dodge Data & Analytics at the Gaylord National Resort and Convention Center in National Harbor, MD. Copies of the report with additional details by building sector can be ordered here or by calling (800) 591-4462.

Related Stories

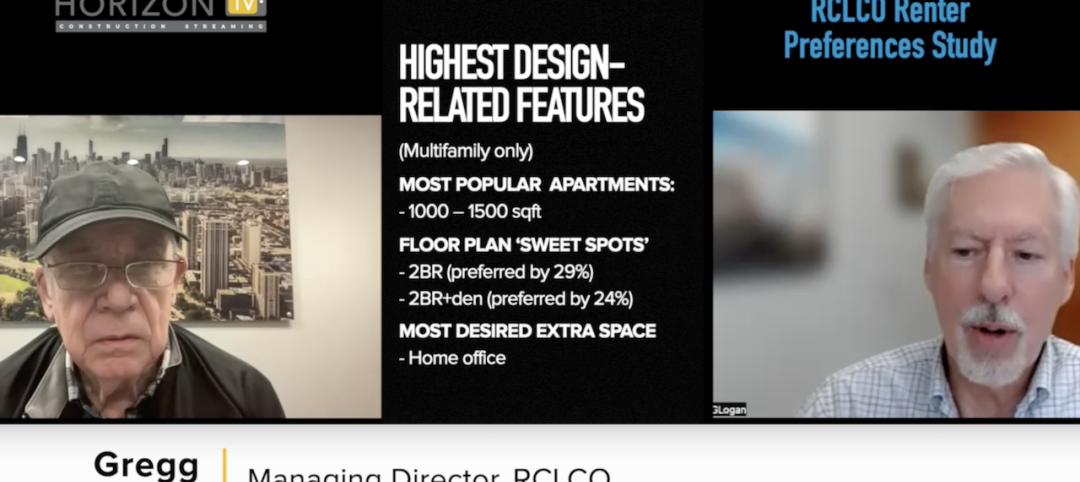

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

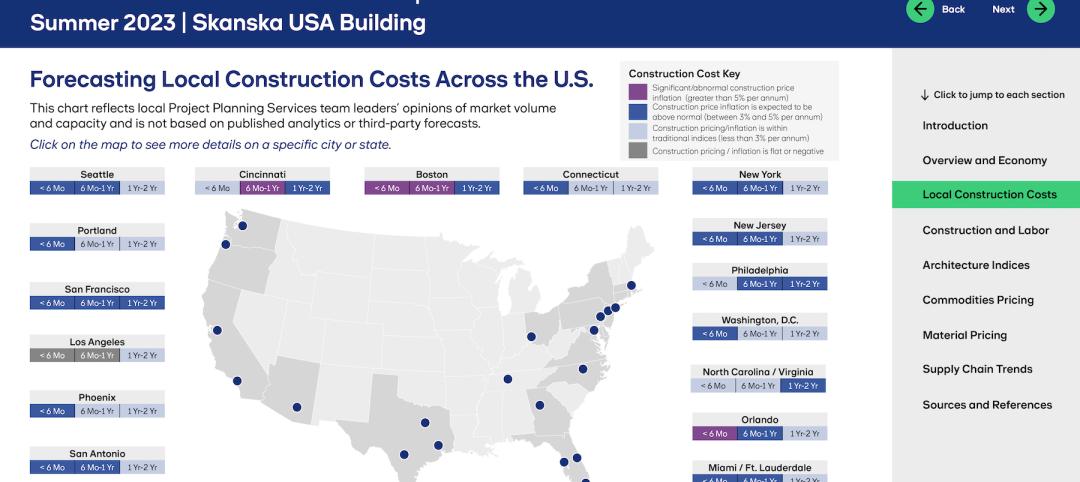

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.