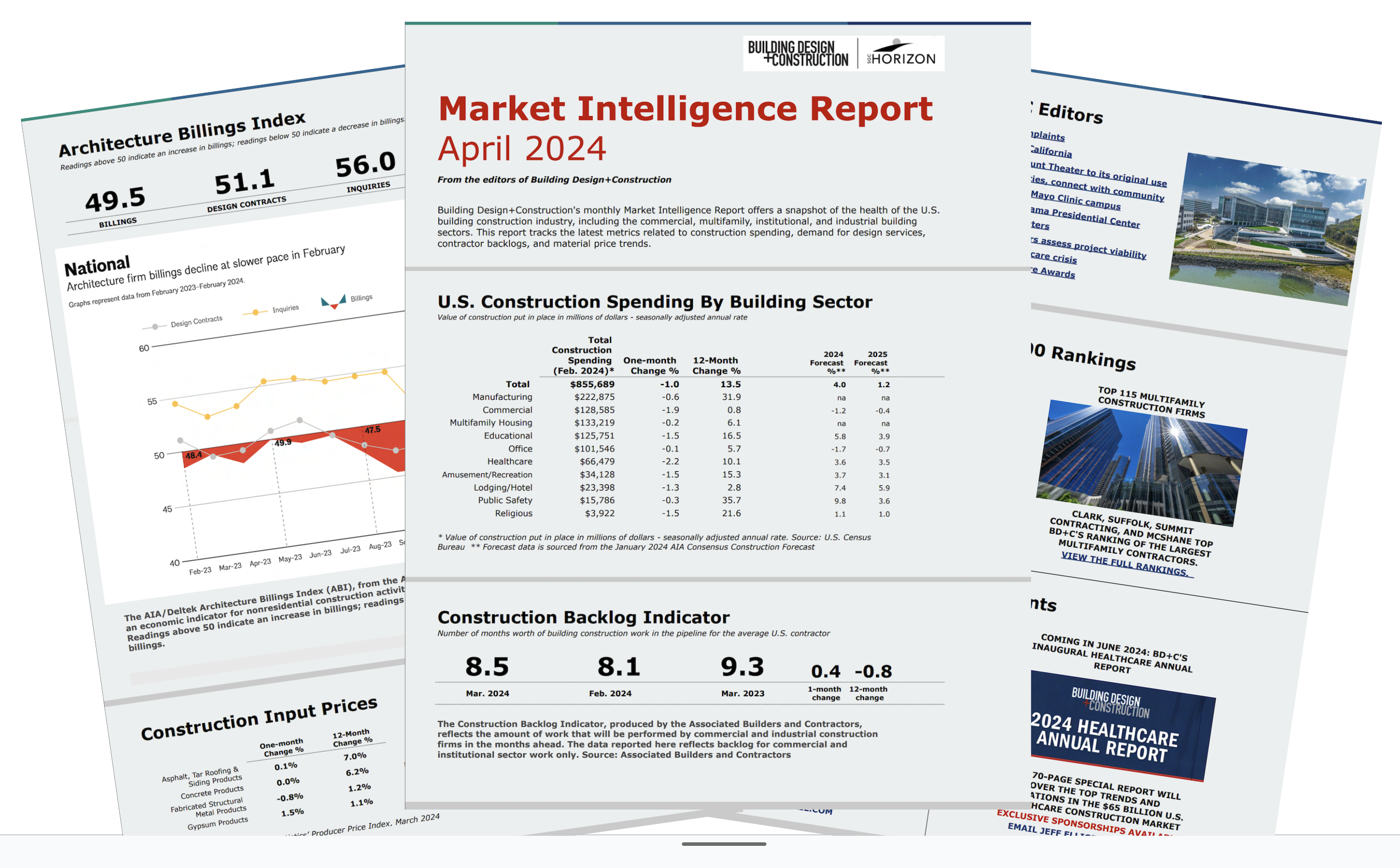

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Data for the Market Intelligence Report is gleaned from reputable economic sources, including the American Institute of Architects, Associated Builders and Contractors, and the U.S. Census Bureau.

Here are some of the highlights from the April 2024 report:

- U.S. construction spending for commercial, institutional, industrial, and multifamily buildings was down 1.0% in February 2024 vs. the previous month, but 13.5% higher than February 2023.

- Public safety, manufacturing, religious, educational, amusement/recreation, and healthcare all saw double-digit year-over-year growth in construction spending.

- The Architectural Billings Index had its best showing since July 2023. While still below 50 (at 49.5), the ABI climbed more than three points in February. The index scores for design contracts and inquiries also jumped in February. Both were above 50, which indicates that, among the firms surveyed by AIA, more firms than not saw increases in design contracts and inquiries for design work.

- Commentary on the latest ABI report from Kermit Baker, PhD, AIA Chief Economist: “There are indicators this month that business conditions at firms may finally begin to pick up in the coming months. Inquiries into new projects grew at their fastest pace since November, and the value of newly signed design contracts increased at their fastest pace since last summer. Given the moderation of inflation for construction costs and prospects for lower interest rates in the coming months, there are positive signs for future growth.”

- Construction backlogs expand: The average U.S. contractor had 8.5 months worth of building construction work in the pipeline as of March 2024, up 0.4 months from February 2024, but down 0.8 months from the same time last year.

- Construction material prices rose 0.4% in March 2024 vs. the previous month, and were 1.7% higher than a year ago. This marks the third straight month of rising prices, after a streak of three consecutive monthly declines.

- Commentary on the latest construction materials price report from Anirban Basu, ABC Chief Economist: “There has been growing evidence of resurfacing inflationary pressures in the nation’s nonresidential construction segment during the past two months. Were it not for declines in energy prices, the headline figure for construction input price dynamics would have been meaningfully higher. A new set of supply chain issues is emerging, including the cost of insuring ships and bottlenecks in the Red Sea, the Panama Canal and Baltimore."

Related Stories

Sustainable Design and Construction | Oct 10, 2024

Northglenn, a Denver suburb, opens a net zero, all-electric city hall with a mass timber structure

Northglenn, Colo., a Denver suburb, has opened the new Northglenn City Hall—a net zero, fully electric building with a mass timber structure. The 32,600-sf, $33.7 million building houses 60 city staffers. Designed by Anderson Mason Dale Architects, Northglenn City Hall is set to become the first municipal building in Colorado, and one of the first in the country, to achieve the Core certification: a green building rating system overseen by the International Living Future Institute.

Contractors | Oct 10, 2024

How to get your construction team engaged and on board with new processes

Discover practical strategies to boost employee engagement and create a collaborative environment where your team feels valued and motivated to contribute to your company’s vision.

3D Printing | Oct 9, 2024

3D-printed construction milestones take shape in Tennessee and Texas

Two notable 3D-printed projects mark milestones in the new construction technique of “printing” structures with specialized concrete. In Athens, Tennessee, Walmart hired Alquist 3D to build a 20-foot-high store expansion, one of the largest freestanding 3D-printed commercial concrete structures in the U.S. In Marfa, Texas, the world’s first 3D-printed hotel is under construction at an existing hotel and campground site.

University Buildings | Oct 9, 2024

Des Moines University Medicine and Health Sciences opens a new 88-acre campus

Des Moines University Medicine and Health Sciences has opened a new campus spanning 88 acres, over three times larger than its previous location. Designed by RDG Planning & Design and built by Turner Construction, the $260 million campus features technology-rich, flexible educational spaces that promote innovative teaching methods, expand research activity, and enhance clinical services. The campus includes four buildings connected with elevated pathways and totaling 382,000 sf.

Student Housing | Oct 9, 2024

University of Maryland begins work on $148 million graduate student housing development

The University of Maryland, in partnership with Campus Apartments and Mosaic Development Partners, has broken ground on a $148.75 million graduate student housing project on the university’s flagship College Park campus. The project will add 741 beds in 465 fully furnished apartments.

AEC Tech Innovation | Oct 8, 2024

New ABC technology report examines how AI can enhance efficiency, innovation

The latest annual technology report from Associated Builders and Contractors delves into how artificial intelligence can enhance efficiency and innovation in the construction sector. The report includes a resource guide, a case study, insight papers, and an essay concerning applied uses for AI planning, development, and execution.

Healthcare Facilities | Oct 8, 2024

Herzog & de Meuron completes Switzerland’s largest children’s hospital

The new University Children’s Hospital Zurich features 114 rooftop patient rooms designed like wooden cottages with their own roofs. The project also includes a research and teaching facility.

Mixed-Use | Oct 7, 2024

New mixed-use tower by Studio Gang completes first phase of San Francisco waterfront redevelopment

Construction was recently completed on Verde, a new mixed-use tower along the San Francisco waterfront, marking the end of the first phase of the Mission Rock development. Verde is the fourth and final building of phase one of the 28-acre project that will be constructed in several phases guided by design principles developed by a design cohort led by Studio Gang.

Brick and Masonry | Oct 7, 2024

A journey through masonry reclad litigation

This blog post by Walter P Moore's Mallory Buckley, RRO, PE, BECxP + CxA+BE, and Bob Hancock, MBA, JD, of Munsch Hardt Kopf & Harr PC, explains the importance of documentation, correspondence between parties, and supporting the claims for a Plaintiff-party, while facilitating continuous use of the facility, on construction litigation projects.

University Buildings | Oct 4, 2024

Renovations are raising higher education campuses to modern standards

AEC higher ed Giants report working on a variety of building types, from performing arts centers and libraries to business schools. Hybrid learning is seemingly here to stay. And where possible, these projects address wellness and mental health concerns.