Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Data for the Market Intelligence Report is gleaned from reputable economic sources, including the American Institute of Architects, Associated Builders and Contractors, and the U.S. Census Bureau.

Here are some of the highlights from the May 2024 report:

- U.S. construction spending for commercial, institutional, industrial, and multifamily buildings was flat in March 2024 vs. the previous month, but 12.5% higher than March 2023.

- The education, amusement/recreation, public safety, manufacturing, and religious sectors all saw double-digit year-over-year growth in construction spending.

- After a relatively solid showing in February, the Architectural Billings Index took a major step back in March, dropping 5.9 points to 43.6. According to AIA, this marks the 14th consecutive month of declining billings at firms.

- Commentary on the latest ABI report from Kermit Baker, PhD, AIA Chief Economist: "This marked the 14th consecutive month of declining billings at firms as inflation, supply chain issues, and other economic challenges continue to affect business. While inquiries into new projects have continued to grow during that period, it has been at a slower pace than in 2021 and 2022. More notably, the value of new signed design contracts was flat in March, which has generally been the trend for the last year and a half. This shows that clients are interested in starting new projects but remain hesitant to sign a contract and officially commit to those projects. However, most firms report that they still have strong project backlogs of 6.6 months, on average, so even with the ongoing soft patch, they still have work in the pipeline."

- Construction backlogs remain steady: The average U.S. contractor had 8.5 months worth of building construction work in the pipeline as of April 2024, flat from March 2024, but down 0.7 months from the same time last year.

- Construction material prices rose 0.5% in April 2024 vs. the previous month, and were 2.3% higher than a year ago. This marks the fourth straight month of rising prices, after a streak of three consecutive monthly declines.

- Commentary on the latest construction materials price report from Anirban Basu, ABC Chief Economist: “Construction input prices jumped half a percentage point higher in April and have increased 3.5% over the first four months of the year. While iron, steel, asphalt and gypsum product prices fell in April, oil and copper prices surged, driving the monthly increase. Rising input prices will put pressure on profits at a time when nearly 1 in 4 contractors expect their margins to contract over the next two quarters, according to ABC’s Construction Confidence Index. Perhaps more importantly for contractors, the overall Producer Price Index reading for final demand goods and services increased 0.5% in April. This is yet another sign that inflation is accelerating and suggests that interest rates are set to stay higher for longer."

Related Stories

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 6, 2023

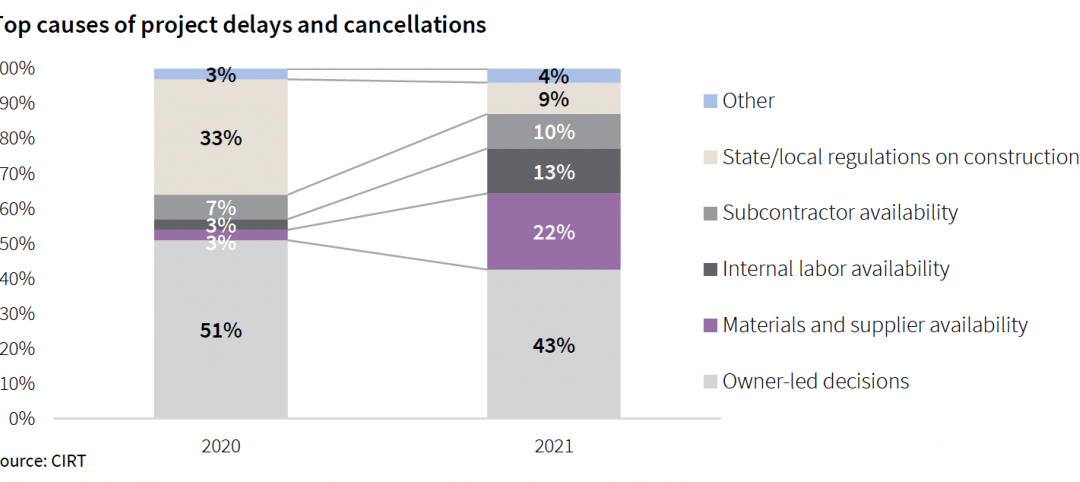

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

| Sep 8, 2022

U.S. construction costs expected to rise 14% year over year by close of 2022

Coldwell Banker Richard Ellis (CBRE) is forecasting a 14.1% year-on-year increase in U.S. construction costs by the close of 2022.

Market Data | Oct 11, 2021

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.