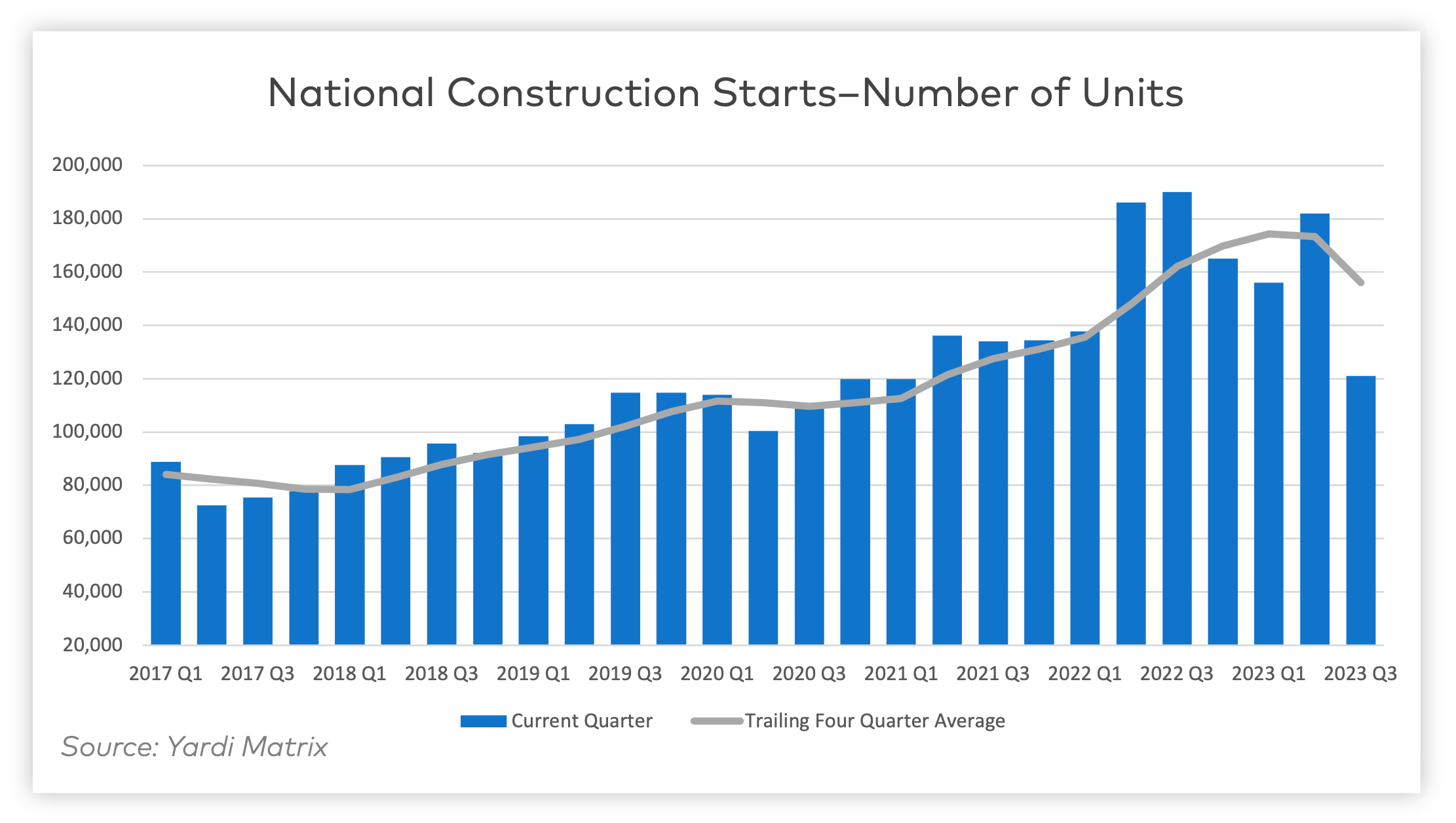

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report. The data from 2023—albeit incomplete—shows that 506,742 units began construction. This figure ranks third for new construction starts even without the complete full year's data.

Yardi’s biggest takeaway is that multifamily development in 2023 exceeded initial expectations. This was driven in part by a “stronger-than-expected” Q1 and Q2, as well as an influx of affordable and single-family rental housing.

New Multifamily Development Insights

These are three insights from the Yardi Matrix Multifamily Construction Starts – January 2024 report:

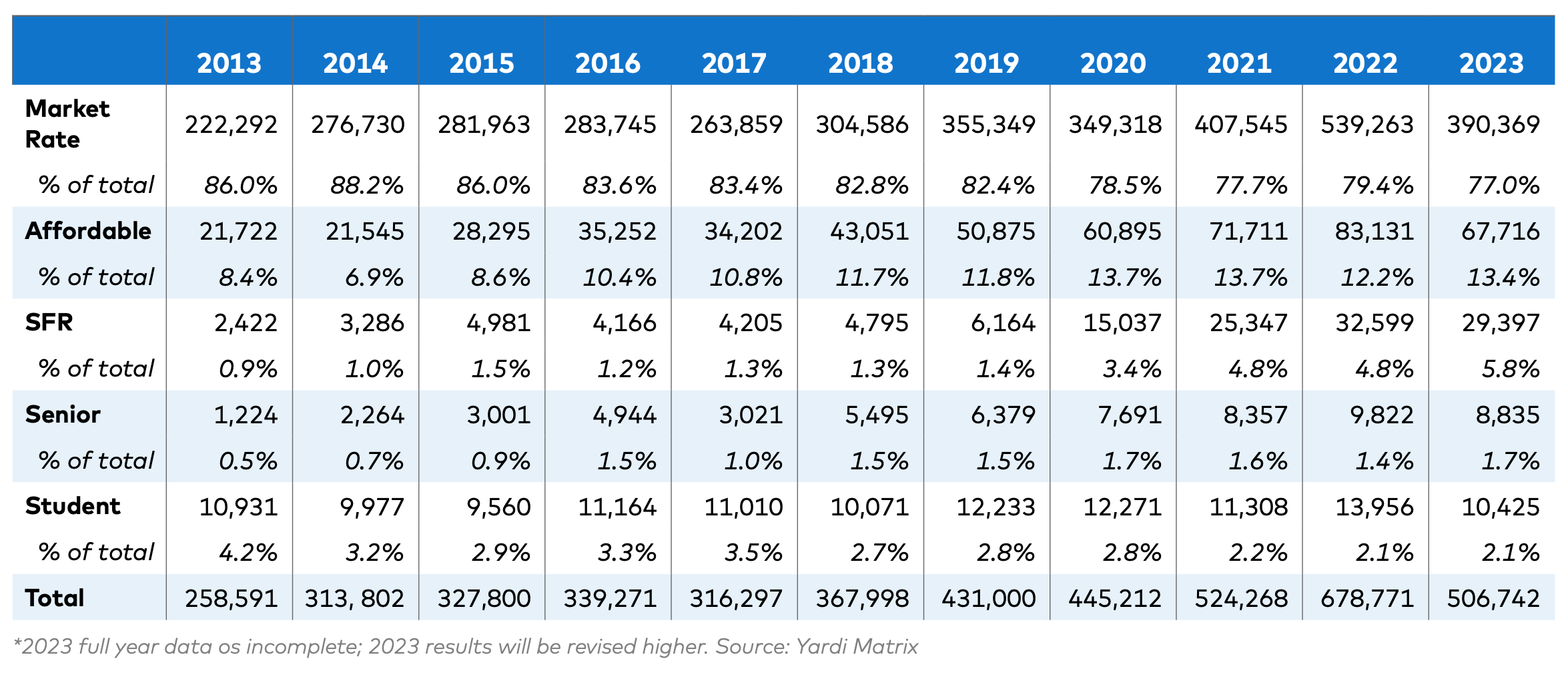

1. Single-family rentals and affordable housing have become increasingly popular

For the last decade, the percentage of market rate multifamily units has declined in favor of other product types. While market rate units comprised 86% of all new multifamily construction starts in 2013, they now make up only 77% of the sector as of last year.

Conversely, affordable housing starts jumped from 8.4% to 13.4% of the total in ten years. Single-family rental increased from 0.9% to 5.8% in the same timeframe.

Senior housing has remained largely unchanged since 2013, increasing from 0.5% to 1.7%; student housing has been declining slowly, comprising 4.2% of multifamily construction starts in 2013 to 2.1% in 2023.

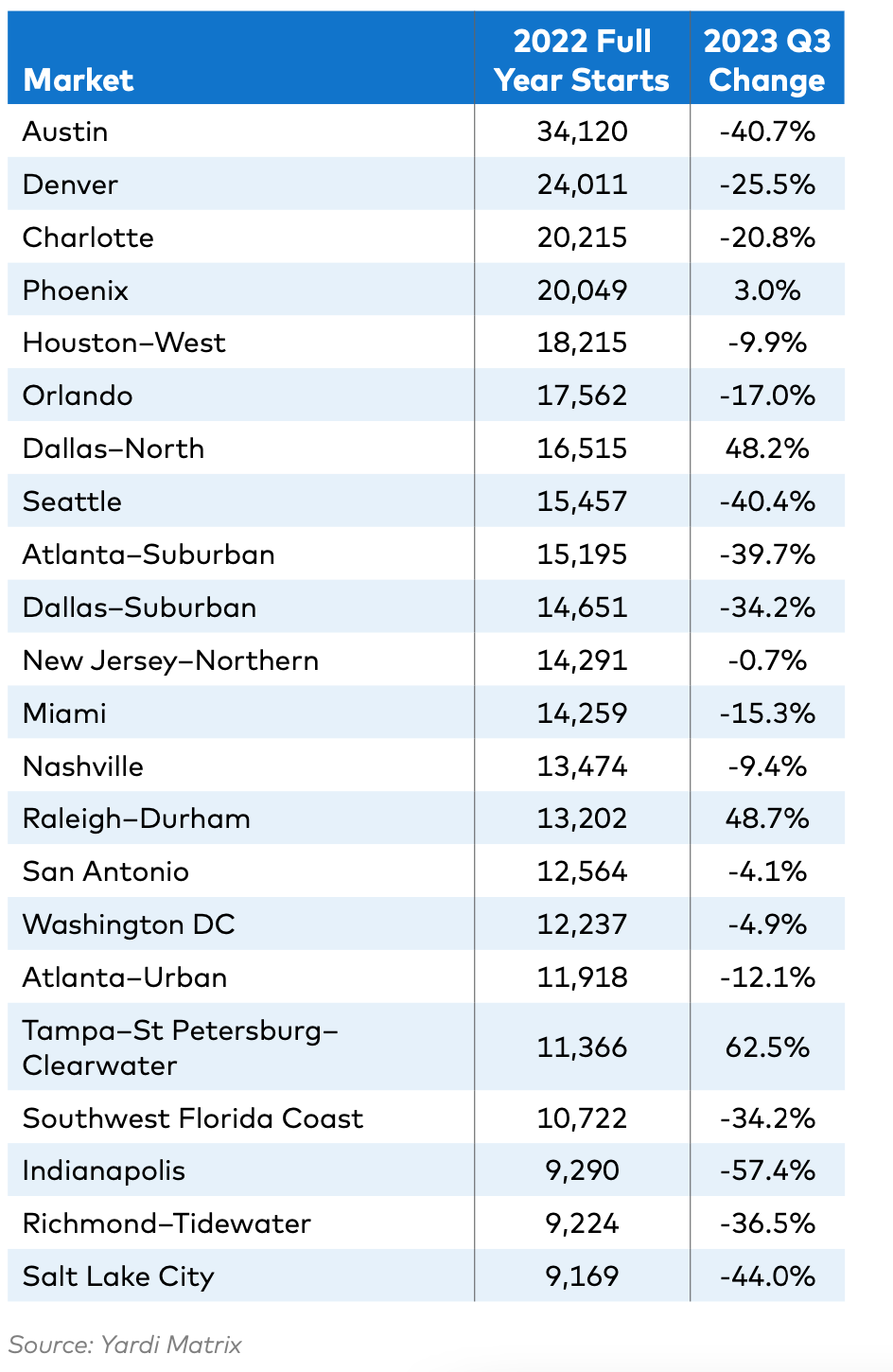

2. Markets with high levels of development in 2022 saw substantial declines in new construction starts in 2023

2022 saw 678,771 units start construction, a 29.4% increase over 2021 levels. Half of those were contained in just 22 markets. For the first three quarters of 2023, 18 of those markets saw starts decline compared to the same period in 2022.

Some of the more sizable declines in major metropolitan areas include:

- Salt Lake City, Utah, had a –44% change in multifamily starts from 2022

- Austin, Texas, had a –40.7% change in multifamily starts from 2022

- Seattle, Wash., had a –40.4% change in multifamily starts from 2022

Other markets like Southwest Florida Coast and suburban Atlanta, Dallas, and Denver saw starts decline by 25% or more.

3. Much of 2023’s new-development activity was driven by smaller and midsize markets

According to the report, markets that did not participate in the post-pandemic development surge were better able to sustain new construction in 2023. These markets tended to be on the smaller size, averaging an increase of 2,161 units over the year.

According to the report, markets that did not participate in the post-pandemic development surge were better able to sustain new construction in 2023. These markets tended to be on the smaller size, averaging an increase of 2,161 units over the year.

Just four of the 22 strongest markets in 2022 continued to grow in 2023:

- Phoenix, Ariz., had a 3% growth in multifamily starts

- North Dallas, Texas, had a 48.2% growth in multifamily starts

- Raleigh–Durham, N.C., had a 48.7% growth in multifamily starts

- Tampa–St. Petersburg–Clearwater, Fla., had a 62.5% growth in multifamily starts

Other markets like Boston, Mass., (35%) and Kansas City, Mo., (41%) saw growth as well.

Bottom Line

Though slightly less than expected, new multifamily starts in 2023 are the 3rd highest year ever with 506,742 units. The growth primarily comes from affordable housing, single-family rentals, and smaller/midsize markets.

The decline this year is largely driven by tight financing conditions, and markets with high 2022 activity not being able to keep up. Despite the decline in starts, completions are expected to stay strong in 2024-2025.

Related Stories

Industry Research | Nov 4, 2016

New survey exposes achievement gap between men and women designers

Female architects still feel disadvantaged when it comes to career advancement.

Market Data | Nov 2, 2016

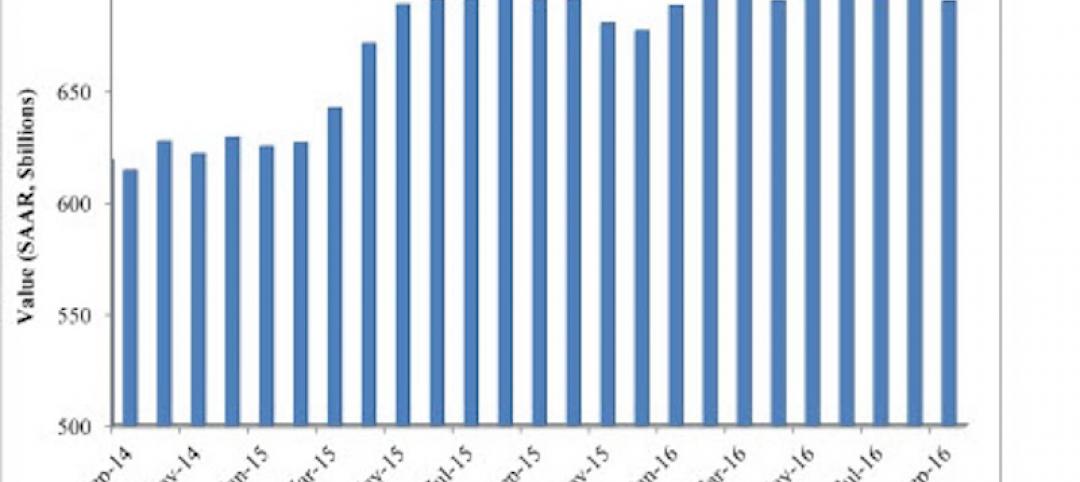

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Industry Research | Nov 1, 2016

Perkins Eastman Research releases white paper on ‘Centers for Healthy Living’ and whole-person wellness

Among the spotlight projects used as case studies for this white paper are C.C. Young, Dallas, Texas; Clark-Lindsey Village, Urbana, Ill.; Moorings Park, Naples, Fla.; NewBridge on the Charles, Dedham, Mass.; Rockwood Retirement Living: The Summit, Spokane, Wash.; Saint John’s on the Lake, Milwaukee, Wis.; and Spring Lake Village, Santa Rosa, Calif.

Market Data | Oct 31, 2016

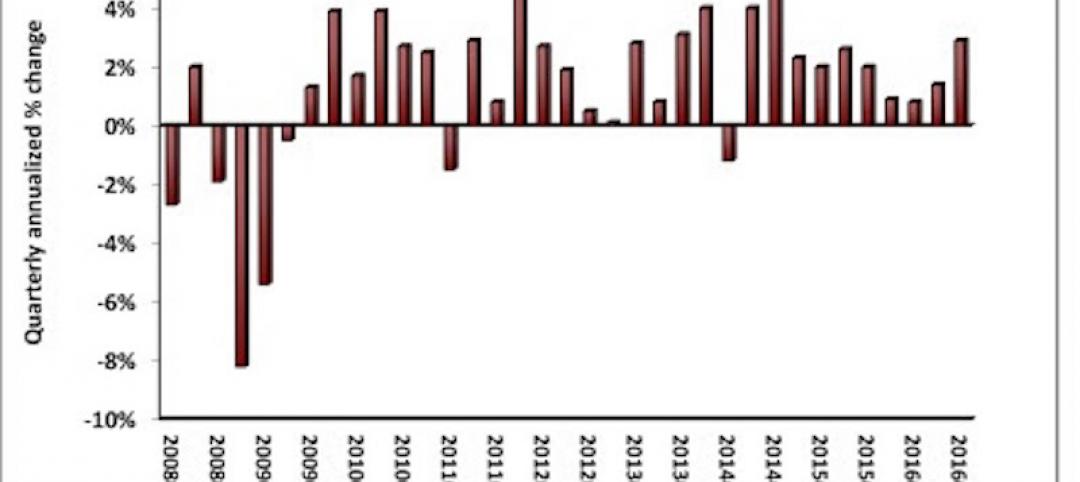

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

Industry Research | Oct 20, 2016

New book from HDR explores opportunities for how healthcare organizations can reinvent the patient experience

Delta offers a close look at specific activities and behaviors that can help healthcare providers and caregivers discover revolutionary concepts to help them embrace and thrive in the rapid change that surrounds them.

Designers | Oct 12, 2016

Perkins Eastman and EwingCole co-publish new white paper examining the benefits and challenges of design research

The survey’s findings, combined with input from the EDRA conference, informed the content produced for “Where Are We Now?”

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion