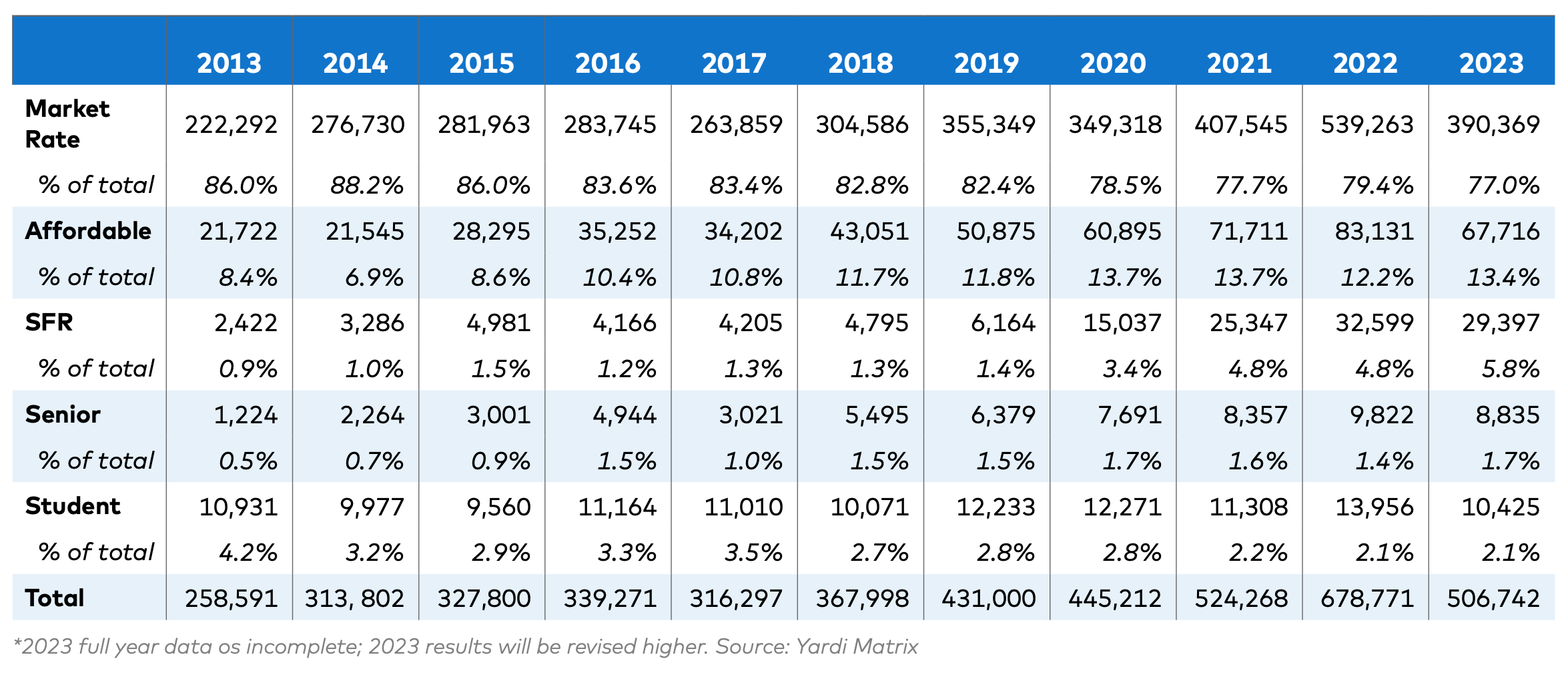

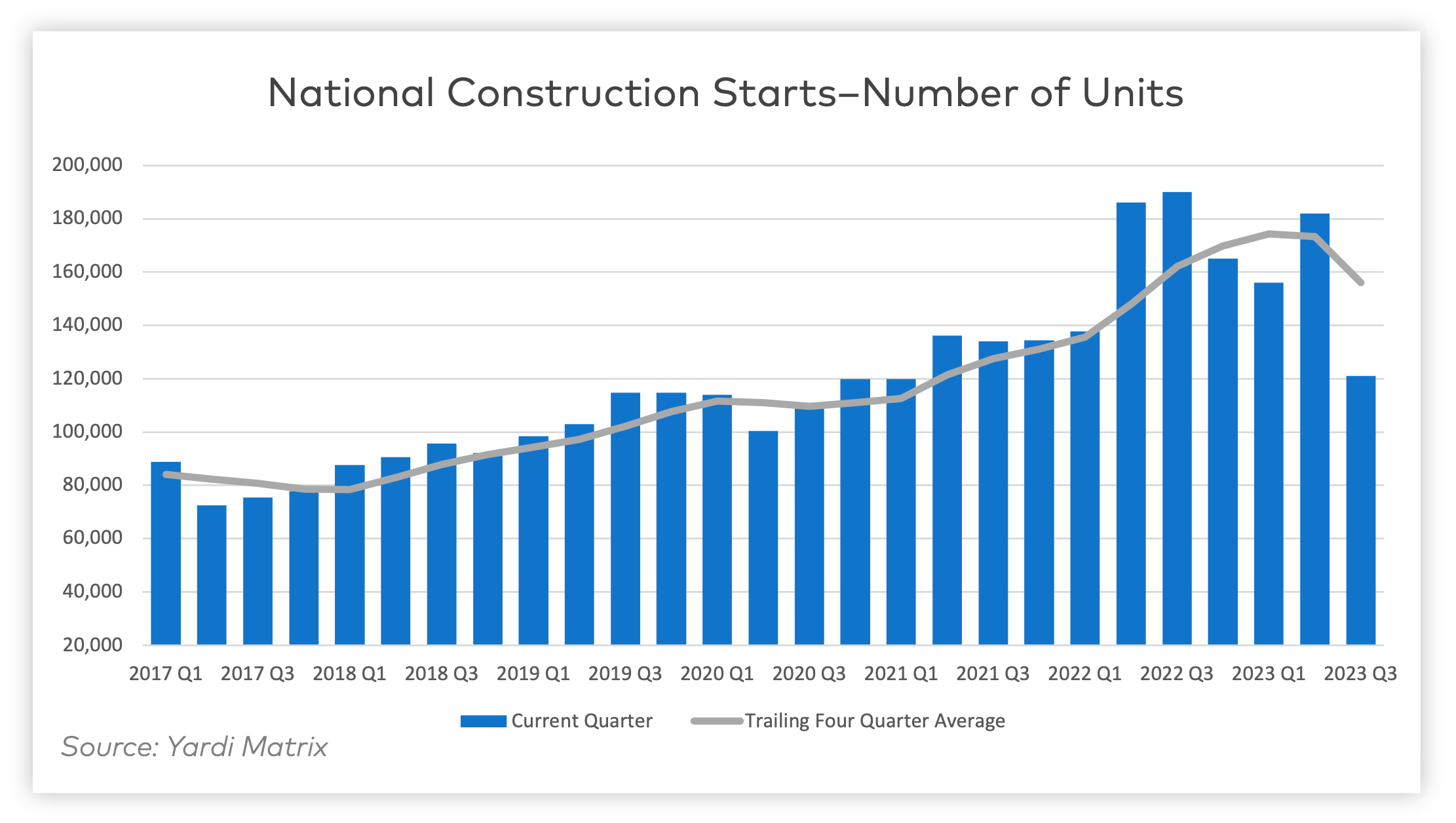

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report. The data from 2023—albeit incomplete—shows that 506,742 units began construction. This figure ranks third for new construction starts even without the complete full year's data.

Yardi’s biggest takeaway is that multifamily development in 2023 exceeded initial expectations. This was driven in part by a “stronger-than-expected” Q1 and Q2, as well as an influx of affordable and single-family rental housing.

New Multifamily Development Insights

These are three insights from the Yardi Matrix Multifamily Construction Starts – January 2024 report:

1. Single-family rentals and affordable housing have become increasingly popular

For the last decade, the percentage of market rate multifamily units has declined in favor of other product types. While market rate units comprised 86% of all new multifamily construction starts in 2013, they now make up only 77% of the sector as of last year.

Conversely, affordable housing starts jumped from 8.4% to 13.4% of the total in ten years. Single-family rental increased from 0.9% to 5.8% in the same timeframe.

Senior housing has remained largely unchanged since 2013, increasing from 0.5% to 1.7%; student housing has been declining slowly, comprising 4.2% of multifamily construction starts in 2013 to 2.1% in 2023.

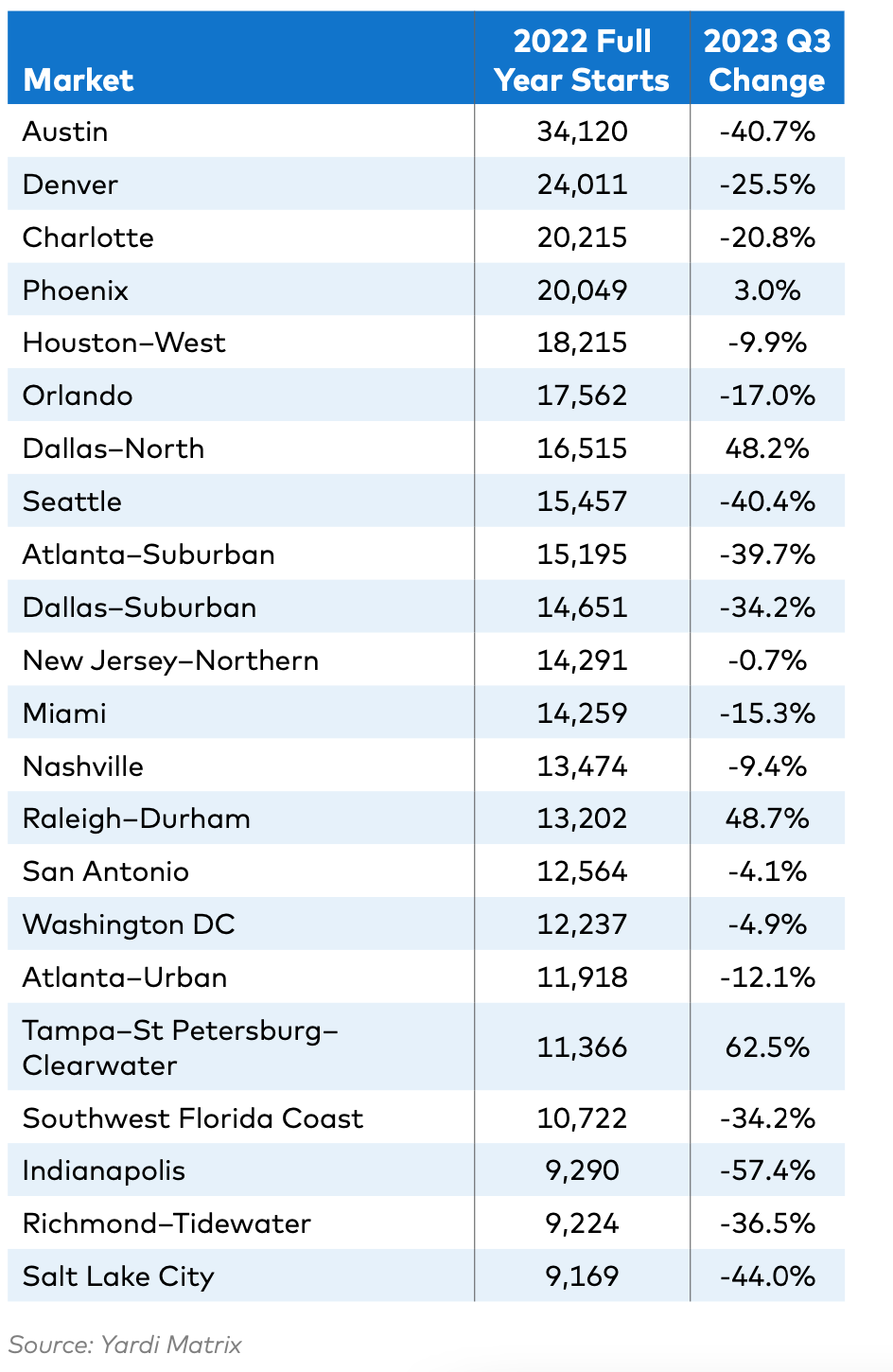

2. Markets with high levels of development in 2022 saw substantial declines in new construction starts in 2023

2022 saw 678,771 units start construction, a 29.4% increase over 2021 levels. Half of those were contained in just 22 markets. For the first three quarters of 2023, 18 of those markets saw starts decline compared to the same period in 2022.

Some of the more sizable declines in major metropolitan areas include:

- Salt Lake City, Utah, had a –44% change in multifamily starts from 2022

- Austin, Texas, had a –40.7% change in multifamily starts from 2022

- Seattle, Wash., had a –40.4% change in multifamily starts from 2022

Other markets like Southwest Florida Coast and suburban Atlanta, Dallas, and Denver saw starts decline by 25% or more.

3. Much of 2023’s new-development activity was driven by smaller and midsize markets

According to the report, markets that did not participate in the post-pandemic development surge were better able to sustain new construction in 2023. These markets tended to be on the smaller size, averaging an increase of 2,161 units over the year.

According to the report, markets that did not participate in the post-pandemic development surge were better able to sustain new construction in 2023. These markets tended to be on the smaller size, averaging an increase of 2,161 units over the year.

Just four of the 22 strongest markets in 2022 continued to grow in 2023:

- Phoenix, Ariz., had a 3% growth in multifamily starts

- North Dallas, Texas, had a 48.2% growth in multifamily starts

- Raleigh–Durham, N.C., had a 48.7% growth in multifamily starts

- Tampa–St. Petersburg–Clearwater, Fla., had a 62.5% growth in multifamily starts

Other markets like Boston, Mass., (35%) and Kansas City, Mo., (41%) saw growth as well.

Bottom Line

Though slightly less than expected, new multifamily starts in 2023 are the 3rd highest year ever with 506,742 units. The growth primarily comes from affordable housing, single-family rentals, and smaller/midsize markets.

The decline this year is largely driven by tight financing conditions, and markets with high 2022 activity not being able to keep up. Despite the decline in starts, completions are expected to stay strong in 2024-2025.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Sports and Recreational Facilities | Jul 26, 2023

10 ways public aquatic centers and recreation centers benefit community health

A new report from HMC Architects explores the critical role aquatic centers and recreation centers play in society and how they can make a lasting, positive impact on the people they serve.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.