In the five months since the pandemic-driven real estate shut downs began, the BD+C editorial team has authored or posted more than 135 articles dedicated to COVID-19 and its impact on the AEC market and the built environment. We’ve curated well more than 250 research reports, on-demand webinars, white papers, and articles from third-party sources in our coronavirus newsfeed. We’ve interviewed nearly two dozen AEC experts about their team’s and clients’ coronavirus response on our new streaming video show, The Weekly.

Through all of this reporting, a single common theme bubbled to the surface: Buildings are part of the problem in controlling a global health pandemic. Yet buildings—and the AEC professionals that design, engineer, and construct them—are also a major part of the solution.

From infection control strategies to 3D-printed PPE equipment to pop-up isolation units and COVID-19 testing stations, AEC firms are delivering practical, innovative solutions to complex problems during a time when their clients need it most. The axiom “innovation loves a good crisis” is playing out right in front of our eyes.

Not since 9/11 has a single event so severely rocked the foundation of the commercial building industry. As owners, developers, and property and facility managers scramble to re-open their properties and create protocols for maintaining safe and healthy interior spaces, they are turning to their AEC firm partners for guidance and support.

And much like the post-9/11 response from the AEC community, many of the best practices and innovations being instituted in response to the COVID-19 pandemic will become permanent fixtures in the built environment (codified, or otherwise).

Take, for example, MEP design, especially for commercial office buildings. Forget the fitness centers, food trucks, and spacious lobbies—the hottest office building amenities are indoor air quality and touchless design. Technologies and design approaches that were on the fringe—bipolar ionization, UV light disinfection, enhanced air filtration—are being pushed to the forefront. Clients are investing in these systems in an effort to retain and attract tenants. These design approaches have been added to the “cost of doing business” list for commercial office owners and developers.

One side effect of the coming MEP spending boom, says Andrew Horning, Vice President with Bala Consulting Engineers, is higher energy bills for building owners. He explains COVID-19’s impact on sustainability and energy efficiency in the July 23rd episode of The Weekly. Watch on demand at: BDCnetwork.com/horizontv.

Related Stories

Healthcare Facilities | Feb 18, 2021

The Weekly show, Feb 18, 2021: What patients want from healthcare facilities, and Post-COVID retail trends

This week on The Weekly show, BD+C editors speak with AEC industry leaders from JLL and Landini Associates about what patients want from healthcare facilities, based on JLL's recent survey of 4,015 patients, and making online sales work for a retail sector recovery.

Market Data | Feb 17, 2021

Soaring prices and delivery delays for lumber and steel squeeze finances for construction firms already hit by pandemic

Association officials call for removing tariffs on key materials to provide immediate relief for hard-hit contractors and exploring ways to expand long-term capacity for steel, lumber and other materials,

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

Market Data | Feb 9, 2021

USGBC top 10 states for LEED in 2020

The Top 10 States for LEED green building is based on gross square feet of certified space per person using 2010 U.S. Census data and includes commercial and institutional projects certified in 2020.

Market Data | Feb 8, 2021

Construction employment stalls in January with unemployment rate of 9.4%

New measures threaten to undermine recovery.

Market Data | Feb 4, 2021

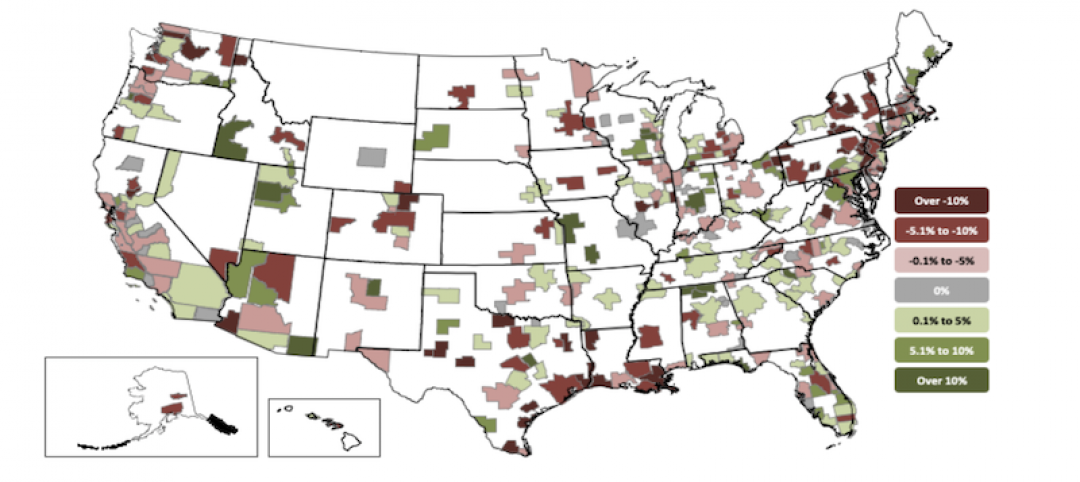

Construction employment declined in 2020 in majority of metro areas

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 2020 losses, while Indianapolis-Carmel-Anderson, Ind. and Walla Walla, Wash. register largest gains in industry jobs.

Market Data | Feb 3, 2021

Construction spending diverges in December with slump in private nonresidential sector, mixed public work, and boom in homebuilding

Demand for nonresidential construction and public works will decline amid ongoing pandemic concerns.

Market Data | Feb 1, 2021

The New York City market is back on top and leads the U.S. hotel construction pipeline

New York City has the greatest number of projects under construction with 108 projects/19,439 rooms.

Market Data | Jan 29, 2021

Multifamily housing construction outlook soars in late 2020

Exceeds pre-COVID levels, reaching highest mark since 1st quarter 2018.

Market Data | Jan 29, 2021

The U.S. hotel construction pipeline stands at 5,216 projects/650,222 rooms at year-end 2020

At the end of Q4 ‘20, projects currently under construction stand at 1,487 projects/199,700 rooms.