In the five months since the pandemic-driven real estate shut downs began, the BD+C editorial team has authored or posted more than 135 articles dedicated to COVID-19 and its impact on the AEC market and the built environment. We’ve curated well more than 250 research reports, on-demand webinars, white papers, and articles from third-party sources in our coronavirus newsfeed. We’ve interviewed nearly two dozen AEC experts about their team’s and clients’ coronavirus response on our new streaming video show, The Weekly.

Through all of this reporting, a single common theme bubbled to the surface: Buildings are part of the problem in controlling a global health pandemic. Yet buildings—and the AEC professionals that design, engineer, and construct them—are also a major part of the solution.

From infection control strategies to 3D-printed PPE equipment to pop-up isolation units and COVID-19 testing stations, AEC firms are delivering practical, innovative solutions to complex problems during a time when their clients need it most. The axiom “innovation loves a good crisis” is playing out right in front of our eyes.

Not since 9/11 has a single event so severely rocked the foundation of the commercial building industry. As owners, developers, and property and facility managers scramble to re-open their properties and create protocols for maintaining safe and healthy interior spaces, they are turning to their AEC firm partners for guidance and support.

And much like the post-9/11 response from the AEC community, many of the best practices and innovations being instituted in response to the COVID-19 pandemic will become permanent fixtures in the built environment (codified, or otherwise).

Take, for example, MEP design, especially for commercial office buildings. Forget the fitness centers, food trucks, and spacious lobbies—the hottest office building amenities are indoor air quality and touchless design. Technologies and design approaches that were on the fringe—bipolar ionization, UV light disinfection, enhanced air filtration—are being pushed to the forefront. Clients are investing in these systems in an effort to retain and attract tenants. These design approaches have been added to the “cost of doing business” list for commercial office owners and developers.

One side effect of the coming MEP spending boom, says Andrew Horning, Vice President with Bala Consulting Engineers, is higher energy bills for building owners. He explains COVID-19’s impact on sustainability and energy efficiency in the July 23rd episode of The Weekly. Watch on demand at: BDCnetwork.com/horizontv.

Related Stories

Market Data | Nov 2, 2018

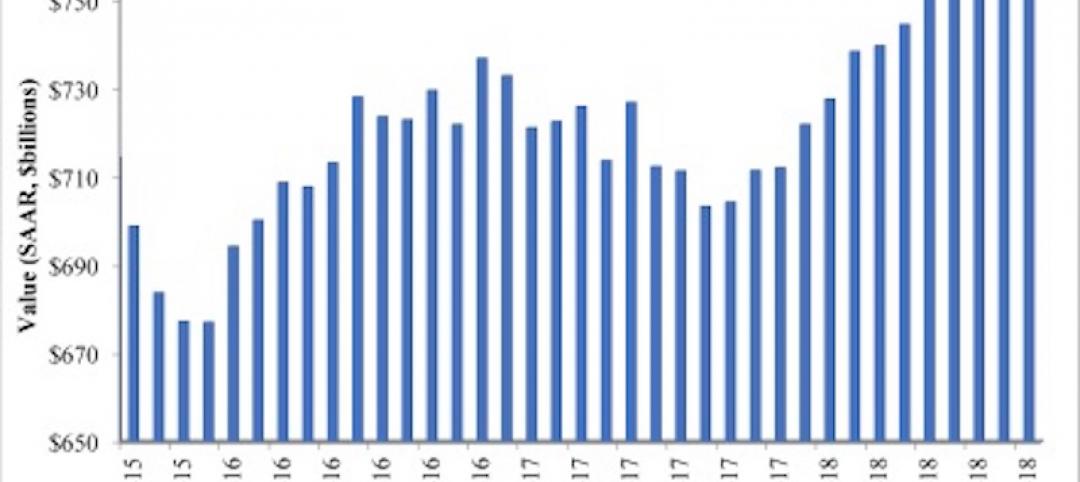

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

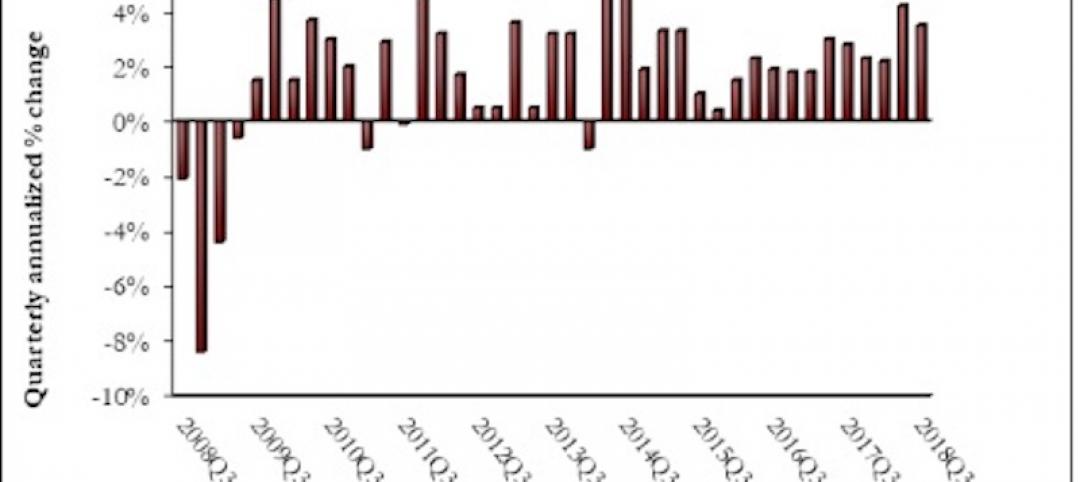

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

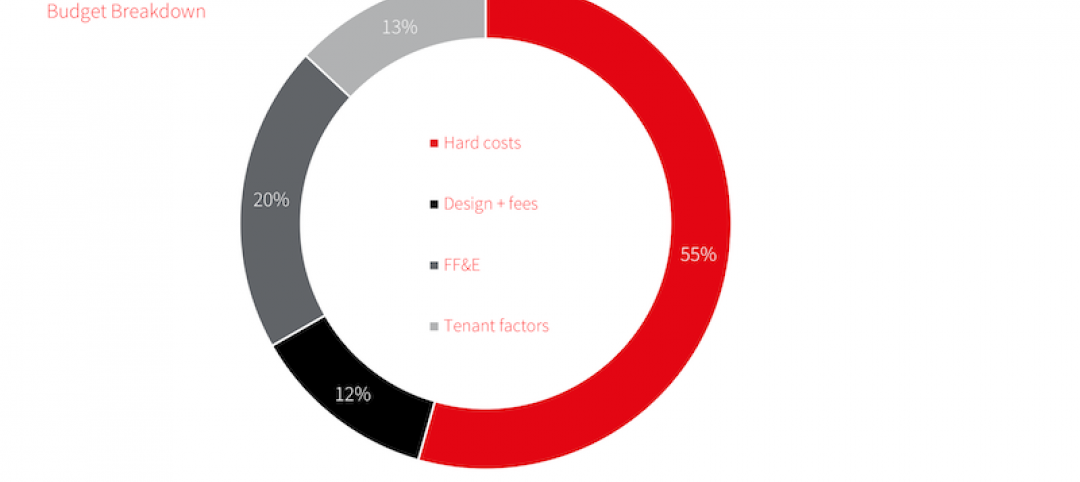

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.