Autodesk, Inc., in partnership with management consulting firm FMI Corporation, recently released findings from an industry study, "Trust Matters: The High Cost of Low Trust." The study measured the costs and benefits of different levels of trust within construction organizations and across construction project teams. The findings reveal organizations with "very high" levels of trust achieve better financial and organizational performance – yet 63% of survey respondents shared their organizations have less than "very high" trust. Compared to organizations with lower levels of trust, "very high" trust organizations generate more repeat business, retain more employees and drive a higher level of operational success.

"The performance advantages at 'very high' trust organizations can represent millions of dollars in profitability," said Jay Bowman, research and analytics lead at FMI. "With margins in the construction industry continuing to shrink, organizations should be aware of their trust ranking and how it can be improved to increase profitability. The 'very high' trust attributes uncovered in this report reflect approaches organizations can focus on to minimize uncertainties, simplify collaboration and ultimately improve trust."

FMI and Autodesk surveyed over 2,500 construction professionals worldwide who ranked trust within their organizations, ranging from "very low" to "very high" trust. The rankings were assessed against respondents' reports of their organizations' internal performance, culture and external relationships.

Key findings include:

1. "Very high" organizational trust can lead to millions of dollars in annual savings and new revenue.

Respondents from the highest trust organizations revealed performance advantages that can add up to millions of dollars of profitability each year, including:

-

More repeat business – The majority (57%) of "very high" trust organizations report working with repeat clients for more than 80% of their projects, whereas only 42% of "above average" trust organizations reported the same. The highest trust organizations working with repeat clients can expect gross margins two to seven percent higher than organizations of a similar size with only "above average" trust. Acquiring new clients is estimated to cost five to 25 times more than continuing work with repeat clients, particularly given new business onboarding processes such as aligning technology, managing payment systems and conducting background tests.

-

Lower voluntary turnover – The majority (56%) of construction professionals at "very high" trust organizations voluntarily choose to stay in their roles, versus just 32% at organizations where trust is "above average". Given the costs associated with recruiting new employees, "very high" trust organizations save as much as $750,000 annually by simply not having to onboard new employees. Retaining skilled labor amid the construction industry's global labor shortage is also particularly valuable for organizational success.

- Timely project delivery – Organizations with the highest levels of trust are twice as confident as those with "above average" trust about meeting their project schedules (43% versus 21%), suggesting a higher sense of reliability among their teams. Since delays require additional staffing, equipment and material costs, as well as opportunity costs of not being able to take on additional work, FMI estimates the highest trust organizations are saving as much as $4 million each year by meeting their deadlines.

2. Organizations with the highest trust generate more employee engagement.

Organizations that rank high on trust also rank high on employee engagement.

Seventy-four percent of respondents from "very high" trust organizations said they would recommend their companies as great places to work. Employee recommendations bolster recruiting efforts and can help attract skilled labor – another organizational benefit that is particularly valuable amid the construction industry's global labor shortage.

Respondents from "very high" trust organizations also disclosed they are twice as likely to go above and beyond what is asked of them (49%), compared to respondents from "above average" trust organizations (24%).

3. "Very high" trust organizations value collaboration and build stronger relationships externally.

Respondents from "very high" trust organizations were more than twice as likely to report that collaboration is central to the way they work (43%), compared to respondents from "above average" trust organizations (19%). The highest trust organizations are more likely to share information with external teams, receive prompt responses from team members and hear about project issues quickly. These findings suggest the collaboration found within "very high" trust organizations not only reduce project rework and schedule overruns, but also strengthens external industry relationships – between owners, architects, engineers, general contractors and specialty contractors – to expand opportunities for more work.

4. Trust can be increased.

The study uncovered common, measurable attributes that foster trust and positively impact performance across construction organizations, such as consistent internal processes, transparent communications, environments where employees feel safe and secure sharing their views, and a focus on employee development.

"Having worked as a project engineer, I know first-hand construction is a team sport and being able to trust the people you work with is essential to business success," said Dustin DeVan, construction strategist and evangelist at Autodesk Construction Solutions. "This study exposes a need for more transparency, accountability and collaboration in the industry. Organizations that effectively adopt processes and technologies that facilitate greater transparency, accountability and collaboration will be able to increase trust and improve their performance outcomes."

More details:

- Download the full report with country-specific insights, "Trust Matters: The High Cost of Low Trust," here

- Also check out the blog and infographic

- Sign up for our upcoming webinar on March 25, 2020 to learn how construction organizations can increase trust internally and across their project teams

About the study

In 2019, Autodesk Construction Solutions and FMI surveyed 2,527 construction professionals worldwide, asking them to rank the level of trust within their organizations and across project teams, and share financial and organizational performance. In the survey, respondents ranked the level of trust within their organization on a scale of 1 – 5 (very low = 1; very high = 5).

To evaluate the costs and benefits of the trust ratings, responses were then grouped in to one of three categories:

- "Very high": Trust extends through the organization and across all functions. Trust is core to how they work.

- "Above average": These firms may have pockets of strong trust, but individuals may still distrust or feel suspicious of others, even unconsciously. To some degree, trust must still be earned.

- "Average" to "below average": Employees of these firms are not consistently trustful, and internal groups may feel suspicious of others. Individual employees may also act in their own best interest rather than for the benefit of their organization or other team members.

Study participants include project owners (11%), architects and engineers (36%), contractors (31%) and specialty trades (22%) from the United States, Canada, United Kingdom, Ireland, Australia, New Zealand, Hong Kong and Singapore. Participants' tenure ranges from less than two years (21%), two to five years (26%), five to 10 years (26%), 10 to 20 years (19%), and more than 20 years (8%).

Related Stories

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

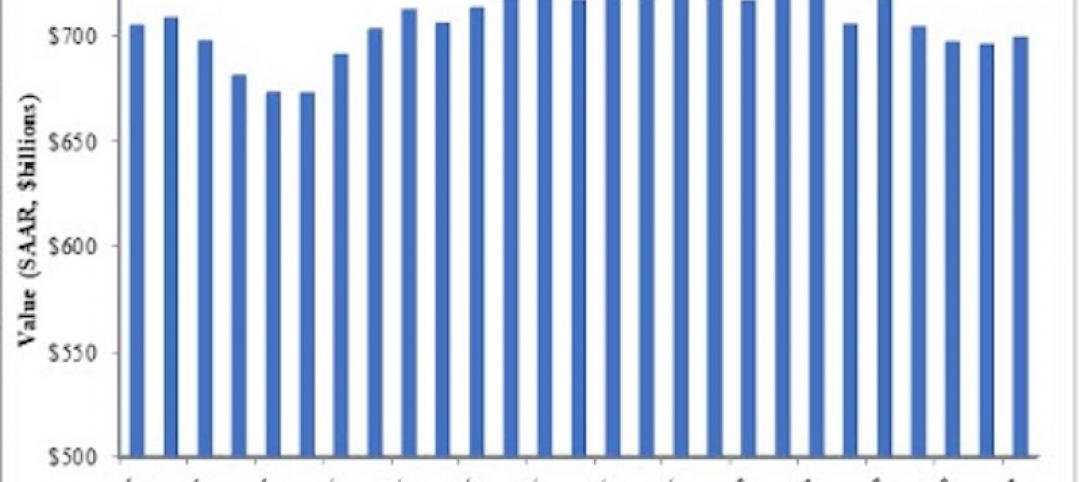

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.

Multifamily Housing | Sep 15, 2017

Hurricane Harvey damaged fewer apartments in greater Houston than estimated

As of Sept. 14, 166 properties reported damage to 8,956 units, about 1.4% of the total supply of apartments, according to ApartmentData.com.