In the recent U.S. Construction Pipeline Trend Report released by Lodging Econometrics (LE), at the close of Q1‘21, New York City continues to hold the lead amongst U.S. markets for the most projects in the U.S. construction pipeline with 145 projects/24,762 rooms. Other U.S. markets that follow are Los Angeles with 144 projects/23,994 rooms, Dallas with 135 projects/16,260 rooms, Atlanta with 132 projects/18,264 rooms, and Orlando with 98 projects/17,536 rooms.

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms. Following New York City with the highest number of projects under construction is Los Angeles with 39 projects/6,657 rooms, and then Atlanta with 39 projects/5,500 rooms, Dallas with 32 projects/3,795 rooms, and Orlando with 27 projects/4,693 rooms.

The top 50 markets in the U.S. announced a total of 74 new projects, accounting for 10,219 rooms, during Q1 ’21. The leading markets for new project announcements include Riverside-San Bernardino, CA with 6 projects/633 rooms, Los Angeles with 5 projects accounting for 768 rooms, Phoenix with 5 projects/402 rooms, Nashville with 4 projects/692 rooms, and San Diego with 4 projects/474 rooms. New project announcements have been slow in the wake of the pandemic, due in part to the inability to conduct business in the traditional pre-COVID way, but developers are increasingly optimistic and anxious to move forward with new projects as the country fully reopens.

Experts at LE are seeing an increase in renovation and brand conversion activity throughout the top 50 markets. During Q1, 1,198 projects/190,475 rooms were in the renovation/conversion pipeline. There are over ten markets in the U.S. that currently have more than 15 substantial renovation and conversion projects underway. This group is led by Houston with 27 projects, Los Angeles, and New York, each with 22 projects, followed by Chicago, Miami, Phoenix, Washington DC, Atlanta, Dallas, Orlando, and Philadelphia.

In the first quarter of 2021, the top 50 markets saw 128 hotels/17,636 rooms open. LE is forecasting these same 50 markets to open another 367 projects/47,592 rooms over the next three quarters, for a total of 495 projects/65,228 rooms in 2021.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

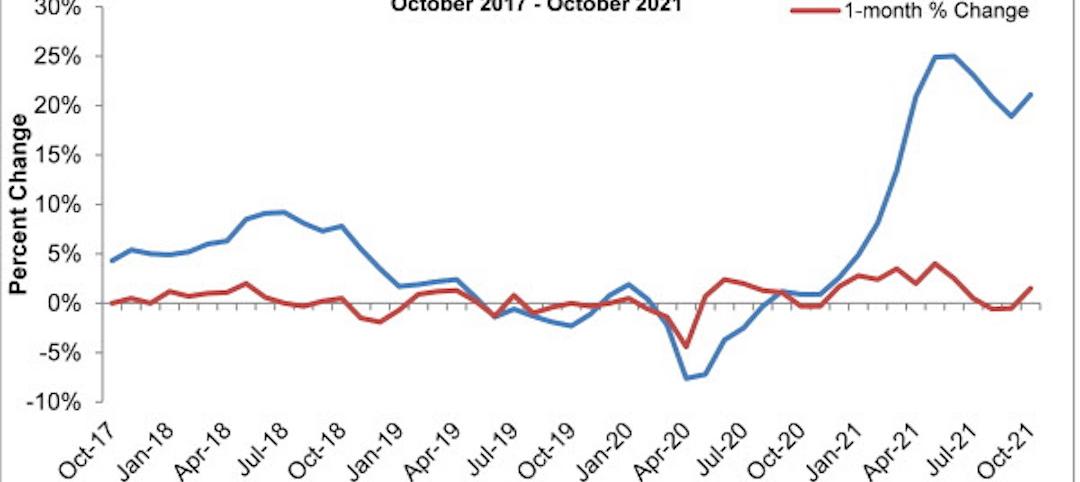

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

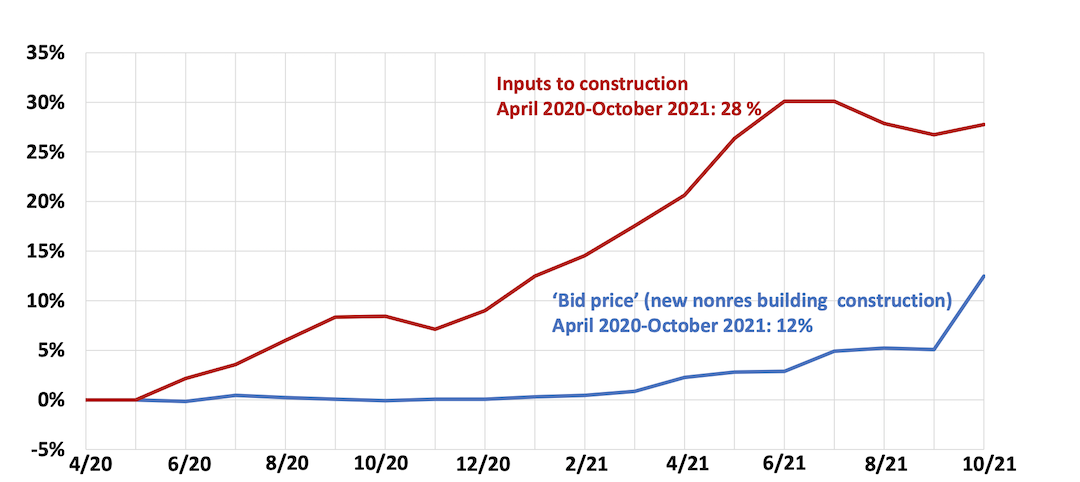

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.