Despite a significant increase to existing building stock in 2022, the national vacancy rate for industrial space in the U.S. fell below 4 percent.

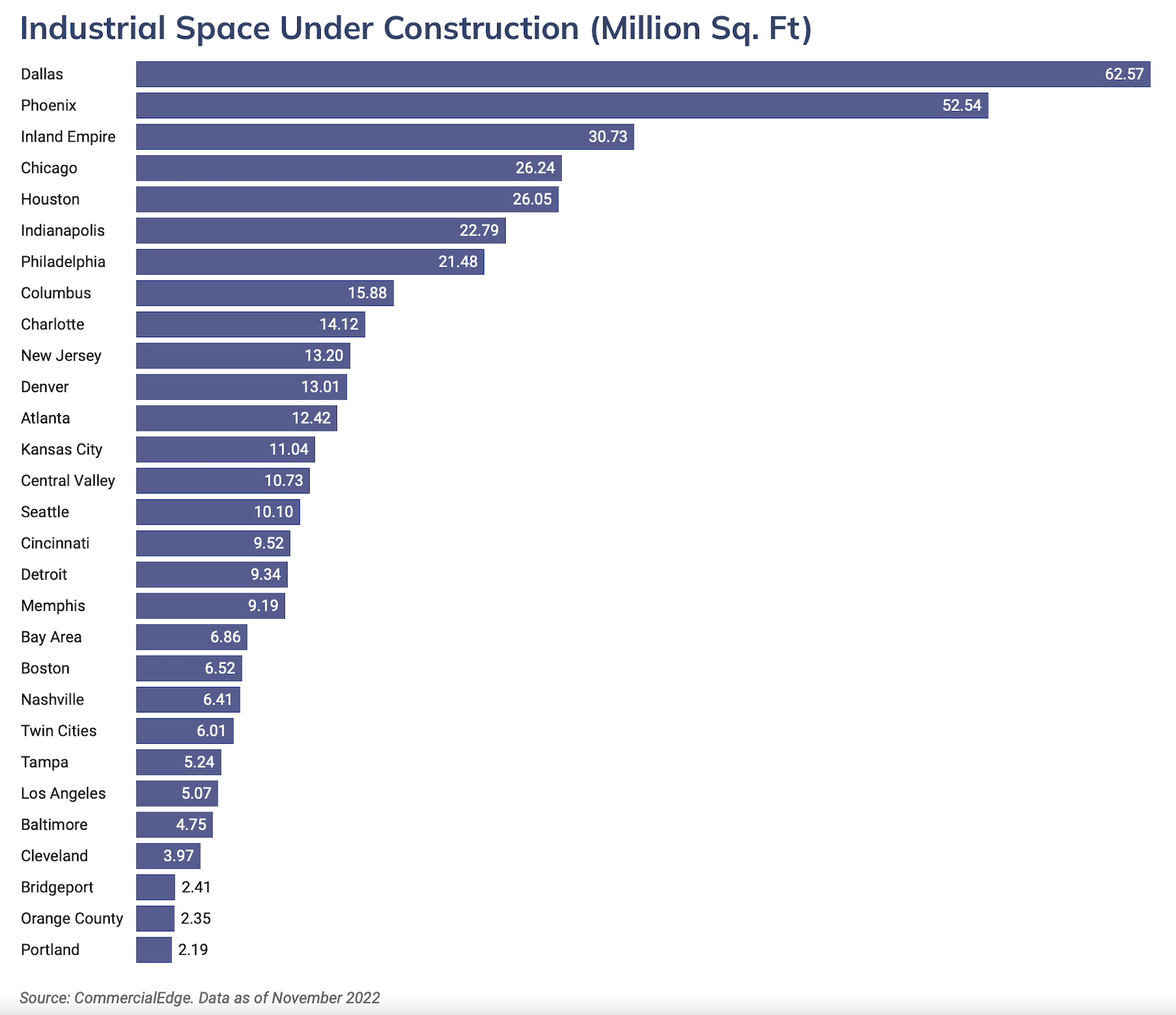

At the end of last November, there were 742.3 million sf of industrial space under construction, representing 4 percent of total existing inventory, according to Commercial Edge’s National Industrial Report, which it released on December 21. Dallas and Phoenix are the two top construction markets for this sector. And nationwide, another 684.5 million sf of industrial space are in their planning stages.

However, new construction is barely keeping up with leasing demand, as the vacancy rate in the 30 largest industrial markets tracked by Commercial Edge stood at 3.8 percent at the end of November. The Report asserts that the biggest challenge for developers is finding suitable land in port markets like California’s Inland Empire, Los Angeles, and New Jersey. But even non-port markets like Nashville and Columbus, Ohio, are experiencing extremely low vacancy rates.

The top 30 markets, through November, recorded aggregate property sales of $78.8 billion. While sales have cooled a bit nationally, the average sales price of $116 per sf in the first two months of the fourth quarter was still nearly 18 percent higher than the same period in 2021.

A huge building for a tight New York market

With these market dynamics as a backdrop, the real estate investment and development firm Turnbridge Equities announced earlier this month the topping out of Bronx Logistics Center, the largest industrial development in New York City.

Nestled in the borough’s Hunts Point industrial area, this Class A 1.3-million-sf, multilevel complex on 14.2 acres (assembled from five properties) consists of 585,000 sf of total warehouse space with 32-ft ceiling heights and 40- by 40-ft column spacing, 730,000 sf of parking space (25 percent of which is electric-vehicle ready with charging stations), 48 loading docks, and 72 drive-in doors.

The building’s rooftop solar panels will generate three megawatts of energy. The site includes a CSX freight railway spur, providing tenants with potential direct rail access, and is located less than two miles from the Hunts Point Food Distribution Center, which generates over $3 billion of annual economic activity.

When it’s completed in the second quarter of 2023, the Bronx Logistics Center will serve the entire New York metropolitan area and beyond. It is a five-minute drive from Manhattan’s Upper West Side, and has convenient access to Interstates 95, 87, 295, and 278.

Arco Design/Build Industrial is the designer and general contractor on this project. “We provided a high level of risk mitigation for our client by locking in construction costs prior to going through all of the design documents,” Arco states on its website. Turnbridge Equities, which owns the building, and the project’s equity partner Dune Real Estate Partners, retained JLL as the leasing agent. (As of mid December, no tenants had committed to leasing space.)

While Turnbridge didn’t release the cost of this project, The Real Deal reported that Turnbridge paid $174 million to acquire the land in 2018 and more recently secured $381 million in construction financing and debt refinancing from KKR.

Once completed, the Bronx Logistics Center’s size will exceed the 1-million-sf industrial development of Innova Property Group and Square Mile Capital Management. The borough’s industrial inventory accounts for about 17 million sf of space. The Bronx Times reports that only 1.6 percent of New York City’s industrial space is available for lease.

Related Stories

| Jul 28, 2014

Reconstruction Sector Construction Firms [2014 Giants 300 Report]

Structure Tone, Turner, and Gilbane top Building Design+Construction's 2014 ranking of the largest reconstruction contractor and construction management firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Engineering Firms [2014 Giants 300 Report]

Jacobs, URS, and Wiss, Janney, Elstner top Building Design+Construction's 2014 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Architecture Firms [2014 Giants 300 Report]

Stantec, HDR, and HOK top Building Design+Construction's 2014 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.

| Jul 27, 2014

Maturing ‘plug and play’ sector could take market share from AEC Giants [2014 Giants 300 Report]

The growth of modular and containerized data center solutions may eventually hinder the growth of traditional data center construction services.

| Jul 27, 2014

Top Data Center Construction Firms [2014 Giants 300 Report]

Holder, Turner, and DPR head Building Design+Construction's 2014 ranking of the largest data center contractors and construction management firms in the U.S.

| Jul 27, 2014

Top Data Center Engineering Firms [2014 Giants 300 Report]

Fluor, Jacobs, and Syska Hennessy top Building Design+Construction's 2014 ranking of the largest data center engineering and engineering/architecture firms in the U.S.

| Jul 27, 2014

Top Data Center Architecture Firms [2014 Giants 300 Report]

Gensler, Corgan, and HDR head Building Design+Construction's 2014 ranking of the largest data center architecture and architecture/engineering firms in the U.S.

| Jul 23, 2014

Architecture Billings Index up nearly a point in June

AIA reported the June ABI score was 53.5, up from a mark of 52.6 in May.

| Jul 21, 2014

Economists ponder uneven recovery, weigh benefits of big infrastructure [2014 Giants 300 Report]

According to expert forecasters, multifamily projects, the Panama Canal expansion, and the petroleum industry’s “shale gale” could be saving graces for commercial AEC firms seeking growth opportunities in an economy that’s provided its share of recent disappointments.

| Jul 18, 2014

Contractors warm up to new technologies, invent new management schemes [2014 Giants 300 Report]

“UAV.” “LATISTA.” “CMST.” If BD+C Giants 300 contractors have anything to say about it, these new terms may someday be as well known as “BIM” or “LEED.” Here’s a sampling of what Giant GCs and CMs are doing by way of technological and managerial innovation.