Nonresidential construction spending in New York City is projected to reach $39 billion in 2018, a nearly 66% increase over the previous year. However, spending is also expected to tail off significantly during the following two years, according to a new report, Construction Outlook 2018-2020, released today by the New York Building Congress.

Spending for all types construction in New York City is in its fifth year of growth and could hit a record $61.8 billion this year, 25% more than in 2017. That growth is attributable in part to several large-scale projects. The New York Building Congress forecasts that, despite some anticipated falloff over the next two years, total construction spending through 2020 will total $177 billion.

Nonresidential construction alone—which includes offices, institutional, government buildings, sports and entertainment, and hotels—is forecast to add a record 39 million gross sf this year, followed by 30.4 million sf and 23.4 million sf in 2019 and 2020, respectively. The projected decrease in construction spending for nonresidential buildings over the next two years can be pegged to the completion of several big projects by 2020, such as the 58-story 1,401-ft-tall One Vanderbilt, and three buildings within the $20 billion Hudson Yards redevelopment.

(All this new floor space is coming at a time when New York’s office vacancy rate hovers around 13%, according to the website Optimal Spaces.)

Residential construction spending—which in New York is primarily for multifamily buildings—will total $14 billion in 2018, up 6% from the previous year. Next year, residential construction spending is expected to hit $15 billion, and then recede to $10.6 billion in 2020. (The totals include renovations and alterations.)

Over the three years, 60,000 housing units and 107.2 million gross sf will be added, states the report. The average annual unit count, though, would be off from the 27,898 housing units added to the city in 2017.

The report states that construction employment will show growth for the seventh consecutive year in 2018, and top 150,000 jobs for the second consecutive year. While the Building Congress predicts an employment dip—to 145,600 in 2019 and to 147,700 in 2020—those numbers would still be higher than the average for the last five years.

Related Stories

Apartments | Aug 22, 2023

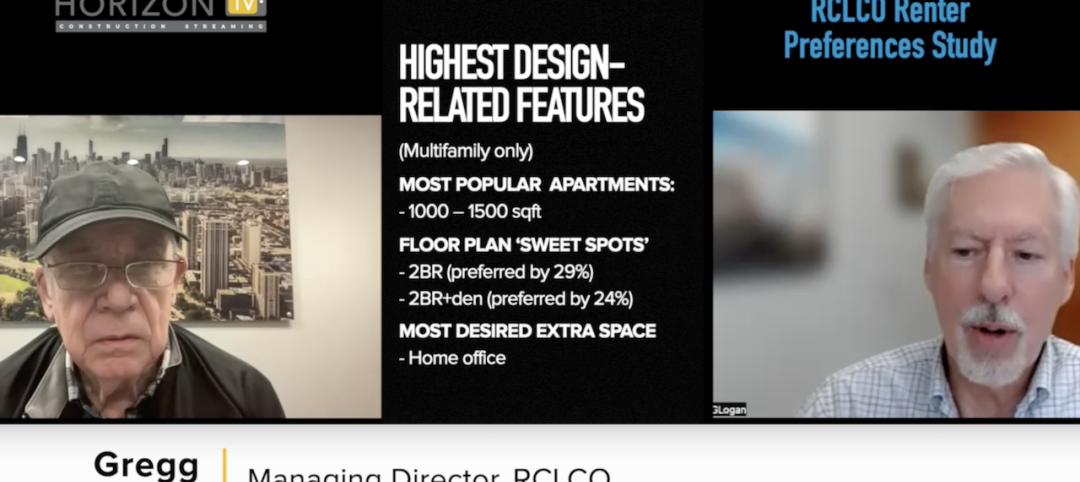

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

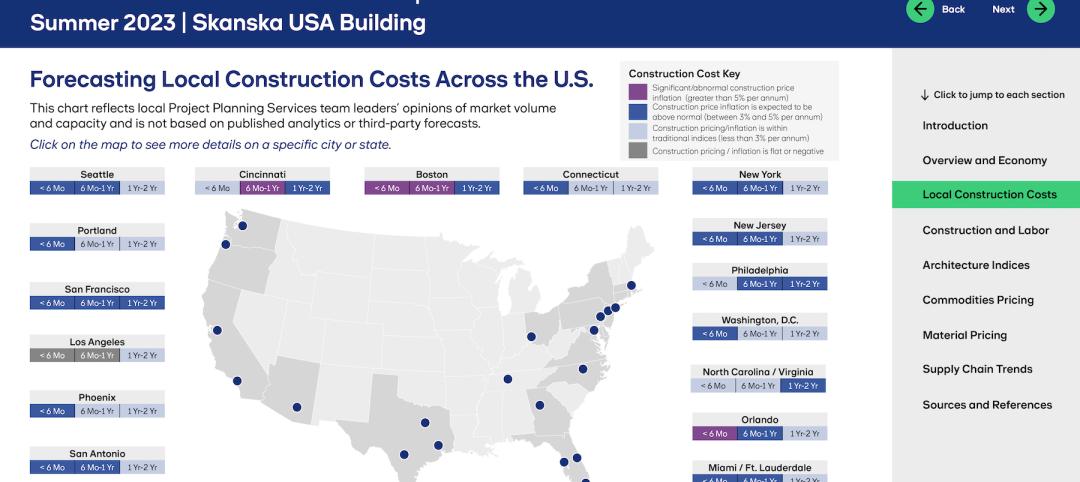

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.