Retailers went through another tough year in 2017, during which store closings included 1,430 Radio Shacks, 808 Payless ShoeSource outlets, 667 Ascentas (which sell nutritional supplements), and 600 Walgreens.

That brick-and-mortar attrition continued in the first month of 2018, when Sears announced it would close another 103 Sears and Kmart outlets, and Toys ‘R’ Us—whose debt now totals about $5 billion—said it would close up to 182 units, reducing its total in the U.S. by one fifth. The carnage this year will also eliminate 379 Teavanas (Starbucks’ struggling tea retail outlets), 200 Gaps and Banana Republics, 63 Sam’s Clubs, 11 Macy’s, 40 Bon-Tons, 50 J. Crews, and between 100 and 150 Michael Kors boutiques.

Physical stores continue to get hammered by online shopping that accounted for more than 9% of total U.S. retail sales last year. However, not every physical vestige of retailing is collapsing under the pressure from eCommerce. 7-Eleven this month made the biggest acquisition in its history when it paid $3.2 billion to buy 1,030 convenience stores in 17 states owned by Sunoco LP, raising its total store count in North America to close to 9,700.

Earlier this month, the New York Post ran an article under the headline “There’s never been a better time to open retail stores in NYC.” The story pointed out how retailers from several countries are scouring New York for real estate. Levi’s will soon relocate its flagship store into a larger, 17,250-sf space in Vornado Realty Trust’s 1535 Broadway. Other retail chains looking for more space in the Big Apple include Target and Lord & Taylor.

That retailers come and go is hardly news to anyone who follows this sector or, for that matter, shops. But the constant drumbeat about a “retail apocalypse” is still premature, according to a report released this month by the research and consulting firm Fung Global Retailing & Technology (FGRT).

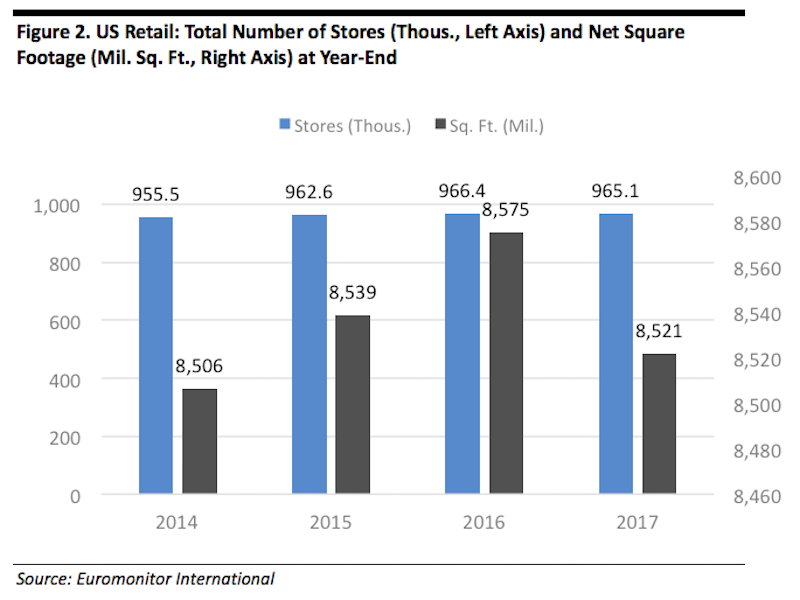

Despite weaker foot traffic, there was only a slight net decline in total U.S. retail stores last year, the first dropoff since 2009.

The report acknowledges that shopper traffic dropped off by 7.9% last year. And 6,995 stores closed in the U.S. in 2017 representing a net decline of 0.1%, according to Euromonitor International, which also estimated a 0.6% decrease in total retail selling space to 8.52 billion sf.

But the store-count reduction was the first since 2009, and it seemed to hit the apparel, mass merchant, and electronics and appliance sectors the hardest.

The grocery and dollar-store sectors, on the other hand, expanded “significantly” last year, with major dealers in those sectors opening a net 1,785 outlets. Other retailers, like the supermarket chain Aldi and the department store T. J. Maxx, are actively opening stores in off-mall and strip-mall locations.

Indeed, selling space for variety stores rose by 4.4% last year, by 1.3% for grocery stores, and by 1% for warehouse clubs.

FGRT points out that while brick-and-mortar retailers are getting more business from online sales, their in-store business continued to expand last year. Nearly 88% of all U.S. retail sales were transacted in physical stores in 2017, according the Census Bureau data. Offline retail sales grew by about 2.5%, and contributed to total U.S. retail sales increasing by 4%.

The study also notes that if online sales were taken out of the equation, the average sales per retail store rose 2.4% to $3.13 million, and average sales per square foot increased by 2.6% to $353.

It’s been conventional wisdom for a while that regional malls have been fast approaching their expiration dates. But FGRT states that superregional malls—defined by having at least 800,000 sf of selling space—were the only major shopping-center segment to grow its occupancy rates last year. FGRT also notes that open-air centers have proven to be a resilient real-estate segment, primarily because they typically have few apparel tenants and often include a strong grocery component.

Mall owners in general are diversifying their mix to incorporate more centers with premium tenants like Apple and even Tesla (which currently operates 109 retail showrooms nationwide). David Simon, CEO and Chairman of Simon Property Group, the country’s largest retail developer, says his company sees “significant opportunity” in densification of its shopping centers with the addition of mixed-use elements such as hotels, multifamily, and offices.

Another developer, Kimco, which was negatively affected by Sports Authority’s liquidation, sees future tenant mixes including more nascent retail chains such as Lidl and HomeSense from TJX. “Kimco is adapting to [the] evolving landscape by working hard to deliver both the product and an experience to tenants and shoppers commensurate with this new world order,” says CEO Conor Flynn. “That is why at many of [our] sites, you’ll see more health and wellness, more service providers, more food and restaurants, more entertainment and more experiential retailing.”

Related Stories

Mixed-Use | Sep 14, 2018

Six-story structure combines a parking garage with street-level retail

Eskew+Dumez+Ripple designed the structure.

Building Tech | Sep 6, 2018

19 decommissioned shipping containers become downtown Phoenix’s hottest marketplace

September 1 marked the opening of downtown Phoenix’s newest restaurant and retail marketplace—and its latest commercial construction project to utilize decommissioned shipping containers as its primarily building form.

Retail Centers | Sep 4, 2018

Heatherwick-designed shopping district set to open at London’s King’s Cross

The district is slated to open on Oct. 26.

Retail Centers | Aug 16, 2018

Chicago’s new flagship McDonald’s supersizes the sustainability features

The restaurant is located at the intersection of Clark and Ontario streets.

Retail Centers | Aug 2, 2018

Retail's age of experimentation

New technology, changing customer expectations force retailers to rethink their businesses from top to bottom.

Retail Centers | Jun 21, 2018

Driving change in automotive retail

We talk a lot about how the retail landscape, particularly in the realm of shopping malls, has changed in this world of clicks versus / and / or bricks. But at the core of all this change is the consumer.

Retail Centers | Jun 5, 2018

The shopping mall value chain - fixing its weakest links

Old malls have three weak links in their value chain. Each weak link affects the mall’s surrounding community, and if one link breaks, the value chain is broken.

| May 24, 2018

Accelerate Live! talk: Security and the built environment: Insights from an embassy designer

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), embassy designer Tom Jacobs explores ways that provide the needed protection while keeping intact the representational and inspirational qualities of a design.

Retail Centers | May 21, 2018

How men’s stores are influencing the entire retail sector

The growth in men’s retail worldwide is projected to outpace women’s retail by 2020.

Retail Centers | May 16, 2018

New tap room and brewery in Ghiradelli Square designed specifically for millennials

BCV Architecture + Interiors designed the space.