Coming off of a year when nonresidential building starts fell by an estimated 7.5%, the industry is expected to bounce back in 2016, especially during the second and third quarters when the annualized growth rate for starts could hit 15% before decelerating later in the year.

However, keeping projects on schedule and on budget will continue to be difficult if, as expected, worker shortages persist, leading to higher labor costs and, potentially, construction delays.

In Gilbane’s Winter 2015-2016 Market Conditions in Construction report, which can be downloaded from here, the giant contractor forecasts nonresidential building starts to increase by 8.5% this year to 222,764.

Gilbane expects spending on nonresidential buildings, which grew by 17.1% to $386.4 billion in 2015, to keep rising this year, by 13.7% to $439.2 billion. However, spending should taper off late this year, “leading to a considerably slower 2017.”

On the whole, nonresidential building sectors should enjoy good years, according to Gilbane’s report, whose spending projections for 2016 include:

•13.6% growth for Educational buildings

•A 13.8% rise for Healthcare construction

•22.5% growth for Amusement and Recreational buildings.

•A 6% spending increase for Retail space

•A retreat in spending for Office buildings, which after gains of 21.3% and 21.4% in the last two years, should increase by only 4.7% in 2016. “Although down 15% in 2015, starts have been strong and multiple months of large volume starts will help keep 2016 spending positive. Office spending is projected to grow again in 2017,” the report states.

•Spending for lodging, which grew by 31% last year, and by 90% during the 2012-2015 period, should increase by 10.8% this year, when starts are expected to be up 16%, “leading to continued spending growth in 2017.”

•Despite a nearly 30% decline in starts last year, manufacturing-related building still hit its second-highest starts level on record, and spending jumped 44.8%. Those starts should drive spending up another 10.8% in 2016.

On average, $1 billion of spending supports approximately 6,000 construction jobs, and generates up to 28,000 jobs in the economy. But Gilbane remains concerned about the ability of contractors to find skilled labor to meet the country’s escalating construction demands. It points out that while the total construction workforce is growing and is near 7.3 million, that is still about 1 million workers short of the 2006-2007 peak.

It cites the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) for the construction industry, which showed 139,000 unfilled positions for October 2015. Gilbane notes that the openings rate has been trending upward since 2012. “A relatively high rate of openings … generally indicates high demand for labor and could lead to higher wage rates,” its report states.

Gilbane’s analyst Ed Zarenski expects construction job gains of between 500,000 and 600,000 through 2017. But Gilbane still foresees shortages of skilled workers over the next five years, as well as declining productivity, and rapidly increasing labor cost. “If you are in a location where a large volume of pent-up work starts all at once, you will experience these three issues.”

Related Stories

Market Data | Aug 6, 2020

6 must reads for the AEC industry today: August 6, 2020

Oklahoma State's new North Academic Building and can smart buildings outsmart coronavirus?

Market Data | Aug 5, 2020

6 must reads for the AEC industry today: August 5, 2020

San Jose's new tallest tower and Virginia is the first state to adopt COVID-19 worker safety rules.

Market Data | Aug 4, 2020

7 must reads for the AEC industry today: August 4, 2020

Construction spending decreases for fourth consecutive month and 100% affordable housing development breaks ground in Mountain View.

Market Data | Aug 3, 2020

Construction spending decreases for fourth consecutive month in June

Association officials warn further contraction is likely unless federal government enacts prompt, major investment in infrastructure as state and local governments face deficits.

Market Data | Aug 3, 2020

6 must reads for the AEC industry today: August 3, 2020

The future is a number game for retail and restaurants and 5 reasons universities are renovating student housing.

Market Data | Jul 31, 2020

5 must reads for the AEC industry today: July 31, 2020

Vegas's newest resort and casino is packed with contactless technology and Mariott, Hilton, and IHG dominate the U.S. hotel construction pipeline.

Market Data | Jul 30, 2020

Marriott, Hilton, and IHG continue to dominate the U.S. hotel construction pipeline at Q2’20 close

Hilton’s Home2 Suites and IHG’s Holiday Inn Express continue to be the most prominent brands in the U.S. pipeline.

Market Data | Jul 30, 2020

7 must reads for the AEC industry today: July 30, 2020

Millennium Tower finally has a fix and construction costs decrease for the first time in 10 years.

Market Data | Jul 29, 2020

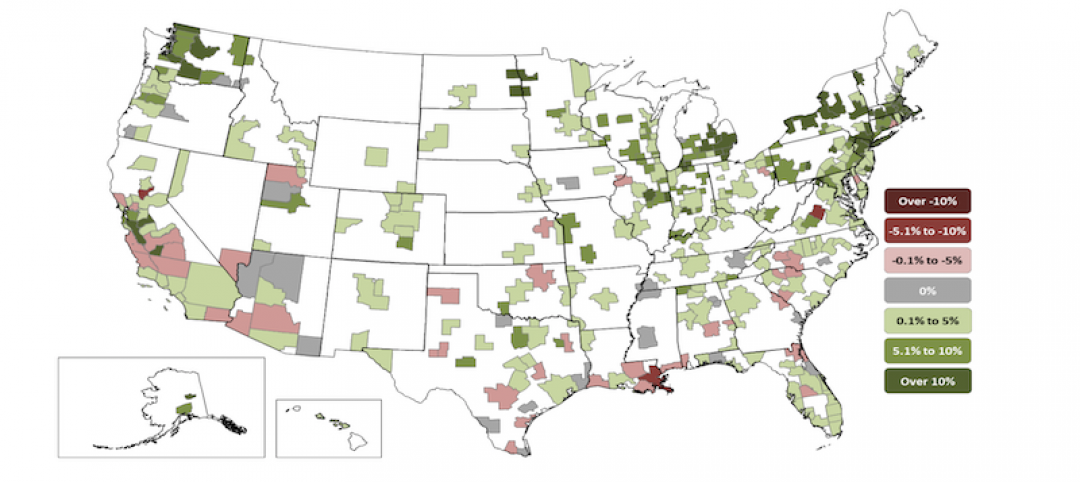

62% of metros shed construction jobs from June 2019 to June 2020 as Association calls for new infrastructure funding, other relief steps

New York City and Brockton-Bridgewater-Easton, Mass. have worst 12-month losses, while Austin and Walla Walla, Wash. top job gainers.

Market Data | Jul 29, 2020

6 must reads for the AEC industry today: July 29, 2020

The world's first net-zero airport and California utility adopts climate emergency declaration.