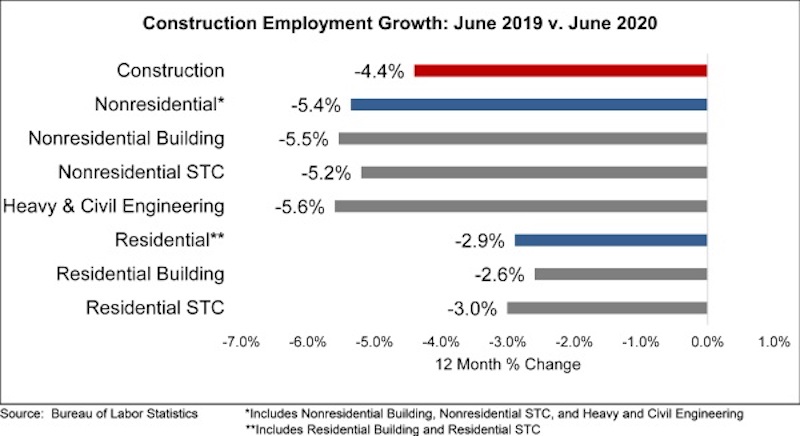

The construction industry added 158,000 jobs on net in June, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last two months, the industry has added 591,000 jobs, recovering 56% of the industrywide jobs lost since the start of the pandemic.

Nonresidential construction employment added 74,700 jobs on net in June. There was positive job growth in two of the three nonresidential segments, with the largest increase in nonresidential specialty trade contractors, which added 71,300 jobs. Employment in the nonresidential building segment increased by 13,100 jobs, while heavy and civil engineering lost 9,700 jobs.

The construction unemployment rate was 10.1% in June, up 6.1 percentage points from the same time last year but down from 12.7% in May and 16.6% in April. Unemployment across all industries dropped from 13.3% in May to 11.1% in June.

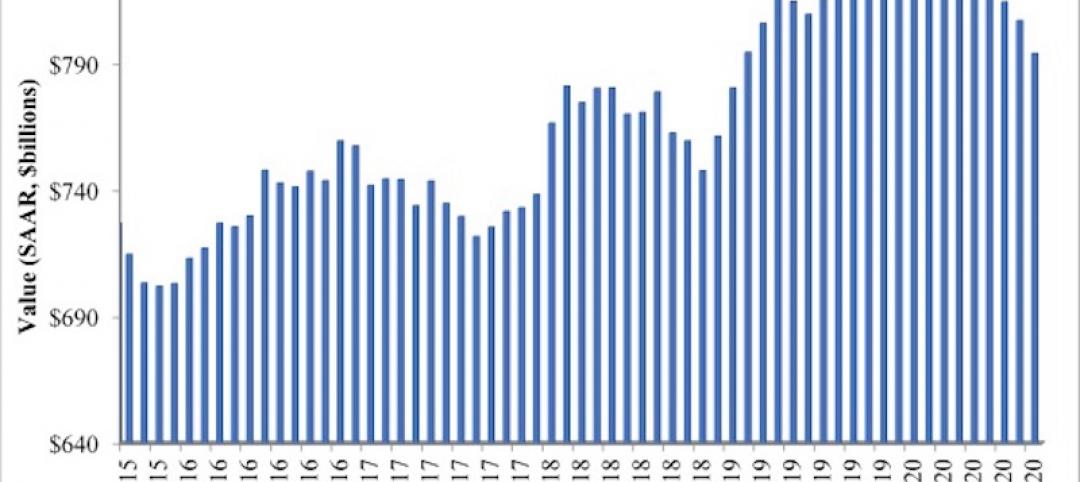

“Since the pandemic devastated the economy, most economists have been predicting a V-shaped recovery,” said ABC Chief Economist Anirban Basu. “To date, this has proven correct. While recovery is likely to become more erratic during the months ahead due to a number of factors, including the reemergence of rapid COVID-19 spread, recent employment, unemployment, residential building permits and retail sales data all highlight the potential of the U.S. economy to experience a rapid rebound in economic activity as 2021 approaches. ABC’s Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading, and its Construction Confidence Indicator continued to rebound from the historically low levels observed in the March survey.

“However, even if the broader U.S. economy continues to rebound in 2020, construction is less likely to experience a smooth recovery,” said Basu. “The recession, while brief, wreaked havoc on the economic fundamentals of a number of key segments of the construction market, including office, retail and hotel construction. Moreover, state and local government finances have become increasingly fragile, putting both operational and capital spending at risk.

“After this initial period of recovery in U.S. nonresidential construction, there are likely to be periods of slower growth or even contraction,” said Basu. “Nonresidential construction activity tends to lag the broader economy by 12-18 months, and this suggests that there will be some shaky industry performance in 2021 and perhaps beyond.”

Related Stories

Market Data | Dec 2, 2020

Nonresidential construction spending remains flat in October

Residential construction expands as many commercial projects languish.

Market Data | Nov 30, 2020

New FEMA study projects implementing I-Codes could save $600 billion by 2060

International Code Council and FLASH celebrate the most comprehensive study conducted around hazard-resilient building codes to-date.

Market Data | Nov 23, 2020

Construction employment is down in three-fourths of states since February

This news comes even after 36 states added construction jobs in October.

Market Data | Nov 18, 2020

Architecture billings remained stalled in October

The pace of decline during October remained at about the same level as in September.

Market Data | Nov 17, 2020

Architects face data, culture gaps in fighting climate change

New study outlines how building product manufacturers can best support architects in climate action.

Market Data | Nov 10, 2020

Construction association ready to work with president-elect Biden to prepare significant new infrastructure and recovery measures

Incoming president and congress should focus on enacting measures to rebuild infrastructure and revive the economy.

Market Data | Nov 9, 2020

Construction sector adds 84,000 workers in October

A growing number of project cancellations risks undermining future industry job gains.

Market Data | Nov 4, 2020

Drop in nonresidential construction offsets most residential spending gains as growing number of contractors report cancelled projects

Association officials warn that demand for nonresidential construction will slide further without new federal relief measures.

Market Data | Nov 2, 2020

Nonresidential construction spending declines further in September

Among the sixteen nonresidential subcategories, thirteen were down on a monthly basis.

Market Data | Nov 2, 2020

A white paper assesses seniors’ access to livable communities

The Joint Center for Housing Studies and AARP’s Public Policy Institute connect livability with income, race, and housing costs.