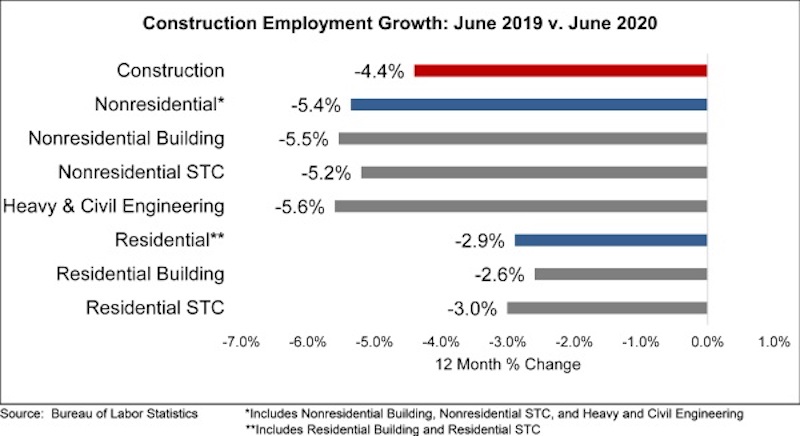

The construction industry added 158,000 jobs on net in June, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last two months, the industry has added 591,000 jobs, recovering 56% of the industrywide jobs lost since the start of the pandemic.

Nonresidential construction employment added 74,700 jobs on net in June. There was positive job growth in two of the three nonresidential segments, with the largest increase in nonresidential specialty trade contractors, which added 71,300 jobs. Employment in the nonresidential building segment increased by 13,100 jobs, while heavy and civil engineering lost 9,700 jobs.

The construction unemployment rate was 10.1% in June, up 6.1 percentage points from the same time last year but down from 12.7% in May and 16.6% in April. Unemployment across all industries dropped from 13.3% in May to 11.1% in June.

“Since the pandemic devastated the economy, most economists have been predicting a V-shaped recovery,” said ABC Chief Economist Anirban Basu. “To date, this has proven correct. While recovery is likely to become more erratic during the months ahead due to a number of factors, including the reemergence of rapid COVID-19 spread, recent employment, unemployment, residential building permits and retail sales data all highlight the potential of the U.S. economy to experience a rapid rebound in economic activity as 2021 approaches. ABC’s Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading, and its Construction Confidence Indicator continued to rebound from the historically low levels observed in the March survey.

“However, even if the broader U.S. economy continues to rebound in 2020, construction is less likely to experience a smooth recovery,” said Basu. “The recession, while brief, wreaked havoc on the economic fundamentals of a number of key segments of the construction market, including office, retail and hotel construction. Moreover, state and local government finances have become increasingly fragile, putting both operational and capital spending at risk.

“After this initial period of recovery in U.S. nonresidential construction, there are likely to be periods of slower growth or even contraction,” said Basu. “Nonresidential construction activity tends to lag the broader economy by 12-18 months, and this suggests that there will be some shaky industry performance in 2021 and perhaps beyond.”

Related Stories

Market Data | Jun 1, 2020

Nonresidential construction spending falls in April

Of the 16 subcategories, 13 were down on a monthly basis.

Market Data | Jun 1, 2020

7 must reads for the AEC industry today: June 1, 2020

Energy storage as an amenity and an entry-point for wellness screening everywhere.

Market Data | May 29, 2020

House-passed bill making needed improvements to paycheck protection program will allow construction firms to save more jobs

Construction official urges senate and White House to quickly pass and sign into law the Paycheck Protection Program Flexibility Act.

Market Data | May 29, 2020

7 must reads for the AEC industry today: May 29, 2020

Using lighting IoT data to inform a safer office reentry strategy and Ghafari joins forces with Eview 360.

Market Data | May 27, 2020

5 must reads for the AEC industry today: May 28, 2020

Biophilic design on the High Line and the office market could be a COVID-19 casualty.

Market Data | May 27, 2020

6 must reads for the AEC industry today: May 27, 2020

AIA's COTE Top Ten Awards and OSHA now requires employers to track COVID-19 cases.

Market Data | May 26, 2020

6 must reads for the AEC industry today: May 26, 2020

Apple's new Austin hotel and is CLT really a green solution?

Market Data | May 21, 2020

7 must reads for the AEC industry today: May 21, 2020

'Creepy' tech invades post-pandemic offices, and meet the new darling of commercial real estate.

Market Data | May 20, 2020

6 must reads for the AEC industry today: May 20, 2020

A wave 'inside' a South Korean building and architecture billings continues historic contraction.

Market Data | May 20, 2020

Architecture billings continue historic contraction

AIA’s Architecture Billings Index (ABI) score of 29.5 for April reflects a decrease in design services provided by U.S. architecture firms.