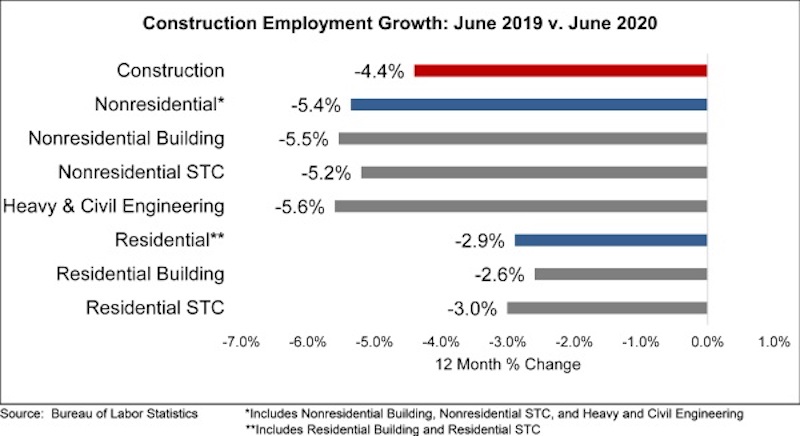

The construction industry added 158,000 jobs on net in June, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last two months, the industry has added 591,000 jobs, recovering 56% of the industrywide jobs lost since the start of the pandemic.

Nonresidential construction employment added 74,700 jobs on net in June. There was positive job growth in two of the three nonresidential segments, with the largest increase in nonresidential specialty trade contractors, which added 71,300 jobs. Employment in the nonresidential building segment increased by 13,100 jobs, while heavy and civil engineering lost 9,700 jobs.

The construction unemployment rate was 10.1% in June, up 6.1 percentage points from the same time last year but down from 12.7% in May and 16.6% in April. Unemployment across all industries dropped from 13.3% in May to 11.1% in June.

“Since the pandemic devastated the economy, most economists have been predicting a V-shaped recovery,” said ABC Chief Economist Anirban Basu. “To date, this has proven correct. While recovery is likely to become more erratic during the months ahead due to a number of factors, including the reemergence of rapid COVID-19 spread, recent employment, unemployment, residential building permits and retail sales data all highlight the potential of the U.S. economy to experience a rapid rebound in economic activity as 2021 approaches. ABC’s Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading, and its Construction Confidence Indicator continued to rebound from the historically low levels observed in the March survey.

“However, even if the broader U.S. economy continues to rebound in 2020, construction is less likely to experience a smooth recovery,” said Basu. “The recession, while brief, wreaked havoc on the economic fundamentals of a number of key segments of the construction market, including office, retail and hotel construction. Moreover, state and local government finances have become increasingly fragile, putting both operational and capital spending at risk.

“After this initial period of recovery in U.S. nonresidential construction, there are likely to be periods of slower growth or even contraction,” said Basu. “Nonresidential construction activity tends to lag the broader economy by 12-18 months, and this suggests that there will be some shaky industry performance in 2021 and perhaps beyond.”

Related Stories

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.