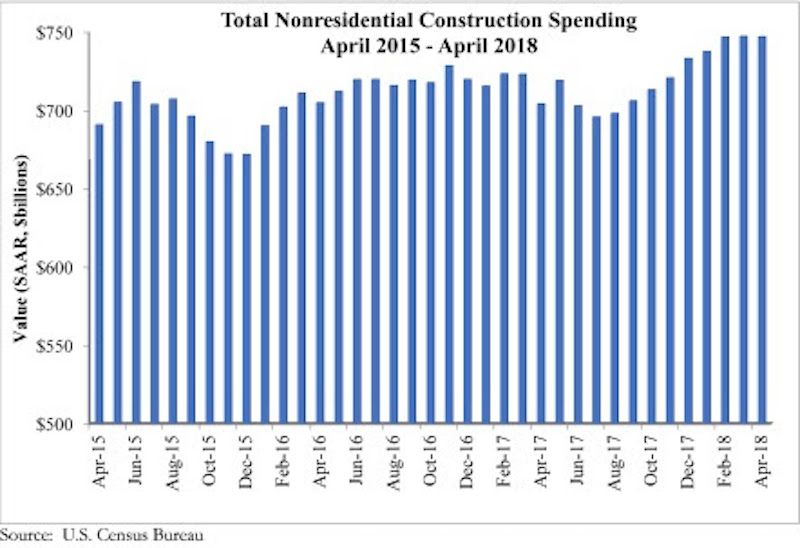

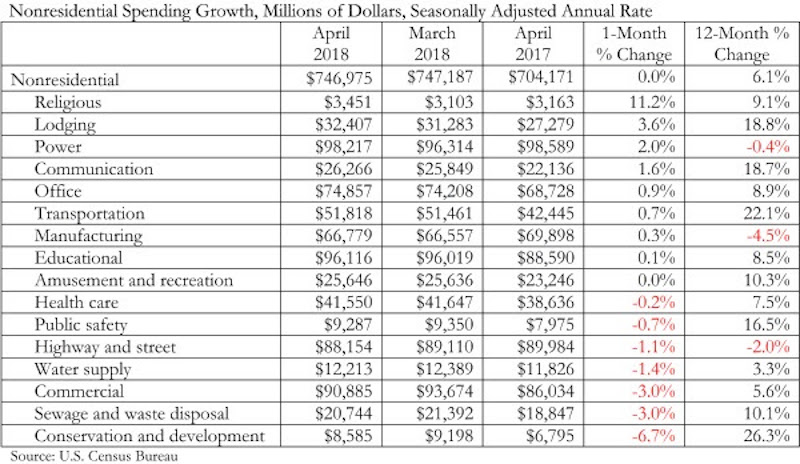

Nonresidential construction spending remained unchanged in April on a monthly basis, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data released today. However, year-over-year spending was up a sturdy 6.1%.

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago. Public sector spending fell 1.4% in April, but is up 7.3% year over year.

“Between today’s employment and construction spending reports, it is clear that the economy continues to exhibit strong momentum and abundant confidence,” said ABC Chief Economist Anirban Basu. “It’s important to remember that the construction spending data generally have failed to display as much economic strength as many other indicators. Even the most recent monthly readings on construction spending were unspectacular, but the year-over-year numbers are consistent with ongoing economic and industry progress.

“Perhaps most encouraging is the growing strength of the public categories,” said Basu. “For many years, public construction spending languished even as private categories demonstrated growing vigor. With the dramatic improvement in state and local government finances in many communities in recent years, there is greater capacity to invest in infrastructure. Not coincidentally, construction spending in the transportation category rose 22% during the past year. Spending in the public safety category, which includes spending on police and fire stations, is up by nearly 17%.

“As always, there is a need to pay attention to any clouds forming on the horizon,” said Basu. “Inflationary pressures continue to build, with tariffs on steel and aluminum likely to accelerate construction materials price appreciation during the next several months. Interest rates are expected to head higher, though perhaps only in fits and starts. Wage pressures also continue to build. The implication is that the cost of financing construction projects is on the rise. Should those costs rise too quickly, the momentum presently observable in nonresidential construction spending and employment data could quickly dissipate.”

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.