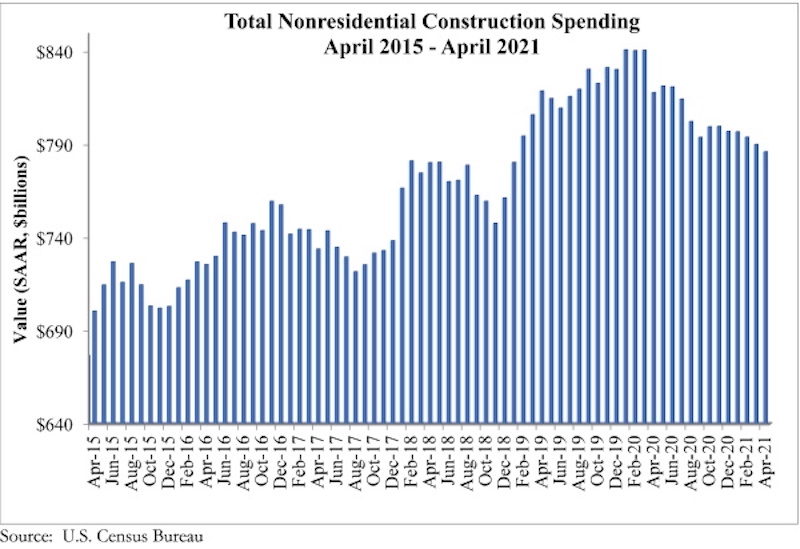

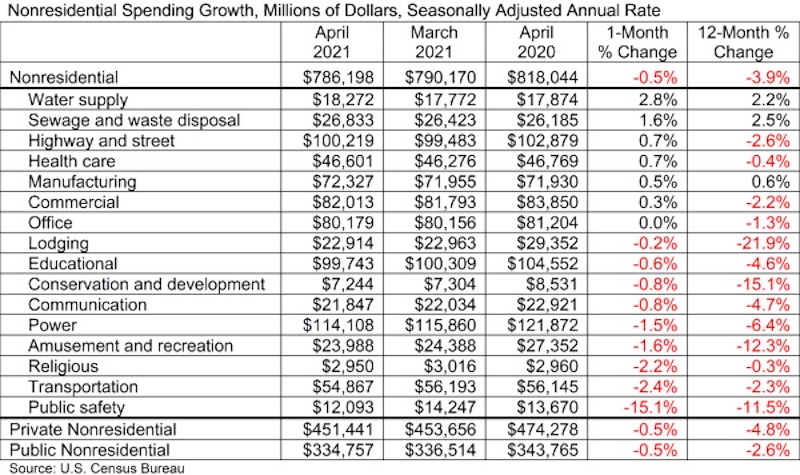

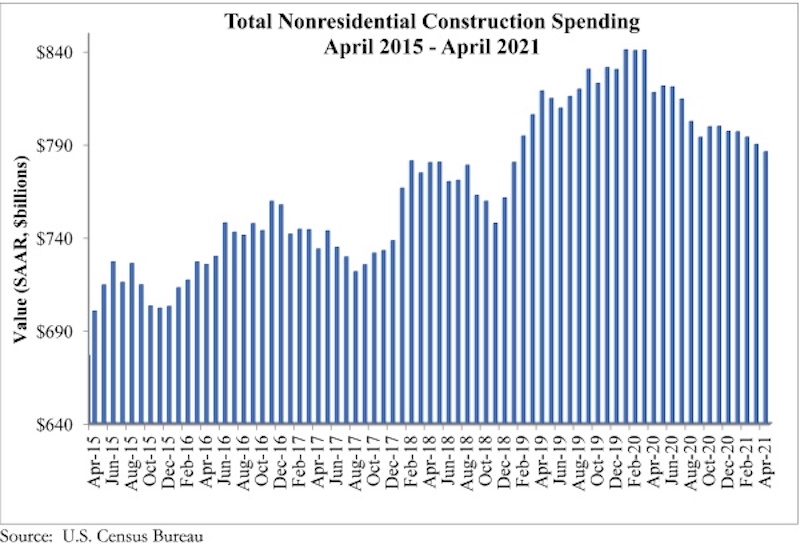

National nonresidential construction spending declined 0.5% in April, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $786.2 billion for the month.

Spending was down on a monthly basis in nine of 16 nonresidential subcategories. Both private and public nonresidential construction spending were down 0.5% for the month.

“The fact that nonresidential construction spending continues to decline is no surprise whatsoever,” said ABC Chief Economist Anirban Basu. “Many factors are at work, including the historic lag between broader economic recovery and the onset of persistent recovery in nonresidential construction. In other words, nonresidential spending levels reflect what the broader economy looked like about a year ago. A year ago, the economy was in dire shape.

“There’s more,” said Basu. “Conventional wisdom holds that many of the projects postponed during the earlier stages of the pandemic are set to come back to life. It is for this reason that many contractors have reported rising backlog and growing confidence in the six-month outlook for revenues, staffing levels and profits, according to ABC’s latest Construction Backlog Indicator and Construction Confidence Index. But just when it seemed safe to get back into the water, a new set of challenges has emerged. Among these are input shortages, rapidly rising materials prices and ongoing issues securing sufficiently skilled workers. What all this has done is to suppress the vigor of nonresidential construction’s current recovery by inducing certain project owners to further delay their projects, hoping to ultimately receive more favorable bids.

“As if this were not enough, certain construction segments may have been permanently undermined by the pandemic,” said Basu. “Among these are construction of new office buildings, shopping centers and hotels that cater to business travelers. The good news is that the longer-term outlook remains upbeat given the anticipated strength of the economic recovery to come, particularly if a sensible infrastructure package manages to make its way out of Washington, D.C.”

Related Stories

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.

Multifamily Housing | Sep 15, 2017

Hurricane Harvey damaged fewer apartments in greater Houston than estimated

As of Sept. 14, 166 properties reported damage to 8,956 units, about 1.4% of the total supply of apartments, according to ApartmentData.com.