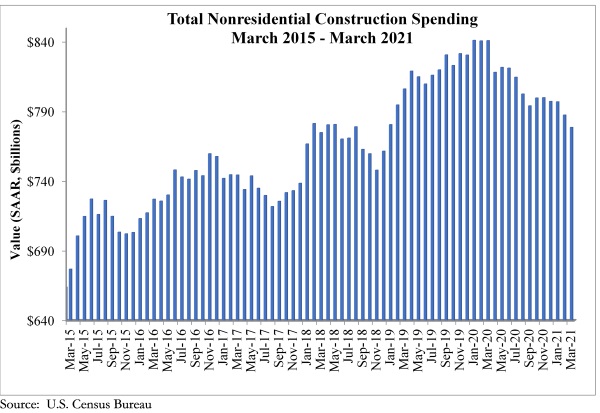

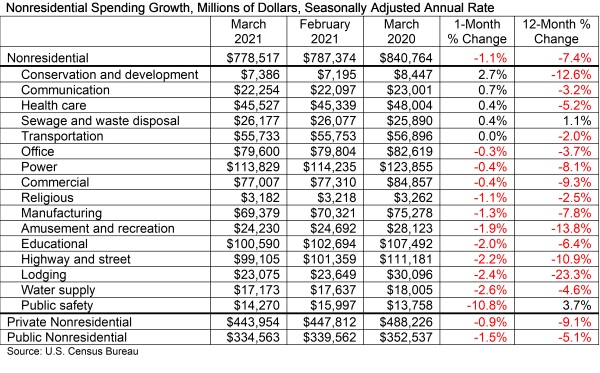

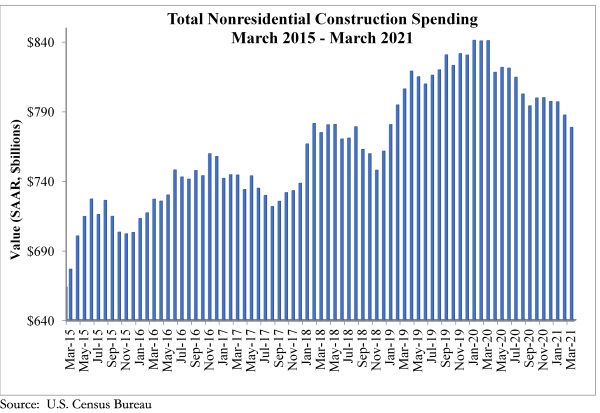

National nonresidential construction spending declined 1.1% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $778.5 billion for the month.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.9%, while public nonresidential construction spending fell 1.5% in March.

“While the longer-term outlook for nonresidential construction is superb, the pandemic is lingering, creating much damage to commercial real estate fundamentals,” said ABC Chief Economist Anirban Basu. “The lodging, office and commercial segments experienced declines in spending in March. Office vacancy rates are elevated in many markets, and the industry experienced negative net absorption. The trials and tribulations of hotel operators, retailers and restauranteurs are also well known. Private nonresidential construction spending is down more than 9% from March 2020.

“Public construction spending was weak in March and is down more than 5% on a year-over-year basis,” said Basu. “While large-scale federal infrastructure outlays are likely in the future, that money has yet to arrive. State and local government finances have generally held up far better than many had predicted earlier in the COVID-19 crisis, but many governments have had to spend significant operational sums to countervail the public health crisis and therefore had to redirect money away from infrastructure.

“ABC’s Construction Backlog Indicator has foreshadowed this state of affairs for months,” said Basu. “The most recent readings suggest that the construction spending recovery will be slow over the near-term. However, as the broader economic recovery picks up additional speed later this year with more pervasive vaccinations and re-openings, both private and public construction spending should begin to manifest more positive momentum later this year and into 2022.”

Related Stories

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.