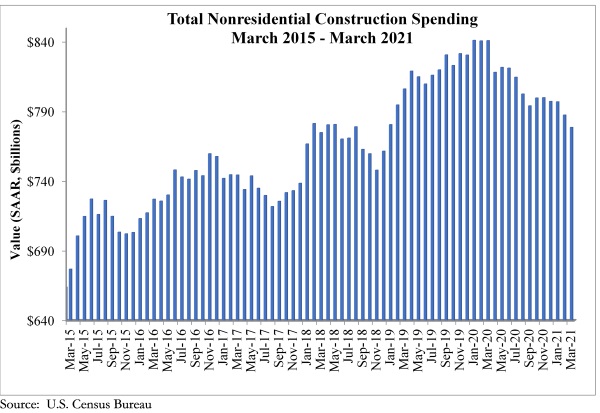

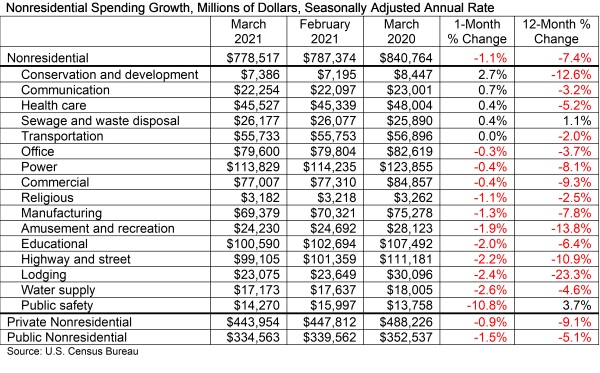

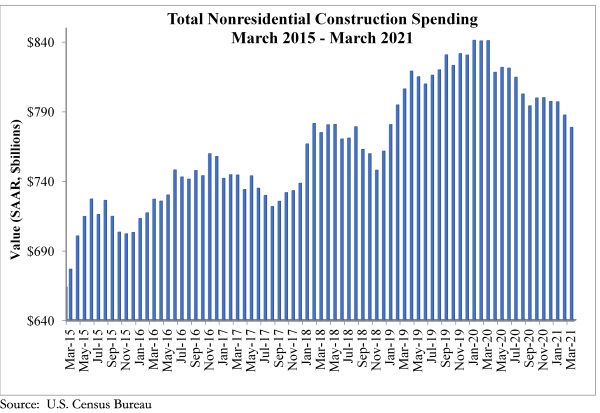

National nonresidential construction spending declined 1.1% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $778.5 billion for the month.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.9%, while public nonresidential construction spending fell 1.5% in March.

“While the longer-term outlook for nonresidential construction is superb, the pandemic is lingering, creating much damage to commercial real estate fundamentals,” said ABC Chief Economist Anirban Basu. “The lodging, office and commercial segments experienced declines in spending in March. Office vacancy rates are elevated in many markets, and the industry experienced negative net absorption. The trials and tribulations of hotel operators, retailers and restauranteurs are also well known. Private nonresidential construction spending is down more than 9% from March 2020.

“Public construction spending was weak in March and is down more than 5% on a year-over-year basis,” said Basu. “While large-scale federal infrastructure outlays are likely in the future, that money has yet to arrive. State and local government finances have generally held up far better than many had predicted earlier in the COVID-19 crisis, but many governments have had to spend significant operational sums to countervail the public health crisis and therefore had to redirect money away from infrastructure.

“ABC’s Construction Backlog Indicator has foreshadowed this state of affairs for months,” said Basu. “The most recent readings suggest that the construction spending recovery will be slow over the near-term. However, as the broader economic recovery picks up additional speed later this year with more pervasive vaccinations and re-openings, both private and public construction spending should begin to manifest more positive momentum later this year and into 2022.”

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

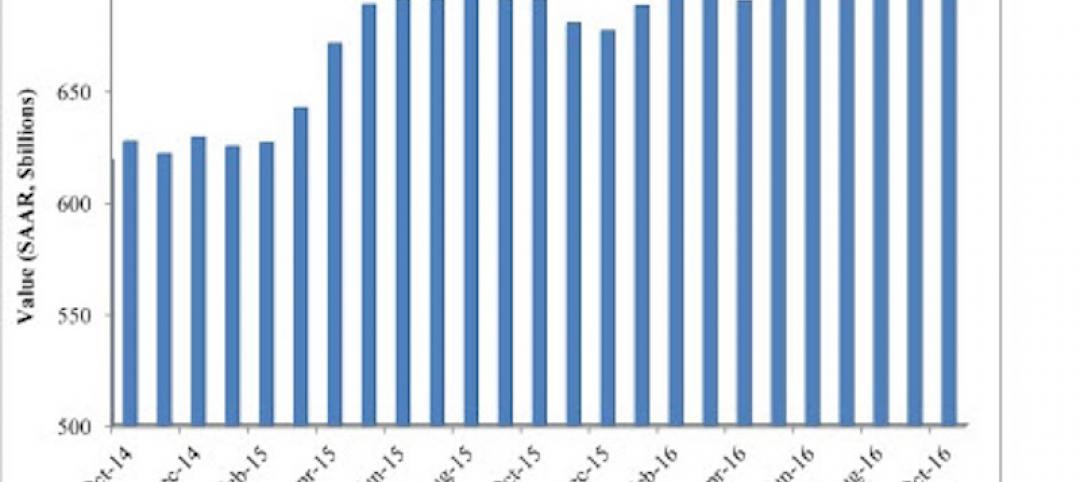

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

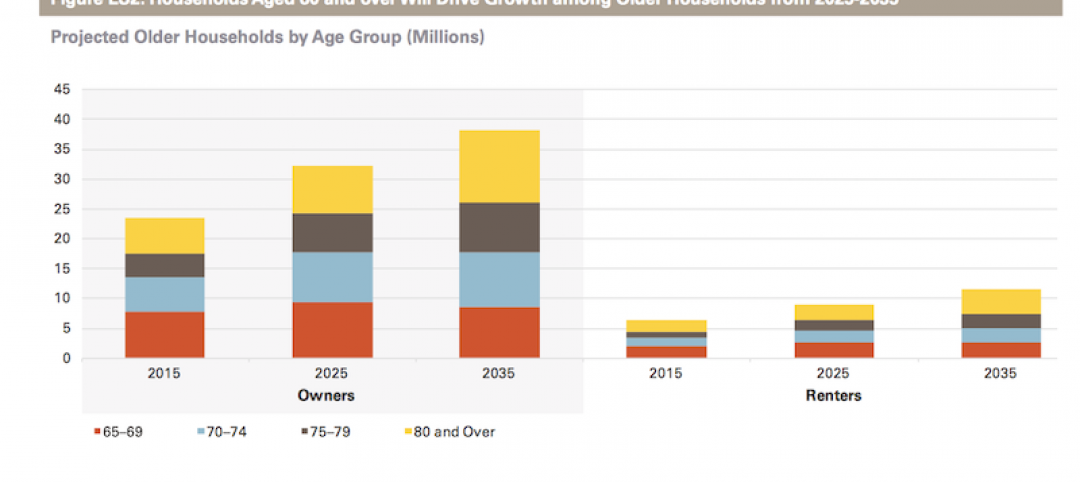

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.