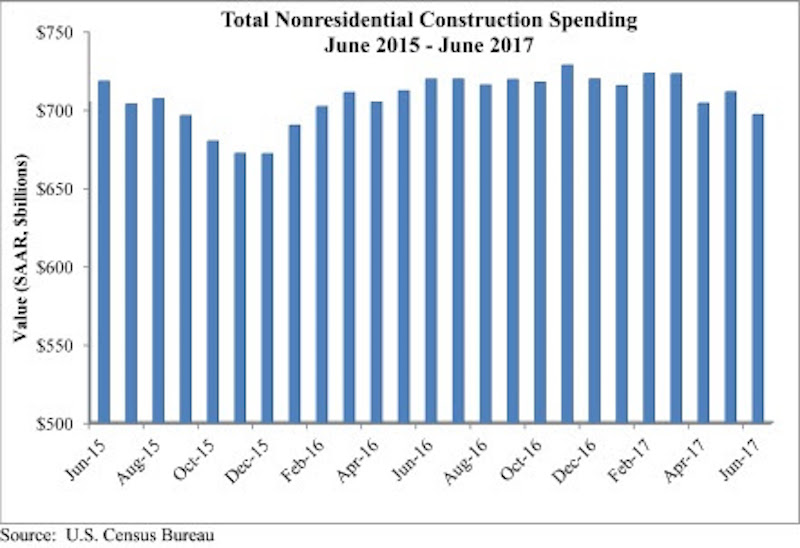

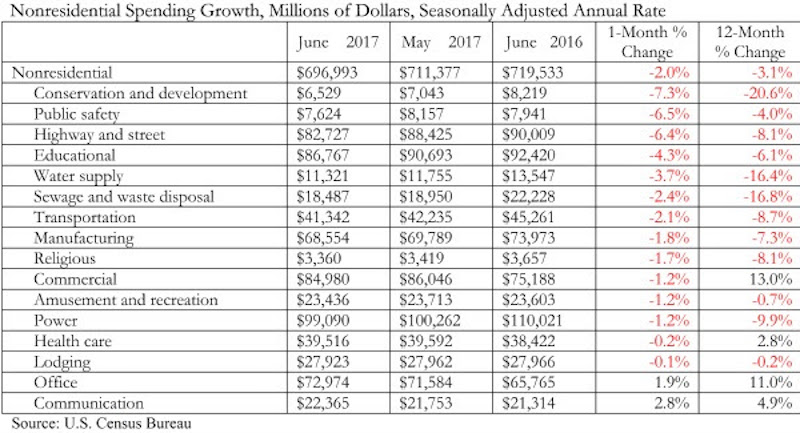

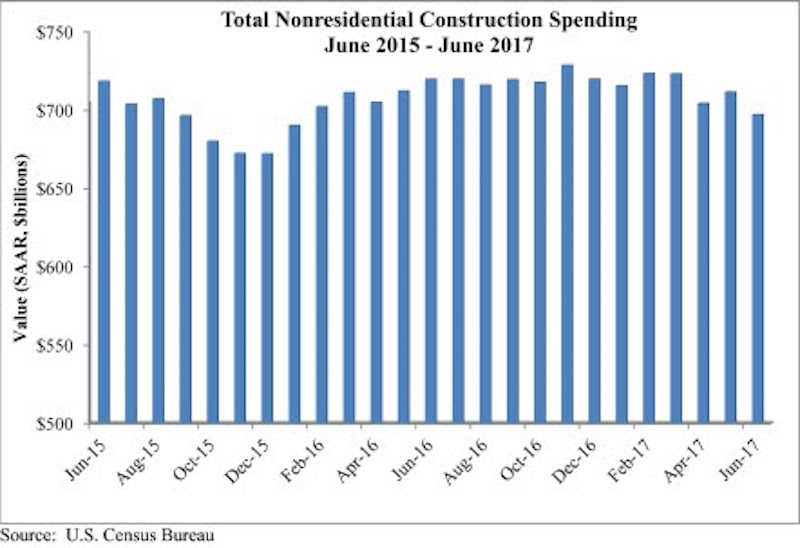

Nonresidential construction spending fell by 2% on a monthly basis in June 2017, totaling $697 billion on a seasonally adjusted, annualized basis according to an analysis of U.S. Census Bureau data released today by Associated Builders and Contractors. June represents the first month during which spending has dipped below the $700 billion per year threshold since January 2016.

June’s weak construction spending report can be largely attributed to the public sector. Public nonresidential construction spending fell 5.4% for the month and 9.5% for the year, and all twelve public subsectors decreased for the month. Private nonresidential spending remained largely unchanged, increasing by 0.1% for the month and 1.1% for the year. April and May nonresidential spending figures were revised downward by 1.1% and 0.4%, respectively.

“Coming into the year, there were high hopes for infrastructure spending in America,” said ABC Chief Economist Anirban Basu. “The notion was that after many years of a lack of attention to public works, newfound energy coming from Washington, D.C., would spur confidence in federal funding among state and local transportation directors as well among others who purchase construction services. Instead, public construction spending is on the decline in America. Categories including public safety and flood control have experienced dwindling support for investment, translating into a nine percent decline in public construction spending over the past twelve months.

“On the other hand, several private segments continue to manifest strength in terms of demand for construction services,” said Basu. “At the head of the class are office construction, driven by a combination of job growth among certain office-space-using categories as well as lofty valuations, and communications, which is being driven largely by enormous demand for data center capacity.

“While there are certainly some parts of the nation experiencing significant levels of public construction, those areas have increasingly become the exception as opposed to the rule,” said Basu. “The more general and pervasive strength is in private segments. Based on recent readings of the architecture billings index and other key leading indicators, commercial contractors are likely to remain busy for the foreseeable future. The outlook for construction firms engaged in public work remains unclear.”

Related Stories

Market Data | Aug 18, 2020

6 must reads for the AEC industry today: August 18, 2020

The world's first AI-driven facade system and LA's Greek Theatre restoriation completes.

Market Data | Aug 17, 2020

5 must reads for the AEC industry today: August 17, 2020

5 strategies for creating safer hotel experiences and how to manage multifamily assets when residents no longer leave.

Market Data | Aug 14, 2020

6 must reads for the AEC industry today: August 14, 2020

The largest single sloped solar array in the country and renewing the healing role of public parks.

Market Data | Aug 13, 2020

5 must reads for the AEC industry today: August 13, 2020

Apple Central World opens in Bangkok and 7-Eleven to buy Speedway.

Market Data | Aug 12, 2020

6 must reads for the AEC industry today: August 12, 2020

UC Davis's new dining commons and the pandemic is revolutionizing healthcare benefits.

Market Data | Aug 11, 2020

6 must reads for the AEC industry today: August 11, 2020

Elevators can be a 100% touch-free experience and the construction industry adds 20,000 employees in July.

Market Data | Aug 10, 2020

Dodge Momentum Index increases in July

This month’s increase in the Dodge Momentum Index was the first in all of 2020.

Market Data | Aug 10, 2020

Construction industry adds 20,000 employees in July but nonresidential employment dips

Association warns skid will worsen without new relief.

Market Data | Aug 10, 2020

5 must reads for the AEC industry today: August 10, 2020

Private student housing owners reap the benefits as campus housing de-densifies and race for COVID vaccine boosts real estate in life sciences hubs.

Market Data | Aug 7, 2020

6 must reads for the AEC industry today: August 7, 2020

BD+C's 2020 Color Trends Report and HMC releases COVID-19 Campus Reboot Guide for Prek-12 schools.