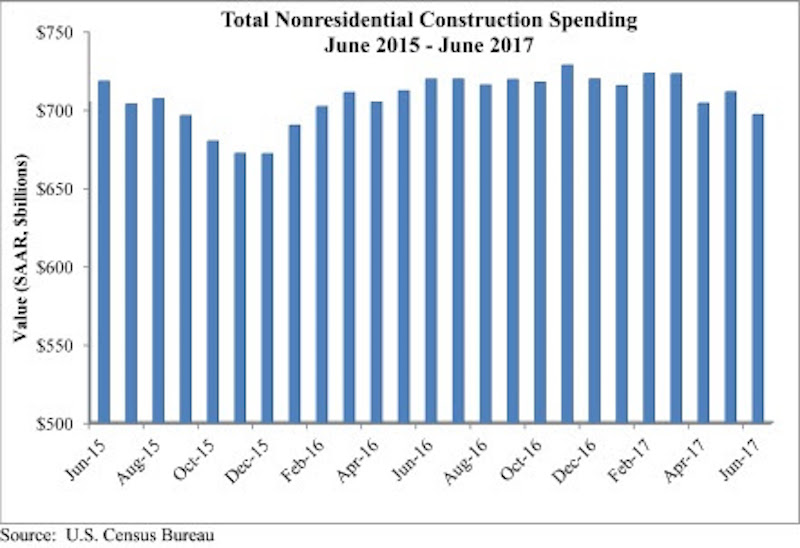

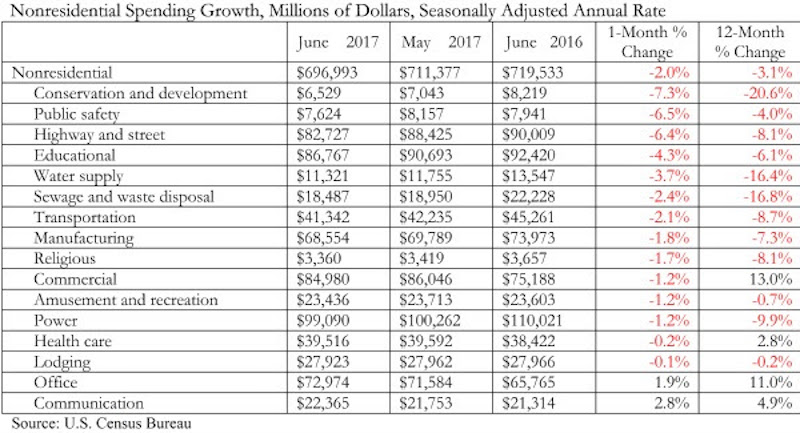

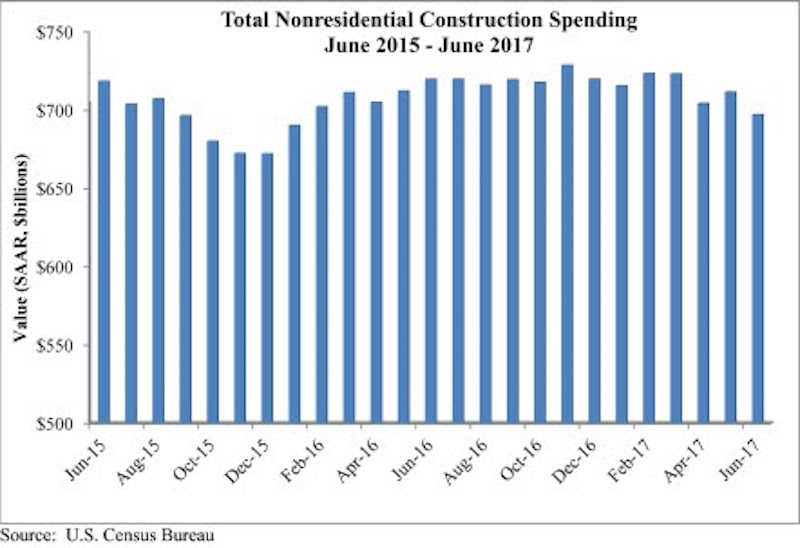

Nonresidential construction spending fell by 2% on a monthly basis in June 2017, totaling $697 billion on a seasonally adjusted, annualized basis according to an analysis of U.S. Census Bureau data released today by Associated Builders and Contractors. June represents the first month during which spending has dipped below the $700 billion per year threshold since January 2016.

June’s weak construction spending report can be largely attributed to the public sector. Public nonresidential construction spending fell 5.4% for the month and 9.5% for the year, and all twelve public subsectors decreased for the month. Private nonresidential spending remained largely unchanged, increasing by 0.1% for the month and 1.1% for the year. April and May nonresidential spending figures were revised downward by 1.1% and 0.4%, respectively.

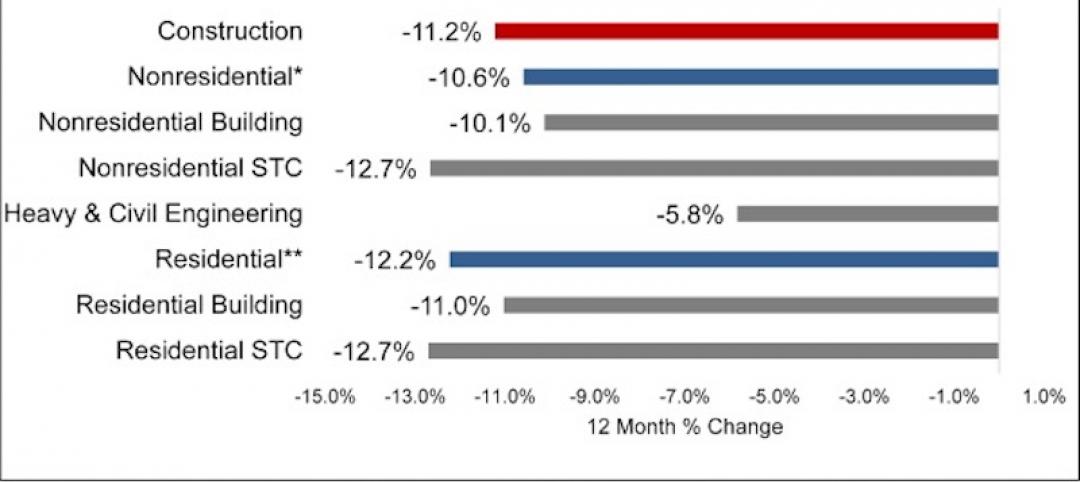

“Coming into the year, there were high hopes for infrastructure spending in America,” said ABC Chief Economist Anirban Basu. “The notion was that after many years of a lack of attention to public works, newfound energy coming from Washington, D.C., would spur confidence in federal funding among state and local transportation directors as well among others who purchase construction services. Instead, public construction spending is on the decline in America. Categories including public safety and flood control have experienced dwindling support for investment, translating into a nine percent decline in public construction spending over the past twelve months.

“On the other hand, several private segments continue to manifest strength in terms of demand for construction services,” said Basu. “At the head of the class are office construction, driven by a combination of job growth among certain office-space-using categories as well as lofty valuations, and communications, which is being driven largely by enormous demand for data center capacity.

“While there are certainly some parts of the nation experiencing significant levels of public construction, those areas have increasingly become the exception as opposed to the rule,” said Basu. “The more general and pervasive strength is in private segments. Based on recent readings of the architecture billings index and other key leading indicators, commercial contractors are likely to remain busy for the foreseeable future. The outlook for construction firms engaged in public work remains unclear.”

Related Stories

Market Data | May 20, 2020

Architecture billings continue historic contraction

AIA’s Architecture Billings Index (ABI) score of 29.5 for April reflects a decrease in design services provided by U.S. architecture firms.

Market Data | May 19, 2020

5 must reads for the AEC industry today: May 19, 2020

Clemson's new mass timber building and empty hotels as an answer for the affordable housing shortage.

Market Data | May 18, 2020

5 must reads for the AEC industry today: May 18, 2020

California's grid can support all-electric buildings and you'll miss your office when it's gone.

Market Data | May 15, 2020

6 must reads for the AEC industry today: May 15, 2020

Nonresidential construction employment sees record loss and Twitter will keep all of its office space.

Market Data | May 15, 2020

Nonresidential construction employment sees record loss in April

The construction unemployment rate was 16.6% in April, up 11.9 percentage points from the same time last year.

Market Data | May 14, 2020

5 must reads for the AEC industry today: May 14, 2020

The good news about rent might not be so good and some hotel developers consider whether to abandon projects.

Market Data | May 13, 2020

House democrats' coronavirus measure provides some relief for contractors, but lacks other steps needed to help construction

Construction official says new highway funding, employee retention credits and pension relief will help, but lack of safe harbor measure, Eextension of unemployment bonus will undermine recovery.

Market Data | May 13, 2020

5 must reads for the AEC industry today: May 13, 2020

How to design resilient libraries in a post-covid world and vacation real-estate markets are 'toast.'

Market Data | May 12, 2020

ABC’s Construction Backlog Indicator falls in April; Contractor Confidence rebounds from historic lows

Nonresidential construction backlog is down 0.4 months compared to the March 2020 ABC survey and 1.7 months from April 2019.

Market Data | May 12, 2020

6 must reads for the AEC industry today: May 12, 2020

A 13-point plan to reduce coronavirus deaths in nursing homes and Bjarke Ingels discusses building on Mars.