The construction industry’s fortunes continued to diverge in October, as residential construction expanded again while nonresidential construction remained largely unchanged from a month ago and is down compared to last year, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said that demand for nonresidential construction is being hit by private sector worries about the coronavirus, tighter state and local budgets and the lack of new federal pandemic relief measures.

“The October spending report shows private nonresidential construction is continuing to slide,” said Ken Simonson, the association’s chief economist. “Public construction spending has fluctuated in recent months but both types of nonresidential spending have fallen significantly from recent peaks this year and appear to be heading even lower.”

Construction spending in October totaled $1.44 trillion at a seasonally adjusted annual rate, an increase of 1.3% from the pace in September and 3.7% higher than in October 2019. But the gains were limited to residential construction, which increased 2.9% for the month and 14.6% year-over-year. Meanwhile, private and public nonresidential spending was virtually unchanged from September and declined 3.7% from a year earlier.

Private nonresidential construction spending declined for the fourth month in a row, slipping 0.7% from September to October, with decreases in nine out of 11 categories. The October total was 8.2% lower than in October 2019. The largest private nonresidential segment, power construction, declined 0.8% for the month. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slid 1.0%, manufacturing construction declined 0.8%, and office construction dipped 0.2%.

Public construction spending increased 1.0% in October and 3.7% year-over-year. The largest public category, highway and street construction, gained 1.6% for the month. Among other large public segments, educational construction increased 1.1% for the month and transportation construction rose 1.0%.

Private residential construction spending increased for the fifth consecutive month, rising 2.9% in October. Single-family homebuilding jumped 5.6% for the month, while multifamily construction spending rose 1.2% and residential improvements spending was flat.

Association officials said demand for nonresidential construction was unlikely to rebound in the near-term without new federal relief measures, putting additional construction careers at risk. These should include new investments in infrastructure, to improve aging roads and bridges, public buildings and water utility networks. Federal officials should refrain from taxing Paycheck Protection Program loans as it would undermine the benefits of that program. And Congress and the administration should work together to enact liability reforms to protect honest firms from frivolous coronavirus lawsuits.

“As long as the coronavirus undermines private sector confidence and public sector budgets, the only way to save good-paying construction careers is through new federal relief measures,” said Stephen E. Sandherr, the association’s chief executive officer. “Fixing the nation’s infrastructure, preserving the benefits of the PPP program and protecting honest employers will give the economy a much-needed short-term boost.”

Related Stories

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

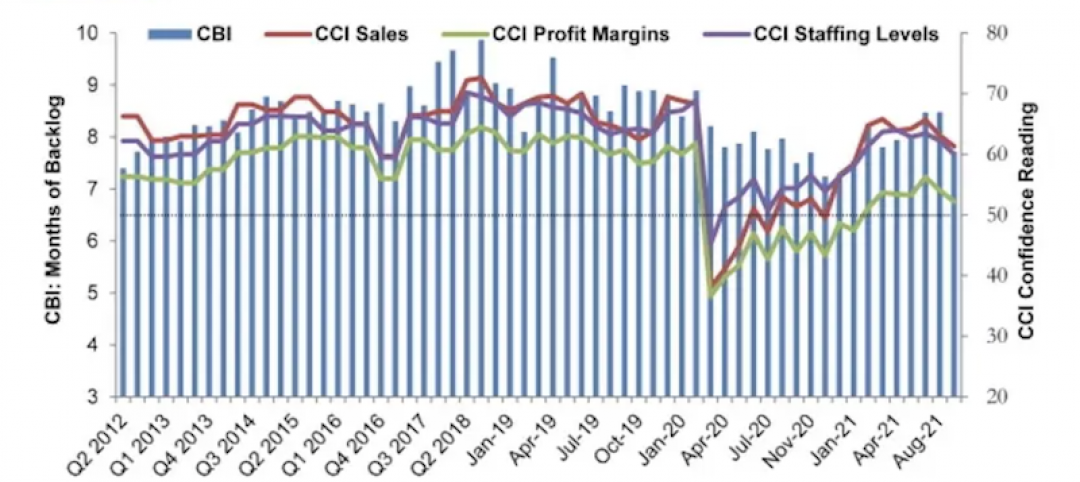

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

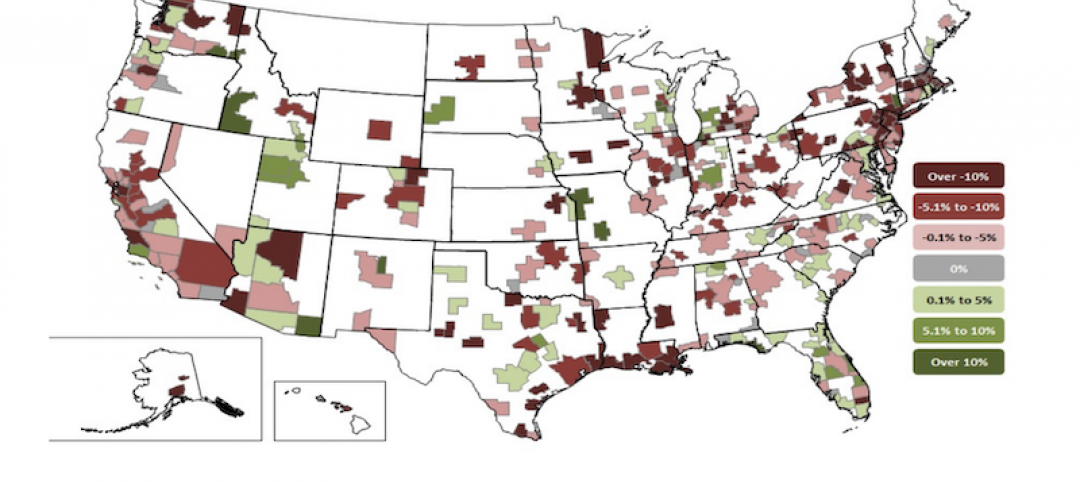

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.

Market Data | Aug 17, 2021

Demand for design activity continues to expand

The ABI score for July was 54.6.