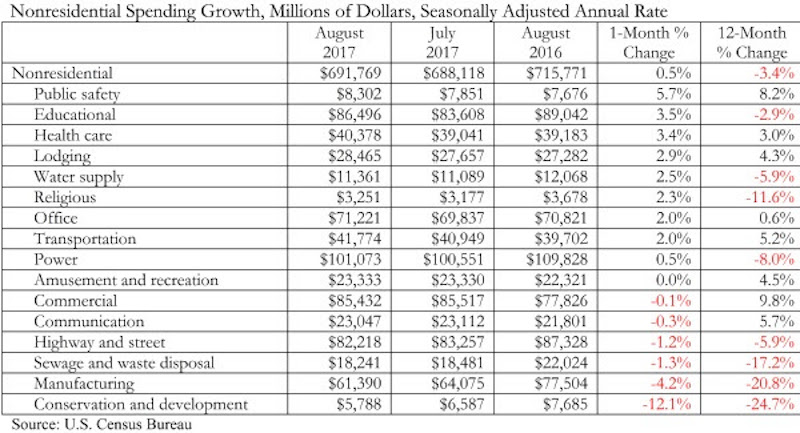

Nonresidential construction spending expanded 0.5% in August, totaling $691.8 billion on a seasonally adjusted, annualized basis, according to an analysis of data from the U.S. Census Bureau by Associated Builders and Contractors (ABC). Though this represents an improvement from July’s total ($688.2 billion), nonresidential spending remains 3.4 percent below its year-ago level and is down 3.8 percent from the cyclical peak attained in May 2017.

Spending levels expanded in 10 of the 16 nonresidential construction subsectors in August on a monthly basis. The manufacturing subsector experienced the largest absolute monthly decline (-$2.6 billion) and the greatest year-over-year decline (-$16.1 billion).

“Though nonresidential construction spending expanded in August, there is a disconnect between spending data and other data characterizing the level of activity, including backlog and employment,” said ABC Chief Economist Anirban Basu. “Collectively, nonresidential construction firms continue to hire, and staffing levels are well ahead of year-ago levels. That is consistent with a busier industry. ABC’s Construction Backlog Indicator (CBI) also continues to show that the average nonresidential construction firm can expect to remain busy, with a significant amount of future work already under contract. But the spending data show that the industry has actually become somewhat less busy over the past year.

“There are a number of possible explanations,” said Basu. “One is that employers may be forced in many instances to replace each retiring skilled worker with more than one employee. This is also consistent with declining industry productivity measured in terms of output per hour worked.

“Another possibility is that the construction segments that have been expanding in recent years are more labor intensive than those in which spending has been in decline,” said Basu. “Spending declines have been especially noteworthy in several capital-intensive public spending segments, including conservation and development and sewage and waste disposal. By contrast, spending increases over roughly the past three years have been apparent in segments requiring many workers specializing in high-quality finishes, including in the lodging and office categories.”

Related Stories

K-12 Schools | Nov 30, 2022

School districts are prioritizing federal funds for air filtration, HVAC upgrades

U.S. school districts are widely planning to use funds from last year’s American Rescue Plan (ARP) to upgrade or improve air filtration and heating/cooling systems, according to a report from the Center for Green Schools at the U.S. Green Building Council. The report, “School Facilities Funding in the Pandemic,” says air filtration and HVAC upgrades are the top facility improvement choice for the 5,004 school districts included in the analysis.

Industry Research | Nov 8, 2022

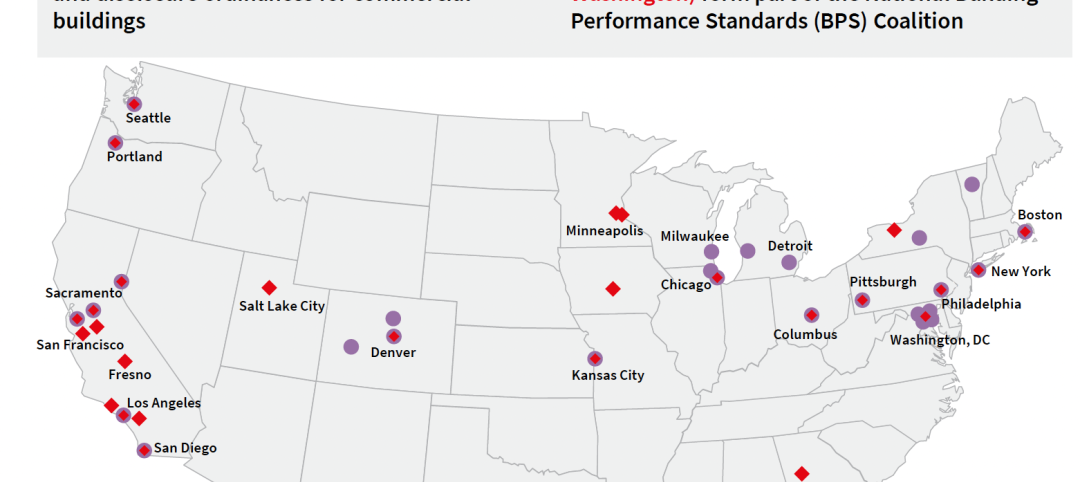

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Multifamily Housing | May 11, 2022

Kitchen+Bath AMENITIES – Take the survey for a chance at a $50 gift card

MULTIFAMILY DESIGN + CONSTRUCTION is conducting a research study on the use of kitchen and bath products in the $106 billion multifamily construction sector.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Industry Research | Apr 4, 2022

Nonresidential Construction Spending Drops Slightly in February, Says ABC

National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau