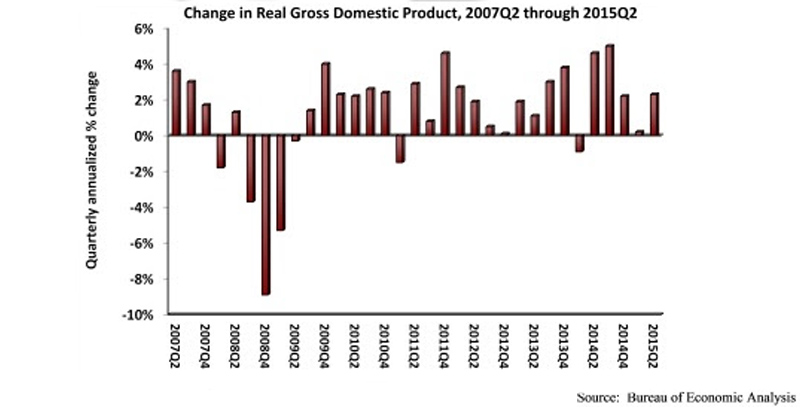

Nonresidential fixed investment fell by 0.6% during the second quarter after expanding by 1.6% during the first quarter, according to the July 30 real gross domestic product (GDP) report by the Bureau of Economic Analysis (BEA).

For the economy as a whole, real GDP expanded by 2.3% (seasonally adjusted annual rate) during the second quarter following a 0.6% increase during the year's first quarter. Note that the first quarter estimate for nonresidential fixed investment was revised upward from -3.4% annualized growth.

"In the first half of 2015, both the broader economy and nonresidential investment lost the momentum they had coming into the year," said Associated Builders and Contractors Chief Economist Anirban Basu. "Rather than indicating renewed progress in terms of achieving a more robust recovery, today's GDP release indicates that a variety of factors helped to stall investment in nonresidential structures. There are many viable explanations, including a weaker overall U.S. economy, a stronger U.S. dollar, decreased investment in structures related to the nation's energy sector, soft public spending, and uncertainty regarding monetary policy and other abstracts of public policy. While the expectation is that the second half of the year will be better, unfortunately not much momentum is being delivered by the year's initial six months.

"Perhaps the most salient facet of this GDP release was the revisions," said Basu. "The BEA revised the first quarter estimate upward from -0.2% to 0.6% annualized growth. This is not surprising; many economists insisted that the economy did not shrink in the first quarter. However, the BEA also downwardly revised growth figures from the fourth quarter of 2011 to the fourth quarter of 2014. Over that period, GDP increased at an average annual rate of 2.1%, 0.3 percentage points lower than previously thought. These revisions could be a function of the agency's ongoing effort to tackle residual seasonality, a pattern in which seasonal adjustments led to repeated first quarter slowdowns. It will take a few more quarters to understand the full impact of the improved seasonal adjustments."

Performance of key segments during the first quarter:

- Investment in nonresidential structures decreased at a 1.6% rate after decreasing at a 7.4% rate in the first quarter.

- Personal consumption expenditures added 1.99% to GDP after contributing 1.19% in the first quarter.

- Spending on goods grew 1.1% from the first quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 2.5% for the second quarter after a 2.5% increase in the first quarter.

- Federal government spending decreased 1.1% in the second quarter after increasing by 1.1% in the first quarter.

- Nondefense spending decreased 0.5% after expanding by 1.2% in the previous quarter.

- National defense spending fell 1.5% after growing 1% in the first quarter.

- State and local government spending grew 2% during the second quarter after a decrease of 0.8% in the first.

To view the previous GDP report, click here.

Related Stories

| Sep 26, 2016

RELIGIOUS FACILITY GIANTS: A ranking of the nation’s top religious sector design and construction firms

Gensler, Leo A Daly, Brasfield & Gorrie, Layton Construction, and AECOM top Building Design+Construction’s annual ranking of the nation’s largest religious facility AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 16, 2016

U.S. construction companies not embracing technology: KPMG survey

U.S. construction companies are not embracing technological advancements, such as drone aircrafts, robotics, RFID equipment and materials tracking, and data analytics, according to KPMG International’s Global Construction Survey 2016, “Building a technology advantage.

Architects | Sep 15, 2016

Implicit bias: How the unconscious mind drives business decisions

Companies are tapping into the latest research in psychology and sociology to advance their diversity and inclusion efforts when it comes to hiring, promoting, compensation, and high-performance teaming, writes BD+C's David Barista.

AEC Tech | Sep 6, 2016

Innovation intervention: How AEC firms are driving growth through R&D programs

AEC firms are taking a page from the tech industry, by infusing a deep commitment to innovation and disruption into their cultural DNA.

Sponsored | Contractors | Sep 5, 2016

Rental vs. purchase: How to minimize job site costs

Smart business decisions can mean the difference between being ‘on budget’ and going ‘way over’ budget.

| Sep 1, 2016

TRANSIT GIANTS: A ranking of the nation's top transit sector design and construction firms

Skidmore, Owings & Merrill, Perkins+Will, Skanska USA, Webcor Builders, Jacobs, and STV top Building Design+Construction’s annual ranking of the nation’s largest transit sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

INDUSTRIAL GIANTS: A ranking of the nation's top industrial design and construction firms

Stantec, BRPH, Fluor Corp., Walbridge, Jacobs, and AECOM top Building Design+Construction’s annual ranking of the nation’s largest industrial sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

HOTEL SECTOR GIANTS: A ranking of the nation's top hotel sector design and construction firms

Gensler, HKS, Turner Construction Co., The Whiting-Turner Contracting Co., Jacobs, and JBA Consulting Engineers top Building Design+Construction’s annual ranking of the nation’s largest hotel sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

CULTURAL SECTOR GIANTS: A ranking of the nation's top cultural sector design and construction firms

Gensler, Perkins+Will, PCL Construction Enterprises, Turner Construction Co., AECOM, and WSP | Parsons Brinckerhoff top Building Design+Construction’s annual ranking of the nation’s largest cultural sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

COURTHOUSE GIANTS: A ranking of the nation's top courthouse design and construction firms

DLR Group, NBBJ, Hensel Phelps, Sundt Construction, AECOM, and Dewberry top Building Design+Construction’s annual ranking of the nation’s largest courthouse sector AEC firms, as reported in the 2016 Giants 300 Report.