Nonresidential fixed investment fell by 0.6% during the second quarter after expanding by 1.6% during the first quarter, according to the July 30 real gross domestic product (GDP) report by the Bureau of Economic Analysis (BEA).

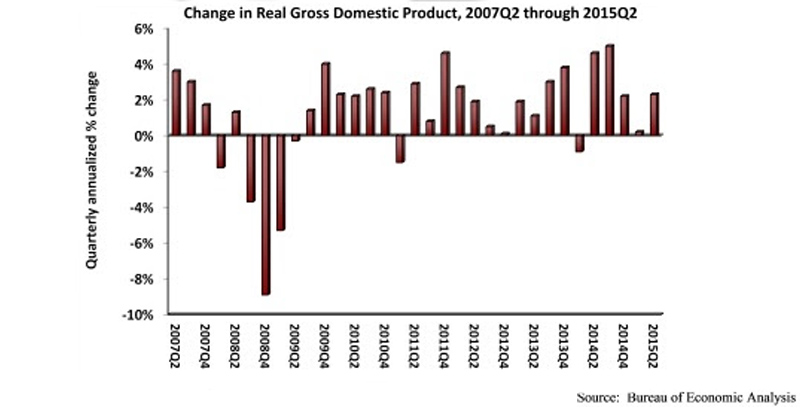

For the economy as a whole, real GDP expanded by 2.3% (seasonally adjusted annual rate) during the second quarter following a 0.6% increase during the year's first quarter. Note that the first quarter estimate for nonresidential fixed investment was revised upward from -3.4% annualized growth.

"In the first half of 2015, both the broader economy and nonresidential investment lost the momentum they had coming into the year," said Associated Builders and Contractors Chief Economist Anirban Basu. "Rather than indicating renewed progress in terms of achieving a more robust recovery, today's GDP release indicates that a variety of factors helped to stall investment in nonresidential structures. There are many viable explanations, including a weaker overall U.S. economy, a stronger U.S. dollar, decreased investment in structures related to the nation's energy sector, soft public spending, and uncertainty regarding monetary policy and other abstracts of public policy. While the expectation is that the second half of the year will be better, unfortunately not much momentum is being delivered by the year's initial six months.

"Perhaps the most salient facet of this GDP release was the revisions," said Basu. "The BEA revised the first quarter estimate upward from -0.2% to 0.6% annualized growth. This is not surprising; many economists insisted that the economy did not shrink in the first quarter. However, the BEA also downwardly revised growth figures from the fourth quarter of 2011 to the fourth quarter of 2014. Over that period, GDP increased at an average annual rate of 2.1%, 0.3 percentage points lower than previously thought. These revisions could be a function of the agency's ongoing effort to tackle residual seasonality, a pattern in which seasonal adjustments led to repeated first quarter slowdowns. It will take a few more quarters to understand the full impact of the improved seasonal adjustments."

Performance of key segments during the first quarter:

- Investment in nonresidential structures decreased at a 1.6% rate after decreasing at a 7.4% rate in the first quarter.

- Personal consumption expenditures added 1.99% to GDP after contributing 1.19% in the first quarter.

- Spending on goods grew 1.1% from the first quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 2.5% for the second quarter after a 2.5% increase in the first quarter.

- Federal government spending decreased 1.1% in the second quarter after increasing by 1.1% in the first quarter.

- Nondefense spending decreased 0.5% after expanding by 1.2% in the previous quarter.

- National defense spending fell 1.5% after growing 1% in the first quarter.

- State and local government spending grew 2% during the second quarter after a decrease of 0.8% in the first.

To view the previous GDP report, click here.

Related Stories

| Aug 15, 2016

MILITARY GIANTS: Cross-laminated timber construction gets a salute from the Army

By privatizing the construction, renovation, operation, maintenance, and ownership of its hotels the Army expects to cut a 20-year timetable for repairs and replacement of its lodging down to eight years.

| Aug 12, 2016

SCIENCE + TECHNOLOGY GIANTS: Incubator model is reimagining research and lab design

Interdisciplinary interaction is a common theme among many new science and technology offices.

| Aug 12, 2016

Top 30 Science + Technology Construction Firms

Skanska USA, Suffolk Construction Co., and The Whiting-Turner Contracting Co. top Building Design+Construction’s annual ranking of the nation’s largest science + technology sector construction and construction management firms, as reported in the 2016 Giants 300 Report.

| Aug 12, 2016

OFFICE GIANTS: Technology is giving office workers the chance to play musical chairs

Technology is redefining how offices function and is particularly salient in the growing trend of "hoteling" and "hot seating" or "free addressing."

| Aug 12, 2016

Top 100 Office Construction Firms

Turner Construction Co., Structure Tone, and Gilbane Building Co. top Building Design+Construction’s annual ranking of the nation’s largest office sector construction and construction management firms, as reported in the 2016 Giants 300 Report.

| Aug 11, 2016

RETAIL GIANTS: Retailers and developers mix it up to stay relevant with shoppers

Retail is becoming closely aligned with entertainment, and malls that can be repositioned as lifestyle centers will have enhanced value.

| Aug 10, 2016

Top 80 Retail Construction Firms

VCC, PCL Construction Enterprises, and The Whiting-Turner Contracting Co. top Building Design+Construction’s annual ranking of the nation’s largest retail sector construction and construction management firms, as reported in the 2016 Giants 300 Report.

| Aug 10, 2016

DATA CENTER GIANTS: Information overload is pushing the limits of mission-critical facilities

Streamlined design and delivery approaches for individual business enterprises and co-location facilities are being born out of the necessity to bring new capacity online as quickly as possible.

Data Centers | Aug 10, 2016

Top 40 Data Center Construction Firms

The Whiting-Turner Contracting Co., Holder Construction Co., and DPR Construction top Building Design+Construction’s annual ranking of the nation’s largest data center sector construction and construction management firms, as reported in the 2016 Giants 300 Report.

Contractors | Aug 10, 2016

Dodge launches new app to simplify pros' search for suitable projects to bid and work on

The product, called PlanRoom, could be particularly useful in sharing data and communications among AEC teams.