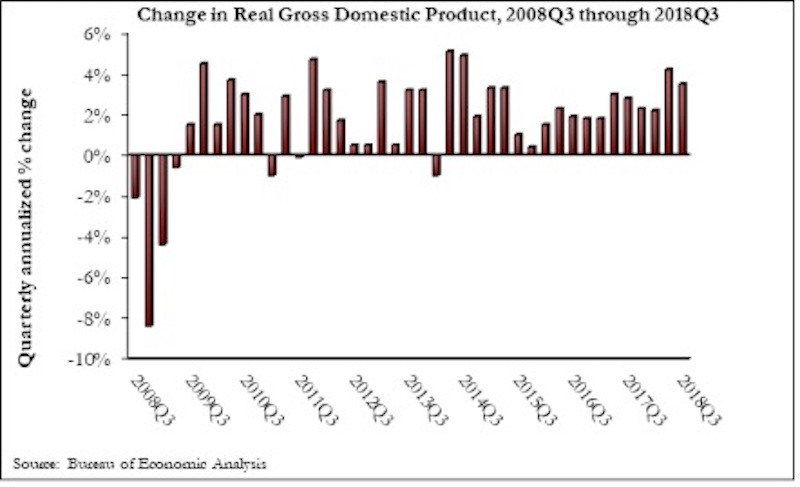

The U.S. economy expanded at a 3.5% annualized rate during the third quarter of 2018, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today. This represents the first time there have been two consecutive quarters of 3%-plus growth since the beginning of 2015.

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter. Nonresidential fixed investment increased at just a 0.8% annualized rate, a stark reversal from the 11.5% and 8.7% growth observed in the first and second quarters, respectively. Investment in structures plummeted 7.9% after increasing by 13.9% and 14.5% in the previous two quarters.

“While the GDP increased, business investment, including investment in structures, was generally disappointing,” said ABC Chief Economist Anirban Basu. “Today’s GDP release is consistent with other data indicating a recent softening in capital expenditures, which caught many observers by surprise. Coming into the year, the expectation among many was that corporate tax cuts would translate into a lengthy period of rising business investment.

“As always, there are multiple explanations for the observed slowing in capital expenditures,” said Basu. “The first is simply that this represents an inevitable moderation in fixed business investment after the stunning growth in investment registered during the year’s initial two quarters. A second explanation, however, is not nearly as benign. This explanation focuses on both the growing constraints that businesses face due to a lack of trained workers available to work on new equipment, as well as the impact of rising input costs. Corporate earnings are no longer as consistently surprising to the upside, an indication of the impact of rising business costs. It may be that the dislocation created by ongoing trade skirmishes is also inducing certain firms to invest less in equipment and structures.

“If the first explanation is correct, one would expect a bounce back in capital expenditures,” said Basu. “The logic is that the U.S. business community has taken a bit of a breather to digest all of the capital investments undertaken during the first half of 2018. However, the second would indicate economic growth and the pace of hiring to soften in 2019. That obviously would not be a welcome dynamic for America’s construction sector.”

Related Stories

Apartments | Aug 22, 2023

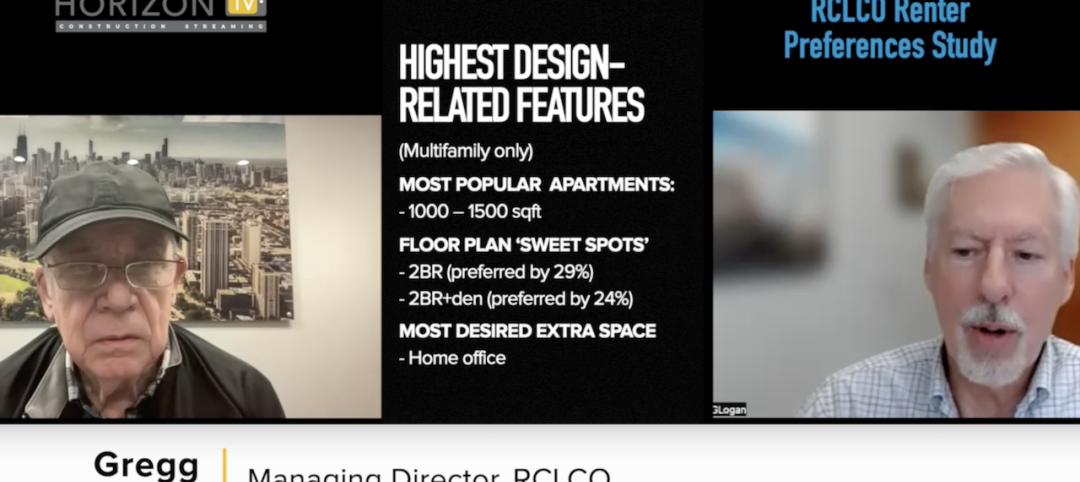

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

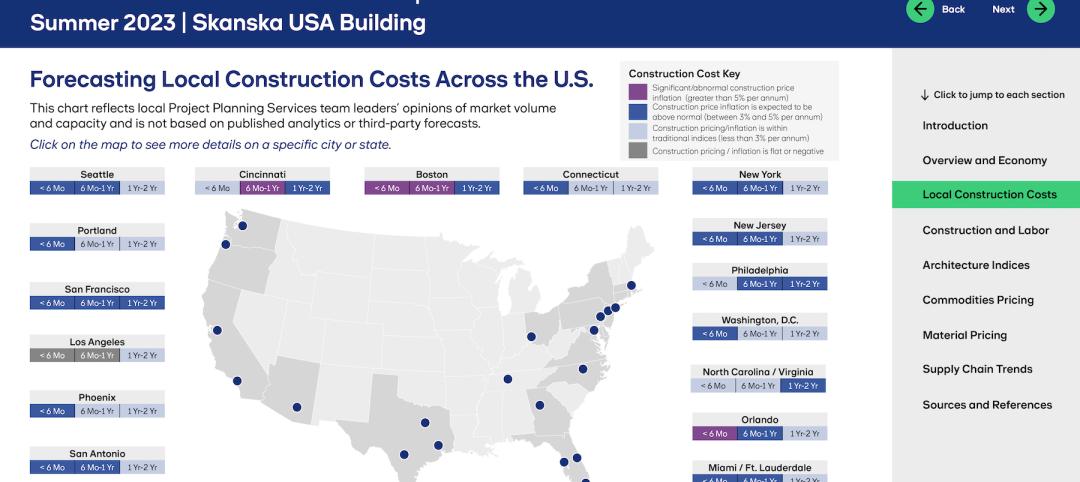

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.