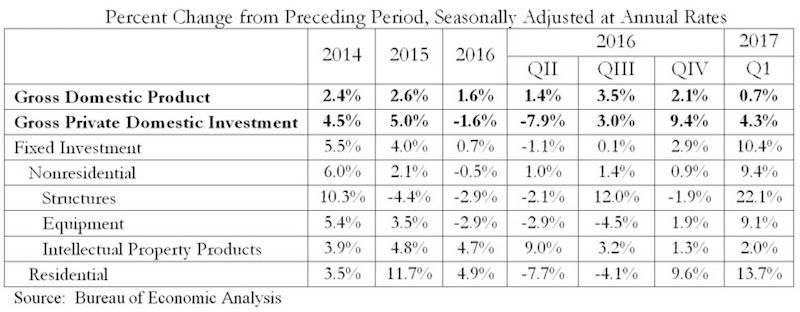

The U.S. economy’s performance slowed in the first quarter of 2017, but nonresidential fixed investment expanded at an impressive 9.4 percent seasonally adjusted annual rate, according to analysis of U.S. Bureau of Economic Analysis data recently released by Associated Builders and Contractors (ABC).

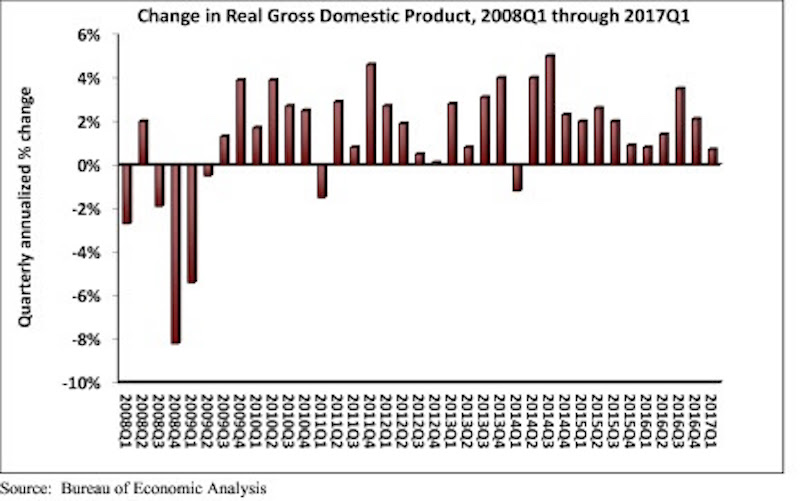

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year. Despite the subdued growth, GDP has now expanded in every quarter over the past three years. Fourth quarter 2016 growth was revised upward from a 1.9 percent annual rate of expansion to a 2.1 percent annual rate.

This represents the best quarter for nonresidential fixed investment, a category closely aligned with construction and other forms of business investment, since the end of 2013 and ends more than a year of tepid nonresidential fixed investment growth. Investment in structures, a subcomponent of nonresidential fixed investment, expanded 22.1 percent for the quarter after contracting by 1.9 percent in the fourth quarter of 2016. The other two subcomponents of nonresidential fixed investment—equipment and intellectual property products—expanded at a 9.1 percent rate and a 2.0 percent rate, respectively.

“It was expected that first quarter GDP would indicate that the U.S. economy remained unable to generate a high rate of growth,” said ABC Chief Economist Anirban Basu in a release. “Many economic actors appear to have adopted a cautious attitude in an environment characterized by a considerable amount of policy uncertainty. The decline in defense expenditures is likely to be a surprise to many given recent discussions about supposed vast increases in defense outlays.

“The investment in nonresidential structures during the first three months of the year is particularly remarkable in an environment otherwise characterized as generating little economic growth,” said Basu. “Rather than adopt a wait-and-see attitude, developers appear to have acted with conviction, taking advantage of growing confidence among investors and other market participants to forge ahead with planned projects. While the new presidential administration has yet to implement even a small fraction of its pro-business agenda, the development community continues to express confidence in the administration’s ability to create the conditions necessary for a much more vibrant U.S. economy.

“The expectation is that the balance of the year will be associated with much more rapid growth,” said Basu. “Consumer spending should pick up after a weak first quarter, given accelerating wage increases and elevated levels of job security. Business spending is also likely to expand briskly, particularly if the Trump administration is able to make meaningful progress on the corporate and personal income tax front.”

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.