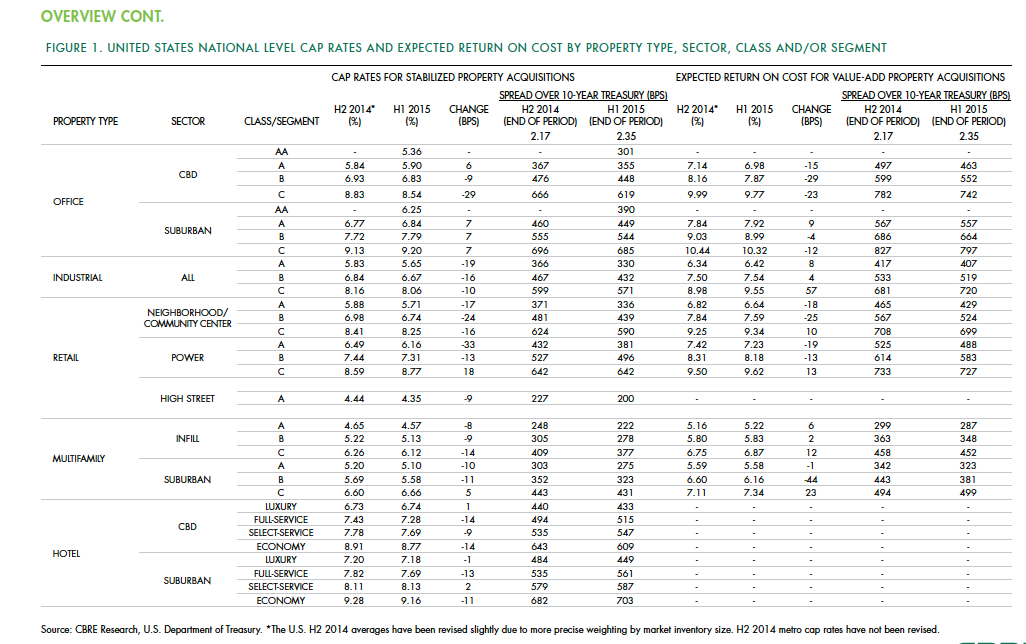

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Adaptive Reuse | Mar 30, 2024

Hotel vs. office: Different challenges in commercial to residential conversions

In the midst of a national housing shortage, developers are examining the viability of commercial to residential conversions as a solution to both problems.

Sustainability | Mar 29, 2024

Demystifying carbon offsets vs direct reductions

Chris Forney, Principal, Brightworks Sustainability, and Rob Atkinson, Senior Project Manager, IA Interior Architects, share the misconceptions about carbon offsets and identify opportunities for realizing a carbon-neutral building portfolio.

Office Buildings | Mar 28, 2024

Workplace campus design philosophy: People are the new amenity

Nick Arambarri, AIA, LEED AP BD+C, NCARB, Director of Commercial, LPA, underscores the value of providing rich, human-focused environments for the return-to-office workforce.

Office Buildings | Mar 27, 2024

A new Singapore office campus inaugurates the Jurong Innovation District, a business park located in a tropical rainforest

Surbana Jurong, an urban, infrastructure and managed services consulting firm, recently opened its new headquarters in Singapore. Surbana Jurong Campus inaugurates the Jurong Innovation District, a business park set in a tropical rainforest.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

Sustainability | Mar 21, 2024

World’s first TRUE-certified building project completed in California

GENESIS Marina, an expansive laboratory and office campus in Brisbane, Calif., is the world’s first Total Resource Use and Efficiency (TRUE)-certified construction endeavor. The certification recognizes projects that achieve outstanding levels of resource efficiency through waste reduction, reuse, and recycling practices.

Office Buildings | Mar 21, 2024

Corporate carbon reduction pledges will have big impact on office market

Corporate carbon reduction commitments will have a significant impact on office leasing over the next few years. Businesses that have pledged to reduce their organization’s impact on climate change must ensure their next lease allows them to show material progress on their goals, according to a report by JLL.

Adaptive Reuse | Mar 21, 2024

Massachusetts launches program to spur office-to-residential conversions statewide

Massachusetts Gov. Maura Healey recently launched a program to help cities across the state identify underused office buildings that are best suited for residential conversions.

Office Buildings | Mar 21, 2024

BOMA updates floor measurement standard for office buildings

The Building Owners and Managers Association (BOMA) International has released its latest floor measurement standard for office buildings, BOMA 2024 for Office Buildings – ANSI/BOMA Z65.1-2024.

Sustainability | Mar 13, 2024

Trends to watch shaping the future of ESG

Gensler’s Climate Action & Sustainability Services Leaders Anthony Brower, Juliette Morgan, and Kirsten Ritchie discuss trends shaping the future of environmental, social, and governance (ESG).