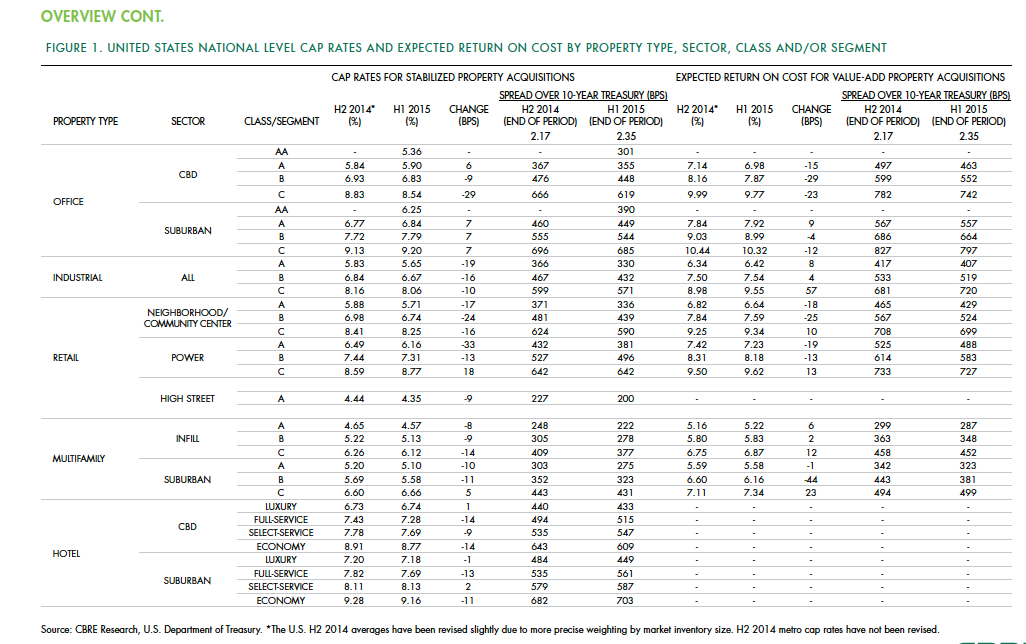

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Office Buildings | Mar 8, 2024

Conference room design for the hybrid era

Sam Griesgraber, Senior Interior Designer, BWBR, shares considerations for conference room design in the era of hybrid work.

Office Buildings | Mar 5, 2024

Former McDonald’s headquarters transformed into modern office building for Ace Hardware

In Oak Brook, Ill., about 15 miles west of downtown Chicago, McDonald’s former corporate headquarters has been transformed into a modern office building for its new tenant, Ace Hardware. Now for the first time, Ace Hardware can bring 1,700 employees from three facilities under one roof.

Designers | Feb 23, 2024

Coverings releases top 2024 tile trends

In celebration of National Tile Day, Coverings, North America's leading tile and stone exhibition, has announced the top 10 tile trends for 2024.

High-rise Construction | Feb 23, 2024

Designing a new frontier in Seattle’s urban core

Graphite Design Group shares the design for Frontier, a 540,000-sf tower in a five-block master plan for Seattle-based tech leader Amazon.

MFPRO+ News | Feb 15, 2024

UL Solutions launches indoor environmental quality verification designation for building construction projects

UL Solutions recently launched UL Verified Healthy Building Mark for New Construction, an indoor environmental quality verification designation for building construction projects.

Office Buildings | Feb 13, 2024

Creating thoughtful tech workplace design

It’s important for office design to be inspiring, but there are some practical principles that can be incorporated into the design of real-world tech workplaces to ensure they convey an exciting, sophisticated allure that accommodates progressive thinking and inventiveness.

Urban Planning | Feb 5, 2024

Lessons learned from 70 years of building cities

As Sasaki looks back on 70 years of practice, we’re also looking to the future of cities. While we can’t predict what will be, we do know the needs of cities are as diverse as their scale, climate, economy, governance, and culture.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Giants 400 | Jan 29, 2024

Top 80 Office Core and Shell Engineering Firms for 2023

Jacobs, WSP, Alfa Tech Consulting Engineers, Thornton Tomasetti, and Burns & McDonnell top BD+C's ranking of the nation's largest office core and shell engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 140 Office Core and Shell Architecture Firms for 2023

Gensler, Stantec, Page Southerland Page, Perkins&Will, and NBBJ top BD+C's ranking of the nation's largest office core and shell architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.