Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

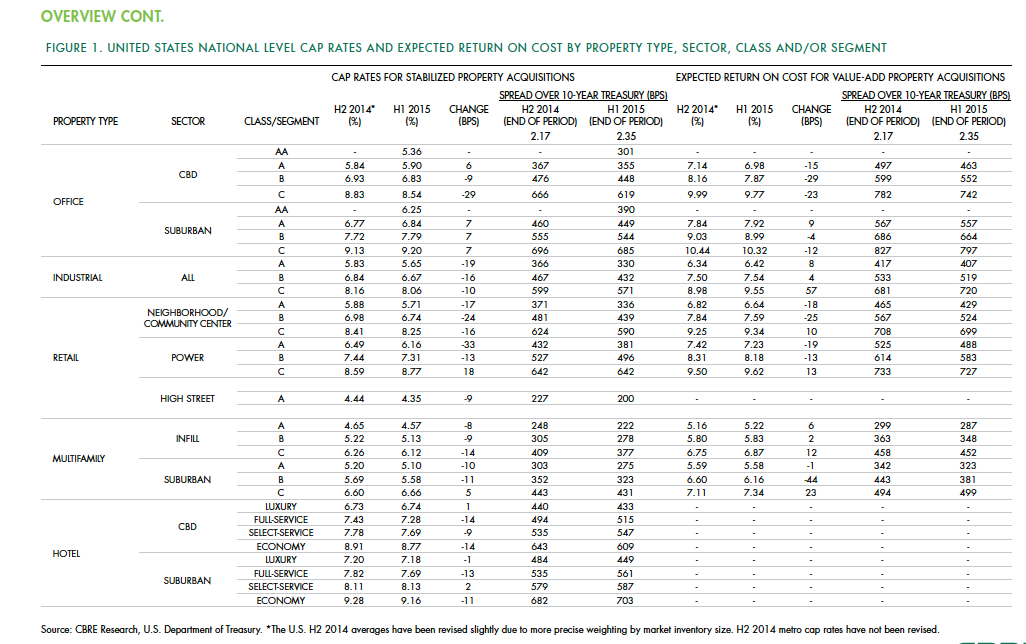

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Office Buildings | Oct 30, 2023

Find Your 30: Creating a unique sense of place in the workplace while emphasizing brand identity

Finding Your 30 gives each office a sense of autonomy, and it allows for bigger and broader concepts that emphasize distinctive cultural, historic or other similar attributes.

Biophilic Design | Oct 29, 2023

Natural wood floors create biophilic experience in Austrian headquarters office

100% environmentally friendly natural wood floors from mafi add to the biophilic setting of a beverage company office in Upper Austria.

Government Buildings | Oct 27, 2023

A spurt in public spending bolsters AEC firms' government building practices

Nonresidential public construction spending, while only about a quarter of private-sector spending, has been growing at a much faster clip lately. In June, it was up 13.8% to $411.4 billion, with commercial and manufacturing the biggest subsectors, according to Commerce Department estimates.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

Biophilic Design | Oct 18, 2023

6 ways to integrate nature into the workplace

Integrating nature into the workplace is critical to the well-being of employees, teams and organizations. Yet despite its many benefits, incorporating nature in the built environment remains a challenge.

Office Buildings | Oct 16, 2023

The impact of office-to-residential conversion on downtown areas

Gensler's Duanne Render looks at the incentives that could bring more office-to-residential conversions to life.

Government Buildings | Oct 10, 2023

GSA names Elliot Doomes Public Buildings Service Commissioner

The U.S. General Services Administration (GSA) announced that the agency’s Public Buildings Service Commissioner Nina Albert will depart on Oct. 13 and that Elliot Doomes will succeed her.

Products and Materials | Sep 29, 2023

Top building products for September 2023

BD+C Editors break down 15 of the top building products this month, from smart light switches to glass wall systems.

Office Buildings | Sep 28, 2023

Structural engineering solutions for office-to-residential conversion

IMEG's Edwin Dean, Joe Gulden, and Doug Sweeney, share seven key focuses for structural engineers when planning office-to-residential conversions.