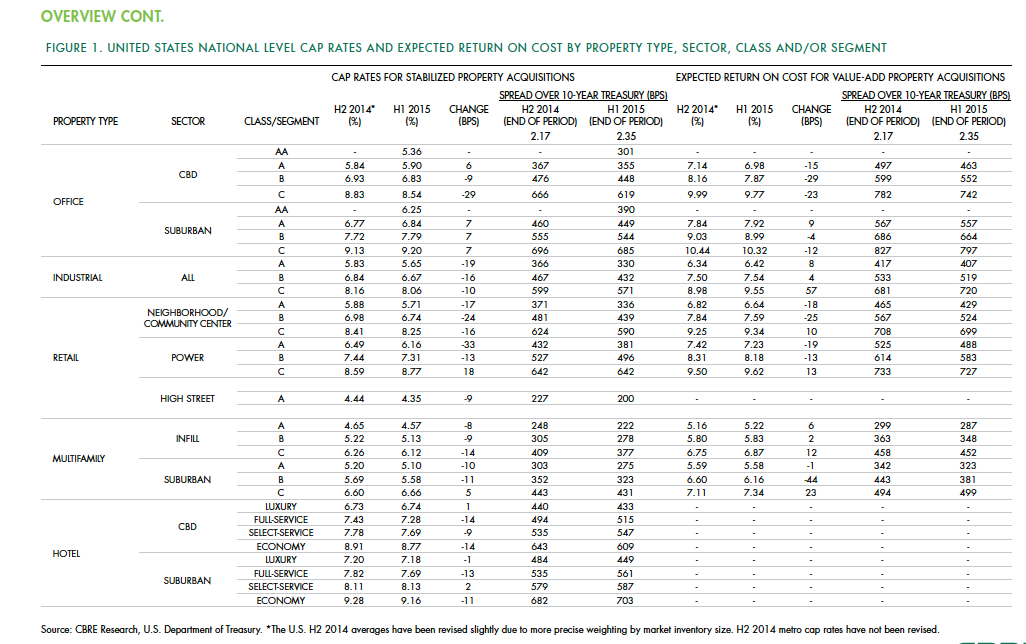

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Office Buildings | Nov 16, 2016

Bjarke Ingels Group and Heatherwick Studios confirmed as architects for Google’s new London Headquarters

The headquarters will be located at Kings Cross, London.

Office Buildings | Nov 15, 2016

Under Armour unveils phase one of 50-acre Baltimore headquarters

The campus will be located in Baltimore’s $5.5 billion Port Covington redevelopment project.

Office Buildings | Nov 14, 2016

Media’s adaptive shift: Converged environments

The converged environment is a live-streaming workplace, a zone where news and content flow continuously and speed to market is everything.

High-rise Construction | Nov 3, 2016

Two identical Kohn Pederson Fox office towers may be headed to Wacker Drive

Murphy Development Group is looking for tenants for the $800 million project.

Office Buildings | Nov 2, 2016

The first completed office building from Bjarke Ingels Group features a double-curved façade and giant periscope

The building also marks the first BIG project in Philadelphia.

Office Buildings | Oct 26, 2016

The power of office amenities in the workplace

With a continued focus on providing more with less, companies across all industries are continually driving their workers to increase efficiency and productivity—to get product and services to market faster and cheaper, writes LPA's Karen Thomas.

Office Buildings | Oct 26, 2016

Zaha Hadid Architects’ Dominion Office Building employs a fantastical design for its atrium

The office is located in Moscow’s southern district.

High-rise Construction | Oct 5, 2016

Plans for Hudson Yards skyscraper from Bjarke Ingels have officially been filed

The 65-story tower will be primarily office space and has an estimated development cost of $3.2 billion

Office Buildings | Sep 30, 2016

How to choose the right amenities for your office

No matter how lavish the amenities, they’ll prove ineffective in making any kind of positive impact if they don’t align to a company’s culture and the characteristics that make an organization unique, write Gensler’s Lena Kitson and Kimberly Foster.

High-rise Construction | Sep 23, 2016

A massive redevelopment in Tokyo reunites developer and architect

Mitsui Fudosan and SOM join forces to create OH-1, a mixed-use complex with a prominent public square.