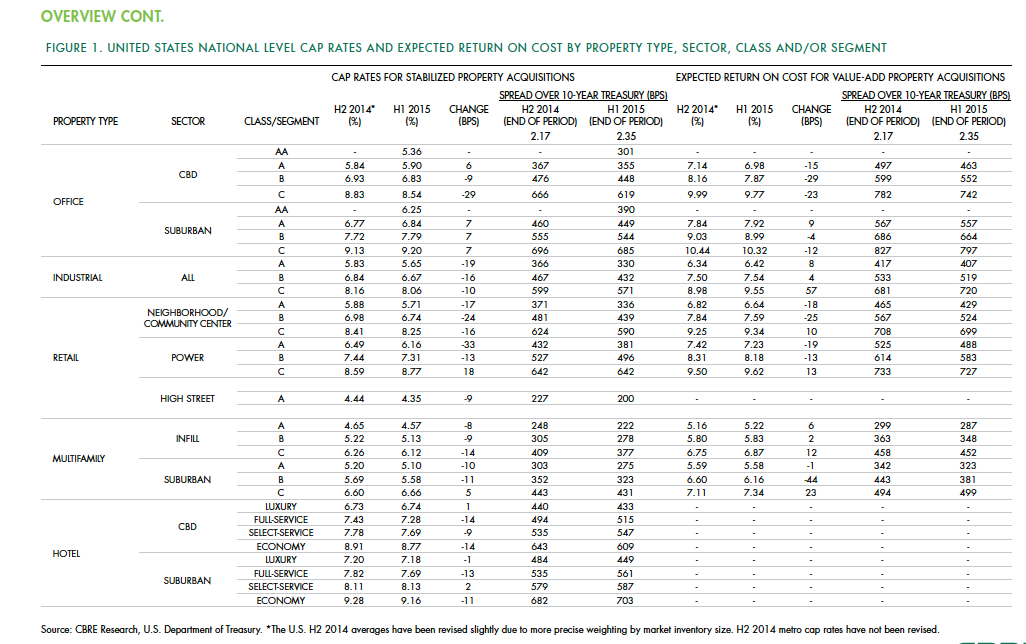

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Apr 18, 2014

First international buildings among 700-plus certified by BOMA 360 Performance Program

In the first quarter of 2014, the Building Owners and Managers Association (BOMA) International certified 66 properties in the BOMA 360 Performance Program for commercial real estate markets across the U.S and, for the first time, abroad.

| Apr 16, 2014

Upgrading windows: repair, refurbish, or retrofit [AIA course]

Building Teams must focus on a number of key decisions in order to arrive at the optimal solution: repair the windows in place, remove and refurbish them, or opt for full replacement.

| Apr 15, 2014

12 award-winning structural steel buildings

Zaha Hadid's Broad Art Museum and One World Trade Center are among the projects honored by the American Institute of Steel Construction for excellence in structural steel design.

| Apr 15, 2014

Chipperfield's sparkling brass-clad scheme selected to be new home of Nobel Prize

The distinctive building, with its shimmering vertical brass elements and glass façade design, beat out two other finalists in the Nobel Center architectural competition.

| Apr 11, 2014

ULI report documents business case for building healthy projects

Sustainable and wellness-related design strategies embody a strong return on investment, according to a report by the Urban Land Institute.

| Apr 11, 2014

First look: KPF's designs for DreamWorks in the massive Shanghai DreamCenter

Two blocks of offices will be centerpiece of new cultural and lifestyle district in the West Bund Media Port.

| Apr 9, 2014

Steel decks: 11 tips for their proper use | BD+C

Building Teams have been using steel decks with proven success for 75 years. Building Design+Construction consulted with technical experts from the Steel Deck Institute and the deck manufacturing industry for their advice on how best to use steel decking.

| Apr 2, 2014

8 tips for avoiding thermal bridges in window applications

Aligning thermal breaks and applying air barriers are among the top design and installation tricks recommended by building enclosure experts.

| Mar 31, 2014

Removable flood prevention system installed in one of New York City's largest office buildings

EKO Flood Protection created a flood prevention solution for one of New York City's largest office buildings, 55 Water Street, that can be put up in 8 hours by a crew of 30 people.

| Mar 26, 2014

Callison launches sustainable design tool with 84 proven strategies

Hybrid ventilation, nighttime cooling, and fuel cell technology are among the dozens of sustainable design techniques profiled by Callison on its new website, Matrix.Callison.com.