Since it was founded in 2010, N|V|5 Global, a publicly owned international engineering services provider based in Hollywood Fla., has acquired 25 companies, five of them in 2017 alone, including, most recently, Boston-based Richard D. Kimble Co., Inc. (RDK Engineers), a 120-year-old MEP engineering and design firm with 185 employees working out of five East Coast offices.

Speaking by phone from the Red Rock Resort in the Summerlin, Nev., master planned community, where N|V|5 Global was holding its annual shareholders meeting, Dickerson Wright, its Chairman and CEO, told BD+C that the addition of RDK Engineers “opens up the Northeast for us,” and strengthens N|V|5’s MEP practice.

Aside from the RDK deal, N|V|5’s acquisitions this year have included H&K, a $6 million geotechnical engineering firm in Northern California; Lochrane, a $6.5 million civil engineering firm in Orlando, Fla.; and Energenz, a $2 million international energy services company based in Irvine, Calif. Last October, NV5 bought JBA Consulting Engineers.

In its first quarter ended April 1, N|V|5’s revenue increased by 42.7% to $64.1 million, and net income grew by 10.4% to $2.27 million.

N|V|5 Global has been growing through acquisition since it launched eight years ago. It places a premium on keeping the employees of the companies it purchases in place, and making sure the acquisition is adding value to the firm. Image: N|V|5 Global

N|V|5 paid for its acquisition of RDK Engineers with a combination of cash and stock. Wright said that it’s typical for his company to pay 50% of a deal’s value in cash.

N|V|5 focuses on construction quality assurance, infrastructure, engineering and support services, energy, program management, and environmental solutions. Over the years, the firm has developed a process to determine whether another business would be a good fit through acquisition. Its criteria, explained Wright, revolve around added value, scalability, IT synchronicity, and single branding.

Perhaps most important, a business’s management has to be completely on board with the merger. Wright pointed out that there are 145,000 engineering firms in North America alone, most of which are private companies. This fragmentation has turned the engineering sector into a revolving door that has eroded any sense of loyalty and continuity between employer and employee.

As part of its acquisition strategy, N|V|R uses a carrot and stick approach to keep valued employees from walking out the door: It gets the managements of the companies it buys to sign employee agreements, in exchange for restricted NV5 stock they would receive after four years of service. Twenty-three of RDK’s managers signed that agreement.

“I am a big believer in partners and a big believer in shareholders; that’s why we’re public,” said Wright.

Christopher Cummings, PE, LEED AP, RDK’s CEO, said he believed that N|V|5 shared RDK’s “priority of providing innovative solutions to our clients through practical ingenuity, efficiency, and quality engineering in every project.”

Wright observed that a lot of mergers and acquisitions fail because too many companies get caught up in completing the deal without thinking through possible cultural collisions. “You’re crossing an emotional bridge [when two companies merge] and often times people aren’t listening to things that end up being problems,” such as allowing the acquired company to operate with the same autonomy or brand it had as an independent.

N|V|5, which has 2,300 employees and 102 offices, continues to look for companies that could be strategic fits. Wright said he sees “phenomenal opportunities” in Texas (where N|V|5 already has offices in Dallas and Austin). “But I don’t want to go in on a company without a solid foundation.”

He said his firm “loves” water-related projects, although he acknowledges that acquisition costs in that sector are high. N|V|5 is also interested in getting deeper into environmental projects, even though they have “a high barrier of entry,” said Wright.

N|V|5 operates four offices in Asia. But international expansion is less likely. “Only if our clients bring us there,” said Wright. For example, it just completed a liquefied natural gas processing plant in Angola for Bechtel Energy, for which N|V|5 provided quality control and energy services.

N|V|5 Global has provided MEP engineering services for a number of MGM-owned properties, including MGM Cotai in Macau. N|V|5's chairman, Dick Wright, said his company's international growth will be client driven. Image: N|V|5 Global

Related Stories

| Dec 24, 2013

First Look: Calatrava's Sharq Crossing in Doha, Qatar [video]

The government of Qatar has released details of Sharq Crossing, a massive infrastructure project designed by Spanish architect Santiago Calatrava.

| Dec 23, 2013

MBI commends start of module setting at B2, world's tallest modular building

The first modules have been set at B2 residential tower at Atlantic Yards in New York, set to become the tallest modular building in the world.

| Dec 23, 2013

First Look: KPF's dual-tower design for Ziraat Bank in Istanbul

Kohn Pedersen Fox Associates (KPF) is designing a new headquarters for Turkey’s largest and oldest financial institution, Ziraat Bank, in a modern, suburban district of Istanbul.

| Dec 20, 2013

Top healthcare sector trends for 2014 (and beyond)

Despite the lack of clarity regarding many elements of healthcare reform, there are several core tenets that will likely continue to drive transition within the healthcare industry.

| Dec 20, 2013

Must see for the holidays: Architects re-create iconic structures using gingerbread

Gensler, PBK, Page Sutherland Page, and Kirksey were among the firms to compete in the 5th Annual Gingerbread Build-Off.

| Dec 20, 2013

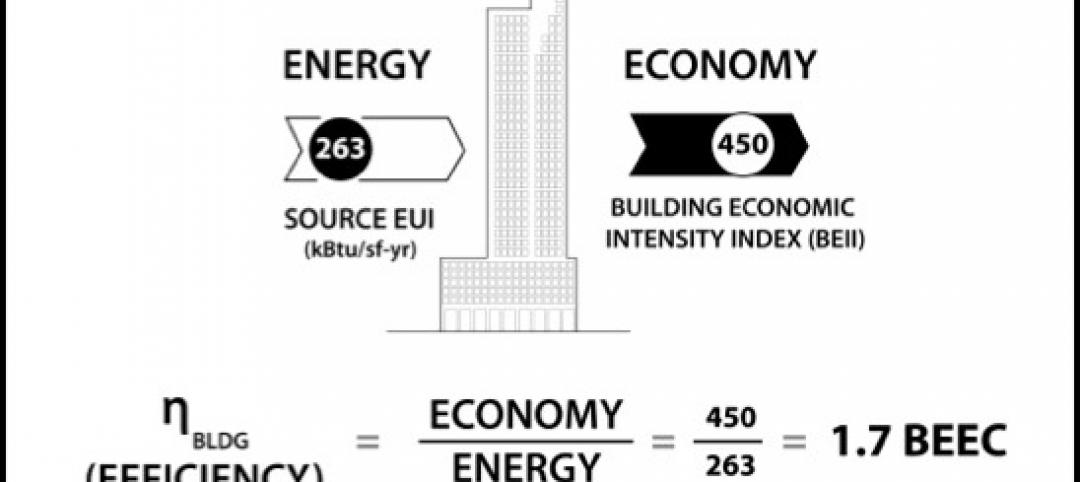

Can energy hogs still be considered efficient buildings? Yes, say engineers at Buro Happold

A new tool from the engineering firm Buro Happold takes into account both energy and economic performance of buildings for a true measure of efficiency.

| Dec 19, 2013

NRDC report relates green infrastructure investments to commercial property value [Infographic]

The Natural Resources Defense Council has released The Green Edge: How Commercial Property Investment in Green Infrastructure Creates Value -- a first-ever illustrative and well-documented report that helps demonstrate the value of green infrastructure. It draws from available published material to capture the multitude of tangible, monetizable non-water quality and water quality benefits that green infrastructure investments (trees, rain gardens, and porous pavement, rainwater harvesting cisterns, bioswales, etc.) can unlock for the commercial real estate sector, including commercial property owners and their tenants.

| Dec 19, 2013

Mastering the art of crowd control and visitor flow in interpretive facilities

To say that visitor facility planning and design is challenging is an understatement. There are many factors that determine the success of a facility. Unfortunately, visitor flow, the way people move and how the facility accommodates those movements, isn’t always specifically considered.

| Dec 19, 2013

Urban populations, climate change demand resilient design: Report

With over fifty percent of the population already living in urban areas, cities must grapple with the potentially catastrophic effects of climate change (think: Superstorm Sandy in New York). In a new report, Jones Lang LaSalle has identified steps cities can take to make their infrastructure more resilient to changing climate conditions.

| Dec 18, 2013

Architecture Billings Index takes step back in November

After six months of steadily increasing demand for design services, the Architecture Billings Index paused in November, dipping below 50 for just the second time in 2013.