Last year was another bumper year for New York City’s real estate market. Multifamily sales hit $12.6 billion, or 39% more that in 2013, according to a year-end report by Ariel Property Advisors, an investment property sales firm.

There were a total of 761 transactions last year, 8% more than in 2013. The borough of Brooklyn accounted for 222 of those transactions valued at $2.35 billion, or 88% higher than the Brooklyn transactions in 2013. In that borough, deals exceeding $20 million accounted for 47% of its transactions. For New York City as a whole, $20 million-plus deals accounted for more than half of all transactions.

Ariel estimates that 1,413 properties were sold last year, 13% more than in 2013. The properties sold had 47,885 total units, or 20% more than the buildings sold in 2013.

In Manhattan, whose real estate prices have been going through the roof in recent years, transactions may have declined by 12% to 139, but dollar volume jumped by 15% to $5.138 billion, with the Upper East Side being the liveliest neighborhood. The Real Deal, a website that reports on New York real estate news and trends, notes that one of the biggest deals last year was the Chetrit Group and Stellar Management’s purchase of two Upper East Side rental buildings at 1660 2nd Avenue and 160 East 88th Street for a combined $485 million.

In a recent interview with the New York Real Estate Journal, Ariel’s founder and president, Shimon Shkury, notes that the average price per square foot in Manhattan rose by 25% to $866, “as investors were willing to pay ever-higher premiums to own core Manhattan.”

For 2015, Shkury remains bullish about New York’s real estate prospects, with some caveats. “We’ve identified a few headwinds, including rising construction costs, the unknowns of the mayor’s housing policy, the sustainability of the luxury market, rents leveling off, interest rates, global uncertainty, and the strengthening dollar.” On the positive side, Shkury believes multifamily sales in New York will benefit from lower oil prices, increased job creation, improved consumer spending, and tight inventory.

Related Stories

Multifamily Housing | Jun 25, 2019

Historic New York hospital becomes multifamily development

CetraRuddy designed the project and Delshah Capital is the developer.

Multifamily Housing | Jun 25, 2019

New Joint Center housing report foresees steady rental demand over the next decade

However, supply shortages, especially on the affordable end, are likely to push rents even higher.

Multifamily Housing | Jun 17, 2019

Boston multifamily development combines a historic warehouse with a new, modern addition

The Architectural Team designed the project.

Multifamily Housing | Jun 4, 2019

New Silver Spring apartment community includes over 5,000 sf of amenity space

Design Collective is the project’s architect.

Multifamily Housing | Jun 3, 2019

11 trends in senior living

Style, flexibility, and fun highlight the latest design trends for the 55+ market.

Multifamily Housing | May 29, 2019

Grilled to order: The art of outdoor kitchens

Seven tips for ensuring outdoor kitchens deliver safe, memorable experiences for residents and guests.

Multifamily Housing | May 17, 2019

At last, downtown Dallas tower to get $450 million redo

The landmark tower has been vacant for a decade.

Multifamily Housing | May 8, 2019

Multifamily visionary: AvalonBay’s relentless attention to detail

The nation's fourth-largest owner of apartments holds more than 85,000 apartments in 291 communities.

| Apr 28, 2019

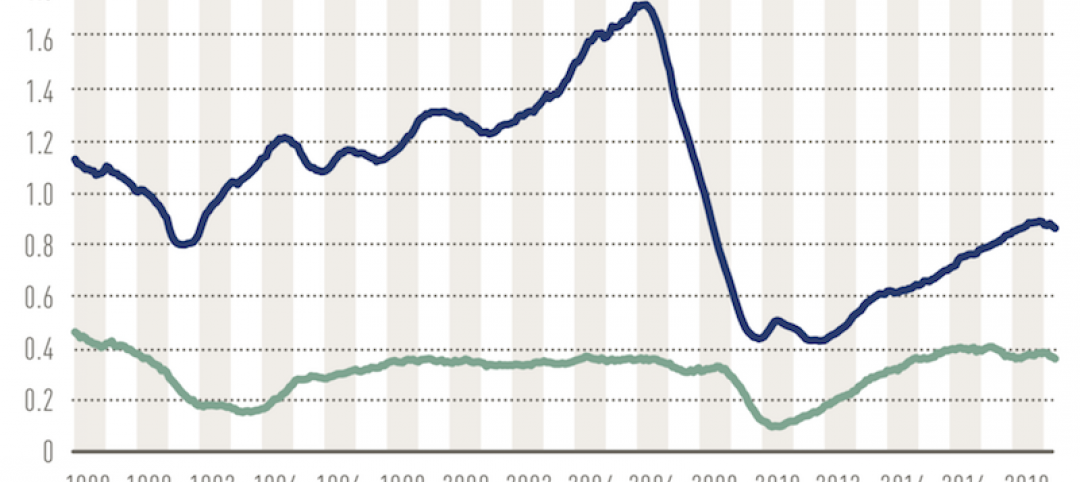

New York Is NOT Most Expensive City for Apartment Sales Transactions

Data from Marcus & Millichap 2019 U.S. Multifamily Investment Forecast on Average Price/Dwelling Unit in apartment transactions.