Last year was another bumper year for New York City’s real estate market. Multifamily sales hit $12.6 billion, or 39% more that in 2013, according to a year-end report by Ariel Property Advisors, an investment property sales firm.

There were a total of 761 transactions last year, 8% more than in 2013. The borough of Brooklyn accounted for 222 of those transactions valued at $2.35 billion, or 88% higher than the Brooklyn transactions in 2013. In that borough, deals exceeding $20 million accounted for 47% of its transactions. For New York City as a whole, $20 million-plus deals accounted for more than half of all transactions.

Ariel estimates that 1,413 properties were sold last year, 13% more than in 2013. The properties sold had 47,885 total units, or 20% more than the buildings sold in 2013.

In Manhattan, whose real estate prices have been going through the roof in recent years, transactions may have declined by 12% to 139, but dollar volume jumped by 15% to $5.138 billion, with the Upper East Side being the liveliest neighborhood. The Real Deal, a website that reports on New York real estate news and trends, notes that one of the biggest deals last year was the Chetrit Group and Stellar Management’s purchase of two Upper East Side rental buildings at 1660 2nd Avenue and 160 East 88th Street for a combined $485 million.

In a recent interview with the New York Real Estate Journal, Ariel’s founder and president, Shimon Shkury, notes that the average price per square foot in Manhattan rose by 25% to $866, “as investors were willing to pay ever-higher premiums to own core Manhattan.”

For 2015, Shkury remains bullish about New York’s real estate prospects, with some caveats. “We’ve identified a few headwinds, including rising construction costs, the unknowns of the mayor’s housing policy, the sustainability of the luxury market, rents leveling off, interest rates, global uncertainty, and the strengthening dollar.” On the positive side, Shkury believes multifamily sales in New York will benefit from lower oil prices, increased job creation, improved consumer spending, and tight inventory.

Related Stories

Multifamily Housing | Jul 31, 2017

Chicago’s Ukrainian Village neighborhood adds new co-living space

The new building offers 12 bedrooms across four floors of living space.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Multifamily Housing | Jul 25, 2017

Co-living arrives in Queens: Common adds two new co-living homes

Common adds a new coliving home in Brooklyn and its first offering in Queens with Common Lincoln and Common Cornelia.

Multifamily Housing | Jul 19, 2017

Student housing trends: The transformation of co-living in college

The Student Hotel is representative of a new model for delivering housing solutions for students globally.

Multifamily Housing | Jul 19, 2017

KTGY-designed Elan Menlo Park nears completion

The 146-unit apartment community was designed as a series of six interactively connected garden-style apartments.

Multifamily Housing | Jul 12, 2017

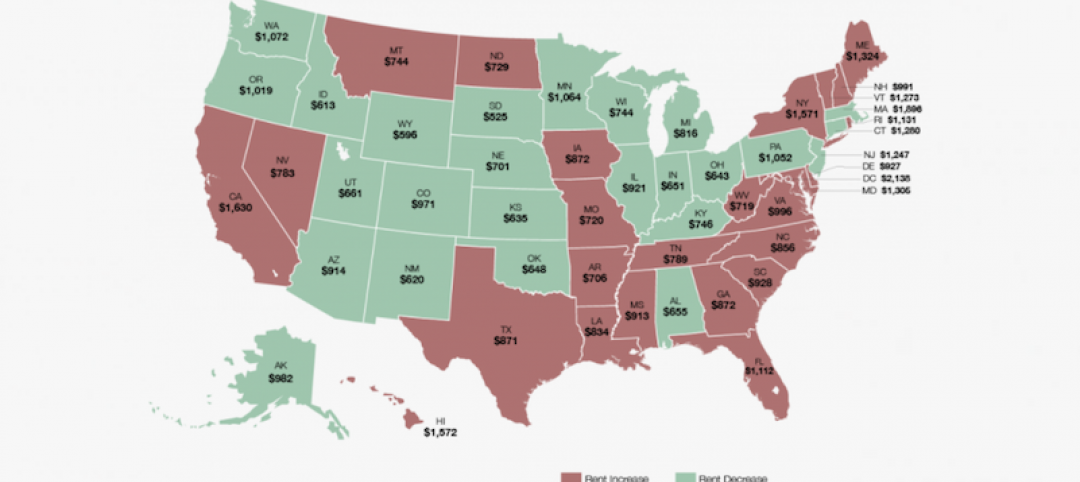

Midyear Rent Report: 26 states saw rental price increases in first half of 2017

The most notable rental increases are in growing markets in the South and Southwest: New Orleans, Glendale, Ariz., Houston, Reno, N.V., and Atlanta.

Multifamily Housing | Jul 12, 2017

7 noteworthy multifamily projects: posh amenities, healthy living, plugged-in lifestyle

Zen meditation gardens, bocce courts, saltwater pools, and free drinks highlight the niceties at these new multifamily developments.

Mixed-Use | Jul 7, 2017

ZHA’s Mandarin Oriental hotel and residences employs ‘stacked vases’ design approach

The mixed-use tower will rise 185 meters and be located in Melbourne's Central Business District.