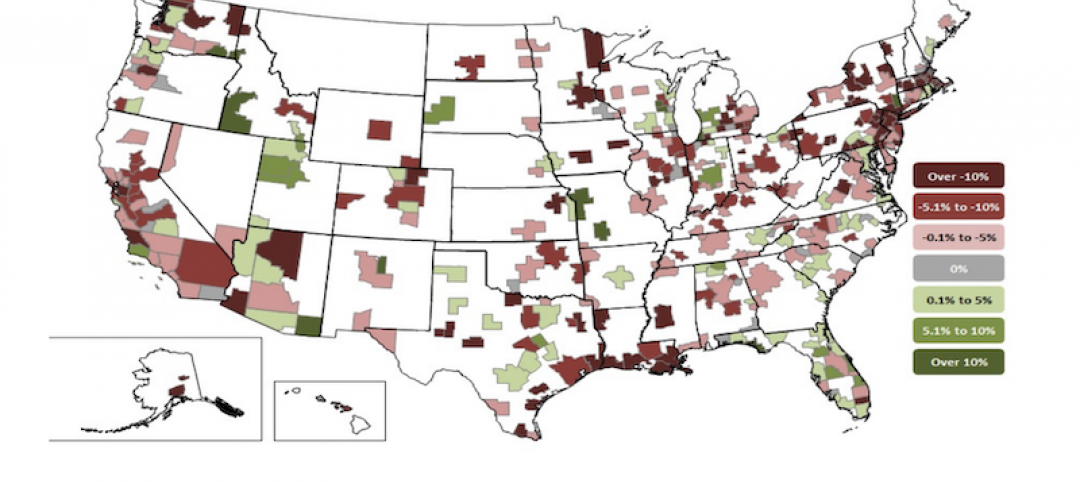

Nearly one-fifth of U.S. metro areas lost construction jobs between September 2020 and September 2021, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials noted that the job losses are occurring in many metro areas as plans to boost investments in infrastructure languish in Washington and firms cope with shortages, delivery delays and construction materials price increases.

“Many metro areas are having a hard time getting back to construction employment levels from last fall that were already low because of the pandemic,” said Ken Simonson, the association’s chief economist. “The challenge is that the economic recovery for the construction industry is being undermined by Washington’s failure to boost infrastructure investments and continuing supply chain disfunction.”

Construction employment declined from a year earlier in 67 metros and held steady in 33. Nassau County-Suffolk County, N.Y. lost the most jobs (-6,000 or -8%), followed by New York City (-5,500 jobs, -4%); New Orleans-Metairie, La. (-3,100 jobs, -12%); Calvert-Charles-Prince George’s, Md. (-3,100 jobs, -9%) and Baltimore-Columbia-Towson, Md. (-2,400 jobs, -3%). The largest percentage declines were in Evansville, Ind.-Ky. (-18%, -1,800 jobs); New Orleans-Metairie; Fairbanks, Alaska (-10%, -300 jobs); Knoxville, Tenn. (-10%, -1,800 jobs); Gadsden, Ala. (-9%, -100 jobs); Calvert-Charles-Prince George's; and Victoria, Texas (-9%, -300 jobs).

Construction employment increased in 258 out of 358 metro areas over the last 12 months. Sacramento--Roseville--Arden-

Association officials urged members of Congress in the House to quickly pass an infrastructure bill that already received broad, bipartisan support in the Senate. They also encouraged the Biden administration to explore ways, like temporarily adjusting hours of service rules for drivers, to unclog shipping facilities that how more goods than drivers.

“Washington leaders have the ability to fix our supply chains now while also investing in their long-term efficiency,” said Stephen E. Sandherr, the association’s chief executive officer. “But nothing is going to get fixed with partisan talk and legislative and executive inaction.”

View the metro employment data, rankings, top 10, new highs and lows, and map.

Related Stories

Market Data | Sep 15, 2021

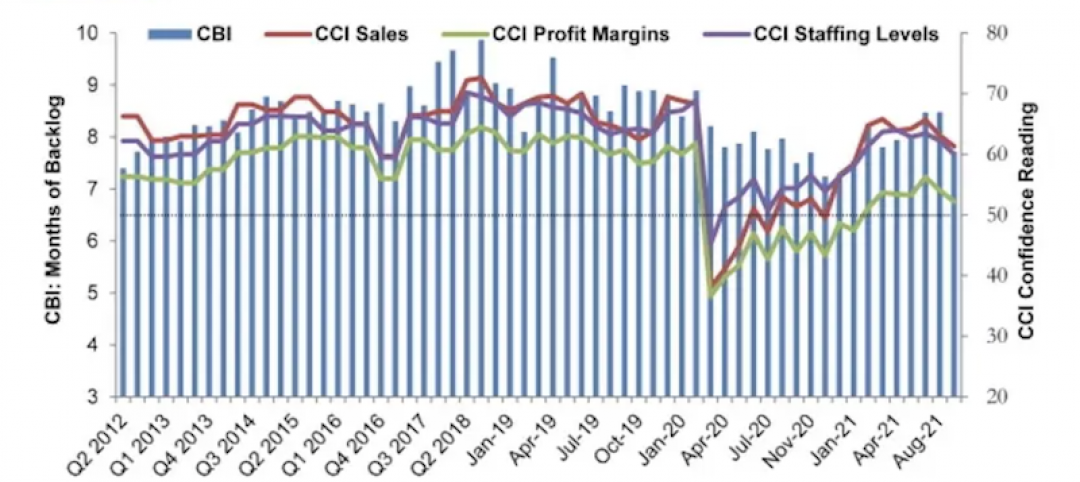

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.

Market Data | Aug 17, 2021

Demand for design activity continues to expand

The ABI score for July was 54.6.

Market Data | Aug 12, 2021

Steep rise in producer prices for construction materials and services continues in July.

The producer price index for new nonresidential construction rose 4.4% over the past 12 months.