Only 14 states and the District of Columbia have added construction jobs since just before the start of the pandemic in February 2020, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials noted that widespread supply chain disruptions amid and the lack of a much-needed federal infrastructure bill have impeded the sector’s recovery.

“Construction employment remains below pre-pandemic levels in more than two-thirds of the states,” said Ken Simonson, the association’s chief economist. “Supply problems have slowed down many projects and forced contractors to hold down employment, while the lack of an infrastructure bill is leading some to delay hiring.”

From February 2020—the month before the pandemic caused project shutdowns and cancellations—to last month, construction employment increased in only 14 states and D.C., decreased in 35 states, and stalled in Connecticut. Texas shed the most construction jobs over the period (-48,000 jobs or -6.1%), followed by New York (-47,300 jobs, -11.6%) and California (-32,600 jobs, -3.6%). The largest percentage losses were in Louisiana (-16.1%, -22,000 jobs), Wyoming (-15.7%, -3,600 jobs) and New York.

Utah added the most construction jobs since February 2020 (9,400 jobs, 8.2%), followed by Washington (6,300 jobs, 2.8%), North Carolina (5,300 jobs, 2.2%), and Idaho (5,100 jobs, 9.3%). The largest percentage gains were in Idaho, Utah, and South Dakota (7.9%, 1,900 jobs).

From August to September construction employment decreased in 16 states, increased in 32 states and D.C., and was unchanged in Iowa and Kansas. The largest decline over the month occurred in Tennessee, which lost 2,800 construction jobs or 2.1%, followed by Missouri (-1,600 jobs, -1.3%). The largest percentage decline was in Alaska (-800 jobs, -4.9%), followed by Tennessee and Montana (-400 jobs, -1.4%).

Texas added the most construction jobs between August and September (8,900 jobs, 1.2%), followed by Florida (6,900 jobs, 1.2%) and Washington (3,600 jobs, 1.6%). Connecticut had the largest percentage gain (3.0%, 1,700 jobs), followed by Delaware (2.9%, 700 jobs) and West Virginia (2.3%, 700 jobs).

Association officials continued to urge the Biden administration to remove tariffs on a host of key construction materials, including steel and aluminum, and to do more to relieve shipping bottlenecks that are crippling many parts of the distribution network. They also urged House officials to quickly pass a Senate-backed infrastructure bill to increase investments in the nation’s transportation and water systems.

“The latest state employment figures show that gridlock in our ports and on Capitol Hill is retarding construction employment as well as the broader economy,” said Stephen E. Sandherr, the association’s chief executive officer. “Even as the administration looks for ways to unclog domestic supply chains, the President should urge the House to pass the infrastructure bill, on its own, as quickly as possible.”

View state February 2020-September 2021 data and rankings, 1-month rankings.

Related Stories

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

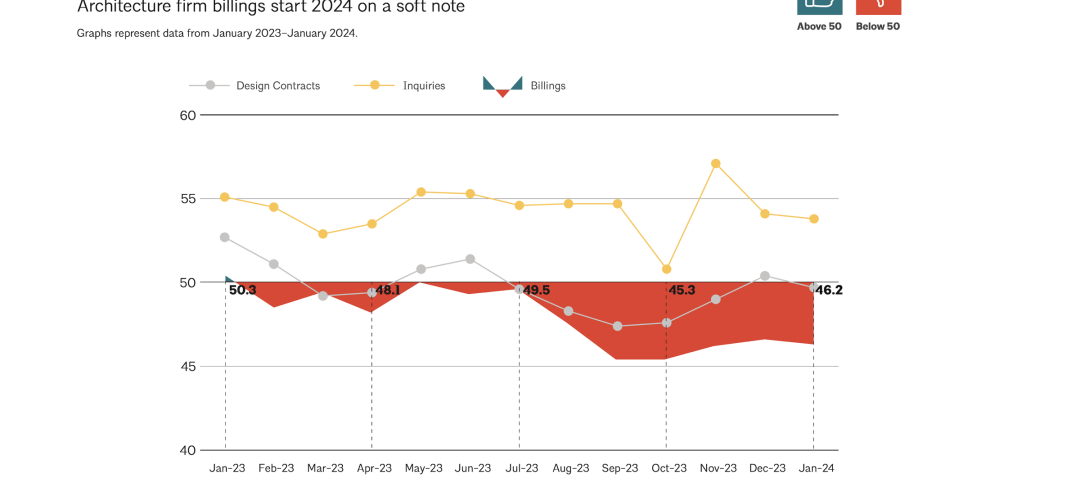

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.